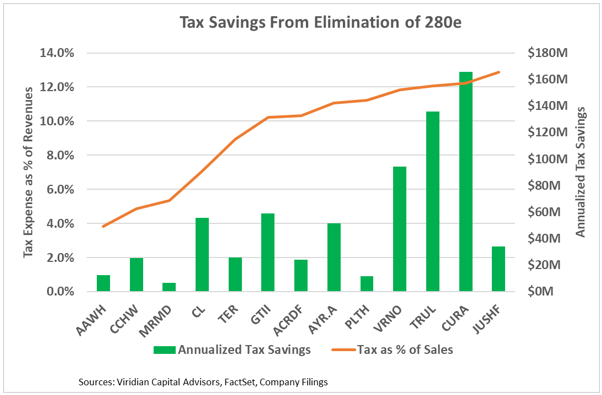

NEW YORK – The twelve largest operators in the cannabis industry would save a combined total of $700 million annually if Internal Revenue Code Section 280E were eliminated, according to a new analysis.

Viridian Capital Advisors recently examined the impact on the industry if 280E were eliminated. The strategic advisory firm extrapolated its findings from the Q2 public filings of multistate operators Acreage Holdings (ACRDF), Ascend Wellness (AAWH), Ayr Wellness Inc. (AYR.A), Cresco Labs Inc. (CL), Curaleaf Holdings Inc. (CURA), Green Thumb Industries Inc. (GTII), Jushi Holdings Inc. (JUSHF), MariMed (MRMD), Planet 13 Holdings (PLTH), TerrAscend Corp. (TER), The Cannabist Co. (formerly Columbia Care; CCHW), Trulieve Cannabis Corp. (TRUL), and Verano Holdings Corp. (VRNO).

Analysts used a straightforward method to arrive at the estimated total annual tax savings. If a company showed negative pretax income, its tax expense was estimated at zero. If a company showed a positive pretax income, a combined state and federal tax rate of 28 percent was applied to its pretax income. The difference between actual and recalculated taxes totaled $700 million annually.

The analysts also put 280E’s financial weight into perspective.

If it were not subject to 280E, a business with 30-percent earnings before interest, taxes, depreciation, and amortization (EBITDA) margins; depreciation calculated with a 15-year fixed asset life; and two times debt-to-EBITDA at an average interest rate of 10 percent would see an annual tax burden of approximately 3 percent of its revenue. Because they are subject to 280E’s prohibition on business expense deductions, cannabis companies pay much higher effective tax rates. Viridian analysts calculated the effective tax rates for Ascend Wellness, MariMed, Green Thumb, and Verano at 84 percent, 192 percent, 65 percent, and 189 percent, respectively.

While the largest MSOs stand to save hundreds of millions, the elimination of 280E could be even more valuable for smaller operators struggling to compete against publicly funded competition that benefits from economies of scale and efficiency from the farm to the retail counter.

“Smaller U.S. operators will perhaps benefit even more, especially non-integrated dispensary owners who typically have the most severe impact from 280E,” said Frank Colombo, chartered financial analyst and director of data analytics at Viridian Capital Advisors. “They may also find they become more attractive acquisition targets in a post-rescheduling world when access to capital becomes easier.”

Section 280E, added to the tax code in 1982, disallows deduction of any expenses incurred “in carrying on any trade or business if such trade or business consists of trafficking in” substances on Schedule I or II of the Controlled Substances Act. In August, the Department of Health and Human Services (HHS), acting on data and scientific input from the Food and Drug Administration, recommended cannabis be moved to Schedule III. Such a reclassification would remove the 280E albatross from around the necks of cannabis businesses.

The decision now rests with U.S. Drug Enforcement Administration (DEA) Administrator Anne Milgram, a Biden appointee who assumed her position as the nation’s drug czar in 2021. President Joe Biden has indicated he supports the move, but the final decision is Milgram’s.

