WASHINGTON, D.C. – The House Financial Services Committee on March 28 passed H.R. 1595, the Secure and Fair Enforcement Banking Act of 2019, or SAFE Banking Act, which would allow legal cannabis businesses to access financial institutions and regular merchant banking services. The proposed legislation passed on a 45 to 15 vote and now advances to the House floor.

“The SAFE Banking Act is about public safety, accountability, and respecting states’ rights,” Rep. Ed Perlmutter (D-CO) said in a prepared statement. “Our federal banking laws were designed to prevent illicit activity and help law enforcement do their jobs. These laws need to be applied to legitimate marijuana businesses and employees in order to improve transparency and accountability and help root out illegal transactions.

“Most importantly, the SAFE Banking Act will get cash off our streets, reducing the risk of violent crime and making our communities safer. While Congress has stuck its head in the sand for many years, this committee has shown leadership on this issue and I want to thank my cosponsors and members of the committee for their support,” he added.

Perlmutter, who co-authored the legislation with Rep. Denny Heck (D-WA), has been a stalwart campaigner for allowing legitimate banking services for the cannabis industry. He first introduced a draft version of the act in 2013.

Cannabis businesses have been mostly limited to cash-only transactions, which include necessary bank-facilitated merchant services like tax payment, property transactions, and payroll. Continuing U.S. federal prohibition of cannabis, with its status as an illegal Schedule I narcotic, causes financial institutions to turn down cannabis-related accounts due to the potential for federal racketeering charges and other RICO violations.

“Given the hardships facing the cannabis industry due to current financial regulations, simply creating a more normal banking environment through passage of the SAFE Banking Act would absolutely be a game-changer,” Morgan Fox, media relations director at trade nonprofit National Cannabis Industry Association (NCIA), told mg.

“There would still be more work to be done in this area, particularly regarding access to capital for small businesses, and some banks may still balk at working with the cannabis industry until prohibition ends at the federal level, but this reform would be a giant step in the right direction,” Fox continued.

The latest version of the SAFE Banking Act, according to Perlmutter, “adds protection for ancillary businesses like real estate owners, accountants, and other vendors from money laundering and other laws as well as adjusts the tribal language and the definition of ‘cannabis-related legitimate business.’ The final version of H.R. 1595 voted on in committee also includes two provisions aimed at expanding access to financial services for minority-owned and women-owned cannabis-related businesses.”

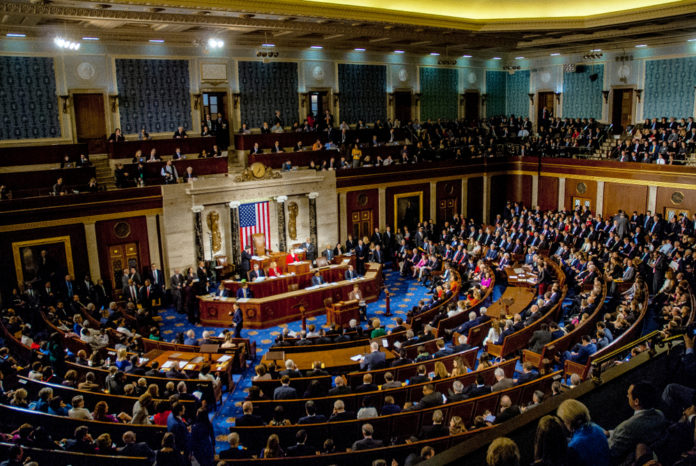

Photo: Mark Reinstein/Shutterstock