What does it mean to have a winning brand? For both the brand manufacturer and the retailer to succeed, they must work together. CannaCraft will teach you what we’ve learned since 2015 as we’ve adapted to a dynamically changing marketplace. We recognize what it takes to operate in a regulated market to effectively launch and sustain winning brands.

Learn our four-part formula for success—our so-called “secret sauce” that’s propelled our brands to the top. It’s a combination of shelf space allocation, reliable distribution and delivery, sell-through support, and new product development.

Shelf space allocation

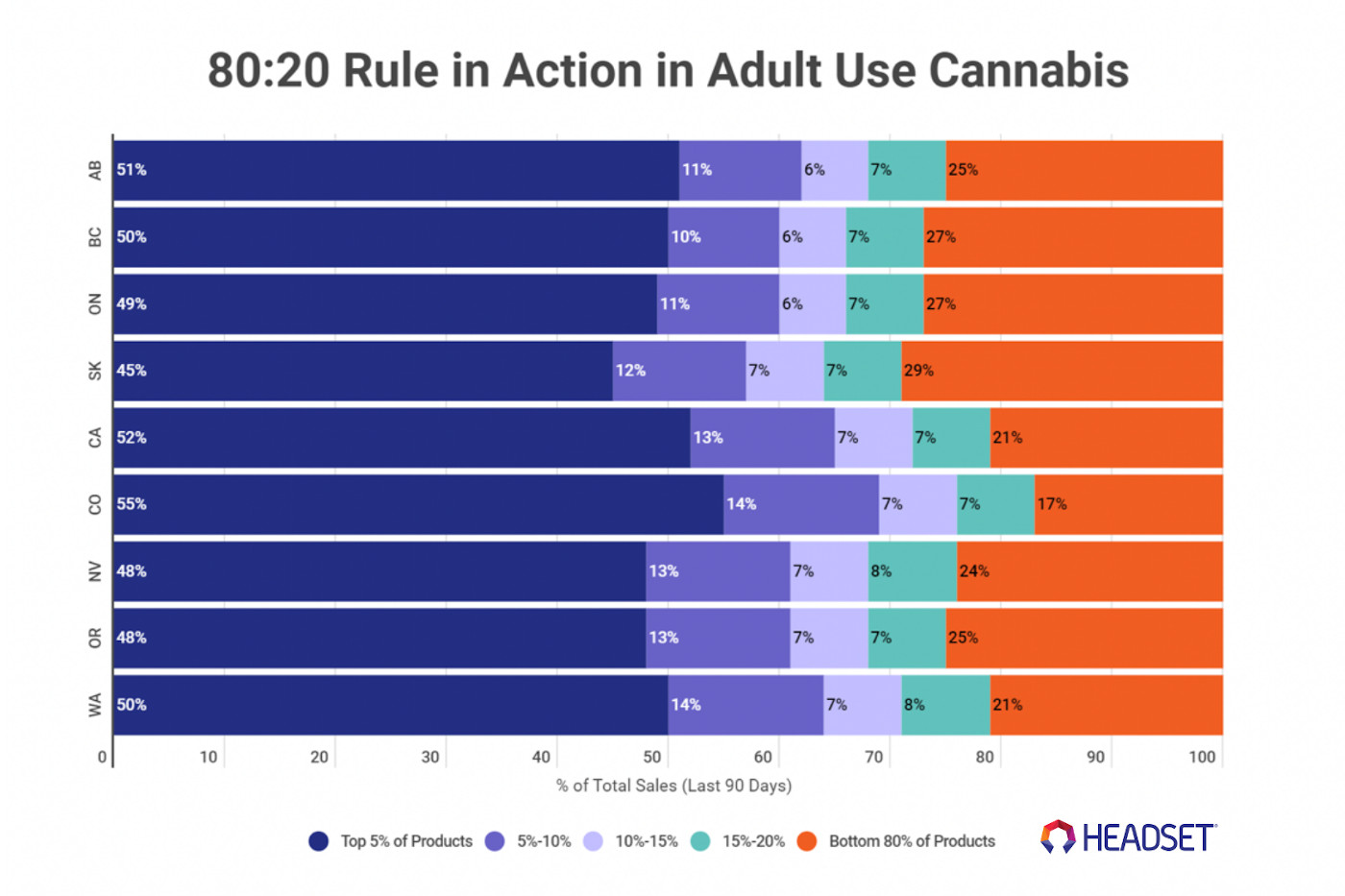

For the average California cannabis retailer, approximately 79 percent of retail sales come from just 21 percent of the inventory on the shelves. This is known as the Pareto principle or the 80/20 rule. Here we can look at the Pareto principle in action in the cannabis industry. Data analysts at Headset looked at products based on their sales volumes and found the top 20 percent of products make up between 83 percent and 75 percent of total sales.

Selecting brands and products that provide a positive return on valuable shelf space is critical to getting a winning product mix formula in your store. In retail analytics, the fair share ratio is used to determine how well SKUs sell relative to their shelf space. Evaluating a product’s performance on the shelf can involve calculating its “fair share ratio,” which means comparing the SKU share to the category sales share.

You can value a product’s performance using these three metrics:

- The average brand SKU share (average percentage of total category SKUs in California retailers).

- Average sales share (average percentage of total category sales in California retailers)

- Fair share ratio (No. 2 divided by No. 1 minus 1).

For example, looking at retail sales for the average California retailer (as presented in the Headset report “CannaCraft SKU Share & Sales Share,” October 2020), CannaCraft products account for 4.3 percent of SKUs in the flower category, but these CannaCraft products drive 6.1 percent of total sales in the category, meaning the SKUs’ sales are high relative to the SKUs’ shelf space. That equates to a 43.9-percent fair share ratio.