The timeline for the DEA’s recommendation and revelation of details within the HHS recommendation are unknown. The recommendation letter HHS sent to the DEA has not been made public.

Although fourteen Republican members of Congress have encouraged Milgram to deny the rescheduling request, it’s possible the DEA could conclude its review by year’s end, including dealing with U.S. obligations under international drug treaties. If the DEA were to agree with the Schedule III recommendation, a public comment period of up to 60 days would take place, followed by a DEA review of the public comments and a near guarantee of lawsuits that could delay implementation.

The recommendation to remove marijuana from the DEA’s list of dangerous Schedule I drugs is not based on science—it’s based on an irresponsible pro-pot agenda. pic.twitter.com/pNdBqfCnRN

— Sen. James Lankford (@SenatorLankford) September 12, 2023

If everything moves swiftly and without any major hurdles, rescheduling and the elimination of 280E for legal cannabis operators could happen as soon as Q2 2024.

[…] you’ll be—especially as a small-to-midsize and/or social equity enterprise. After all, big-budget MSOs have the money and manpower to have scouts in emerging markets long before they open, learning […]

[…] flow increases as tax burdens decline. The ten largest companies alone would save more than $700 million annually; the industry as a whole could save more than twice that […]

[…] I to Schedule III under the Controlled Substances Act (CSA). Rescheduling is expected to bring tax relief and other financial benefits to cannabis businesses and their hundreds of thousands of American […]

[…] 2023 public filings of 12 multistate operators. The potential savings in tax liability totaled $700 million annually. While the major MSOs will save hundreds of millions of dollars, independent operators and smaller […]

[…] every street corner. But we’re past that now. Today, limited licenses mostly serve to accommodate large multistate operators who want to keep their stocks up and their competition […]

[…] businesses fighting for every dollar, maximizing returns from the plant is a crucial component of success. The art of extracting […]

[…] has on investors’ perceptions. While Viridian analysts have predicted a dozen MSOs would save $700 million annually with the 280E relief rescheduling likely would deliver, companies including Green Thumb Industries, […]

[…] of pre-rolled cone manufacturer Hara Supply. “They need highly specialized equipment, while the Curaleafs of the world are just looking for highly efficient machinery so they can pump out numbers.” Multistate […]

[…] leap forward for an industry desperate for the financial relief Schedule III could deliver with a significantly lower tax burden and fewer roadblocks to traditional banking and financial […]

[…] said independent retailers often receive the brunt of delinquency criticism but, in fact, multistate operators (MSOs) share the blame. “In Nevada, some [survey respondents] said there are a lot of big MSOs […]

[…] larger MSOs have their own kind of business model, and I think we have a little more boutiquey style. Their […]

[…] is the ultimate goal for our industry, most cannabis professionals probably would list the elimination of Internal Revenue Code Section 280E as a close […]

[…] analysts at Viridian Capital Advisors, the twelve largest operators in the cannabis industry would save a combined total of $700 million annually without 280E—a sea change drawing interest from investors and optimism from operators in every […]

[…] son casi diez veces más de lo que ganan los directivos de nivel medio del sector, según un nuevo informe de la agencia de búsqueda de ejecutivos y personal […]

[…] on Capitol Hill. Although the organization’s two big issues from the beginning—banking and Internal Revenue Code Section 280E—remain unresolved, Smith said politicians’ attitudes about the industry have changed. “Even […]

[…] YORK – Chief executive officers at the largest cannabis companies by revenue have moved past the $400,000 base salary threshold with annual salaries topping $416,000—almost […]

[…] In my opinion, the state regulators’ number-one goal was to make the pie smaller for larger and existing operators. But you can’t make the pie smaller for a certain group without making the pie smaller for everyone, and that’s what they’ve done. They created this pie that is a tiny fraction of what it should have been because they wanted to hurt the big players. […]

[…] is always mentioned as a growth industry, but consensus estimates of the 2023 revenues for the ten largest [multistate operators] show a growth of only about 1 percent from […]