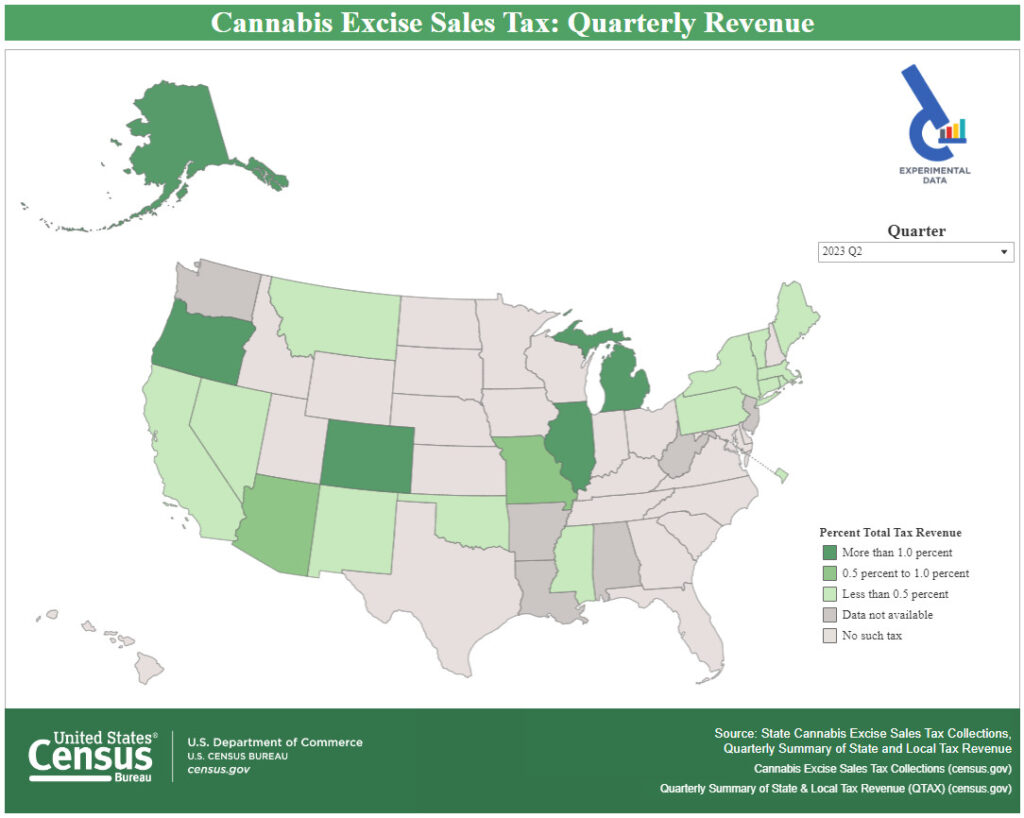

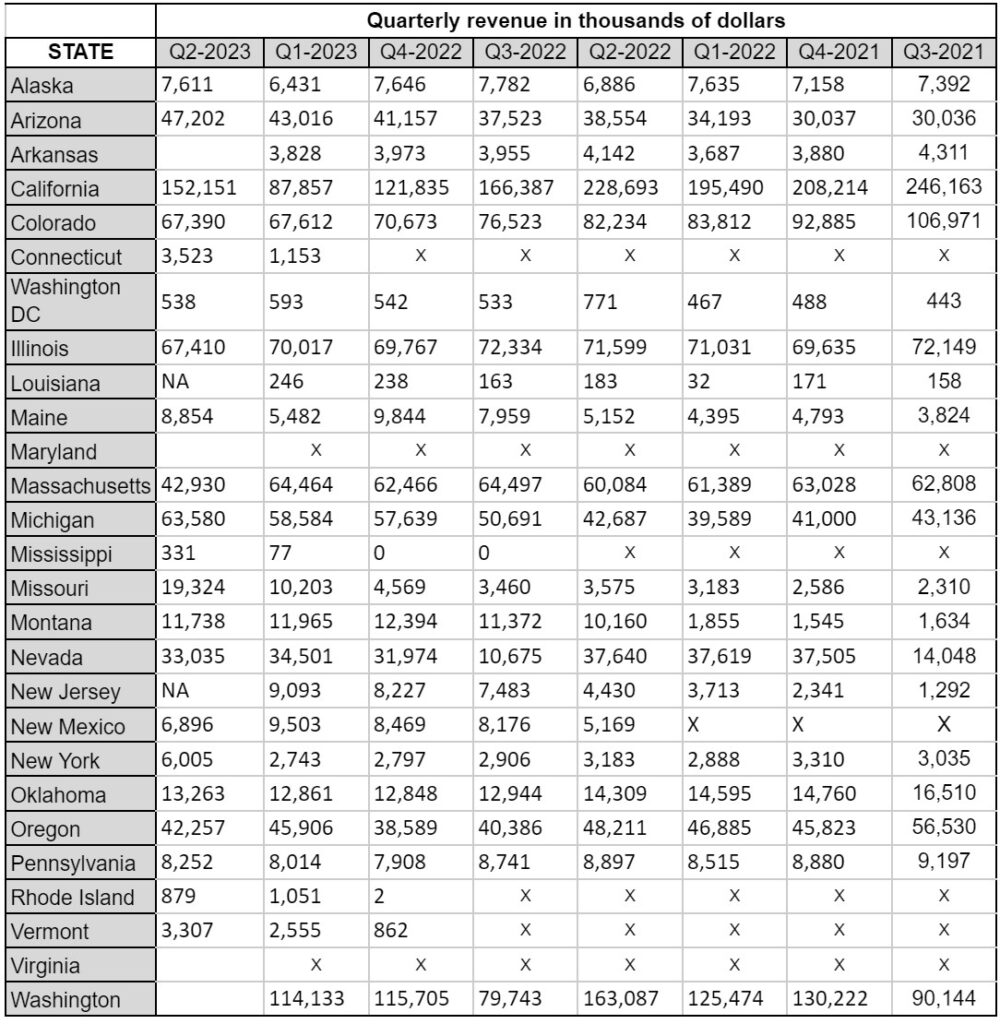

SUITLAND, Md. – The U.S. Census Bureau’s latest quarterly cannabis excise-tax revenue data from 2023’s second quarter showed a nearly 10-percent drop in total collections despite a strong comeback performance from the country’s largest state market.

Total cannabis excise sales tax revenue reached $606 million in Q2 2023, down nearly 28 percent from its peak of $839 million in Q2 2022. Despite the overall national decline, California jumped 73 percent in quarterly tax revenue with $152 million collected from April, May, and June.

Of the twenty states plus Washington D.C. tracked for the bureau’s experimental data report, twelve saw a quarterly increase in excise sales tax revenue in Q2. Looking at the nine states with a quarterly decline, only Massachusetts, New Mexico, and Rhode Island suffered double-digit drops at 33, 27, and 16 percent respectively. However, double-digit growth was seen by seven states with Mississippi and New York leading the way with increases of 331 and 119 percent respectively.

While the positive momentum appears great in the Golden State, it comes on the heels of disastrous Q1 performance of $88 million—the single worst quarter since the bureau began tracking tax data in Q3 2021. At $152 million, the most recent figure for California sits 33 percent below the state’s quarterly excise sales tax record of $228 million in Q2 2022.

The tax data is provided by the states but classified across different categories by the U.S. Census Bureau. The bureau’s classifications might not reflect the actual classification provided by state governments. For this dataset, taxes are defined by all compulsory contributions, which include related penalties and interest receipts.