In the beverage category, CannaCraft products account for 26.3 percent of SKUs, but these products drive 30.5 percent of category sales, according to Headset. That delivers a 16:1 fair share ratio. In the tincture category, CannaCraft SKUs account for 17 percent of the SKUs in the category, accounting for 21.1 percent of total category sales. In this case, CannaCraft drops provide retailers with a 24.2 percent fair share ratio.

Our advice to retailers is to look at what products are selling best in your stores and determine why they are selling. Is the brand doing a good job of also promoting your store for product purchase? Has the brand delivered a product that spurs repeat visits?

Always dedicate a portion of your shelf space to new product introductions and curate your inventory to meet the needs of your customers, regardless of sell-in gimmicks or price discounts. Work with your brand partners on a trial period and share your expectations for sell-through ahead of time to help forecasting and pricing discussions materialize for your best sales experience.

Reliable distribution and delivery

Distribution partners are crucial to a smooth relationship between brand manufacturers and retailers. As a retailer, you must trust a brand’s distribution partner as another essential component in the process of selecting profitable brands to sell.

Be sure the brand manufacturer’s distributor has a winning record on compliance, delivers on-time and in full, and offers accounts receivable support, contract terms, and easy ordering. Known for stellar customer service, Kind House Distribution is CannaCraft’s wholly owned distribution company, consistently delivering across California on a regular schedule on which retailers can rely.

Sell-through support

When customers find a CannaCraft product they enjoy, they stick with it, driving brand loyalty so real we can measure it. Our customers shop more often and spend more on average. Be sure the brands on your shelf can deliver new and returning customers to your store.

According to an October 2020 California-wide sales analysis by Headset, the average cannabis retail basket in 2020 was $64.79, compared to retail baskets containing a CannaCraft product at $96.13. CannaCraft consumers also visit dispensaries more often than most, the report indicated, buying CannaCraft products thirteen times a year. The average Californian shops only eight times a year. The number one inquiry we receive from consumers is, “Where can we find your products?” Our customers have proven themselves to be highly valuable to retailers. Can you say that about all the brands you carry?

COVID-19 prompted a faster shift to online retail sales, curbside pick-up, and delivery, shifting our tactics to help support sell-through for retailers. Look for brands that help you drive traffic.

Compelling content marketing amplifies brand messaging and creates customer engagement, with a frequently updated supply of fresh photos, blogs, and videos to share on social media. With comprehensive digital marketing services available to support key accounts, CannaCraft promotes sales through strategic omnichannel campaigns that can include directory ads, social initiatives, online shopping, and display ads that integrate with marketplace and store menus. We use programmatic ads and provide content and SMS messaging options to drive digital conversions for your store.

Educated, insightful retail staff and budtenders are a brand’s bridge to consumers. Providing retailers with on-the-go and virtual options for product training and education is also a must-have for winning brands to help enable sell-through in today’s retail environment.

New product development

As stated earlier, devoting shelf space to new products is an important element of curating your inventory. We suggest retail buyers carefully consider not only a new product’s space dedication but also what besides a price incentive is the brand bringing to the table. Will the supply be constant? Is the brand committed to long-term success? What are the line extension plans?

If you consider just how many new products are offered in the market while tempting to want to try it all, remember that on average in California, 79 percent of sales come from only 21 percent of the top-selling products in a store. It’s important to consider how you bring in a product. What is the brand’s track record on developing and supporting new product extensions and new brands? How crowded is the new product space?

Over the ninety days ending January 31, 2021, Headset point-of-sale insights show 741 new vape category products, seventy-seven new edibles, and sixteen new beverages hit the market (Headset Retail Insights Data, New Product Introductions Nov 2020 – Jan 2021). Create specific criteria to help you map out when and how you’ll take on new SKUs and go beyond the initial sell-in pricing discussions. It starts with knowing your customers and finding the best matches so the new products find their way into your 25-percent top-selling products list.

We know of what we speak. Continuing in our tradition of cannabis excellence, CannaCraft offers world-class products and services aimed at helping our dispensary partners succeed in a quickly evolving marketplace. In 2021, CannaCraft has three new brands launching, and there’s truly something for every cannabis fan, from new Gen Z consumers and Millennial connoisseurs to Gen X aficionados and curious Boomers returning to the plant.

As innovators back in 2014, CannaCraft introduced qualified patients to ABX strain-specific vape carts and Care by Design’s pioneering CBD and THC ratio blends. Today, CannaCraft continues to expand to serve all adult customers, in virtually every market segment while maintaining our old-school values and authenticity. Our product lines include award-winning chocolates, delicious gummies, hard-hitting soft gels, tasty sun-grown flower, terpy live resin, hoppy drinks, full-spectrum vapes, and more—all available to fill your store’s shelves with cannabis-infused goodness.

We look forward to adding more retailers to our family. We hope you will partner with CannaCraft this year to grow your dispensary business, drive sales, build community, satisfy your customers, and keep them coming back to your store. We can succeed together because there’s always a winning brand with CannaCraft.

As one of the state’s largest manufacturers, CannaCraft’s in-house cultivation, extraction, product development, and distribution enables transparency from seed to shelf. Positioned to meet the needs of a diverse customer base, CannaCraft brands include AbsoluteXtracts, ABX Live, Care by Design, Hi-Fi Hops, Humboldt Terp Council, Keef, Loud+Clear, Satori, The Farmer and the Felon, and Unlocked, with combined retail sales totaling more than $155 million in 2020(Headset Retail Insights [POS] total retail sales for CannaCraft manufactured brands, Jan – Dec 2020).

No guarantee of success. Information provided herein is provided on an as-is basis, and CannaCraft makes no express or implied warranty as to the success or profitability a retailer may have based on its use of this information.