JEFFERSON CITY, Mo. – During the first weekend of adult-use sales, the average recreational retailer saw more than $70,000 in revenue—eclipsing historical weekend medical sales in the state by more than 300 percent.

According to state regulators, the opening weekend of adult-use sales from Friday, February 3 to Sunday, February 5 delivered $8,500,900.61 in revenue with an additional $4,189,064.46 coming from the medical side for a combined total of $12,689,965.07.

In November, Missouri voters approved Amendment 3 to legalize adult-use cannabis possession, cultivation, and licensed retail sales with 53.11 percent of the vote. This was the first time a Midwestern state voted in favor of a citizens’ initiative to legalize cannabis for adult use.

“Missourians have clearly demonstrated that support for ending prohibition isn’t relegated to the coasts or deep blue states, but that it is a common sense position that resonates with all Americans,” said NORML Executive Director Erik Alteri said at the time. “With the approval of Amendment 3, Missouri voters rejected the failed ideas of the past and elected to chart a new path oriented on justice and sound public policy.”

In addition to the basic sales revenue data provided by the state, Headset produced an opening weekend report highlighting the diversity of the state’s new market and the unique challenges retailers face. Headset’s data measured 3.9 million transactions, representing $330 million in cannabis sales in Missouri. dutchie POS appears to be the retail software of choice, with 73 percent of shops in Headset’s sample data utilizing the dispensary point-of-sale system.

According to Headset, the average basket size for medical and recreational customers in Missouri remained steady at $77.90 and 2.9 items. However, average daily customers per store jumped 173 percent from 92 on the medical side to 251 for adult-use retailers. The report’s authors saw the increased foot traffic as a “testament to the increasing demand for recreational cannabis in the state and a sign of the thriving market that has emerged as a result of legalization.”

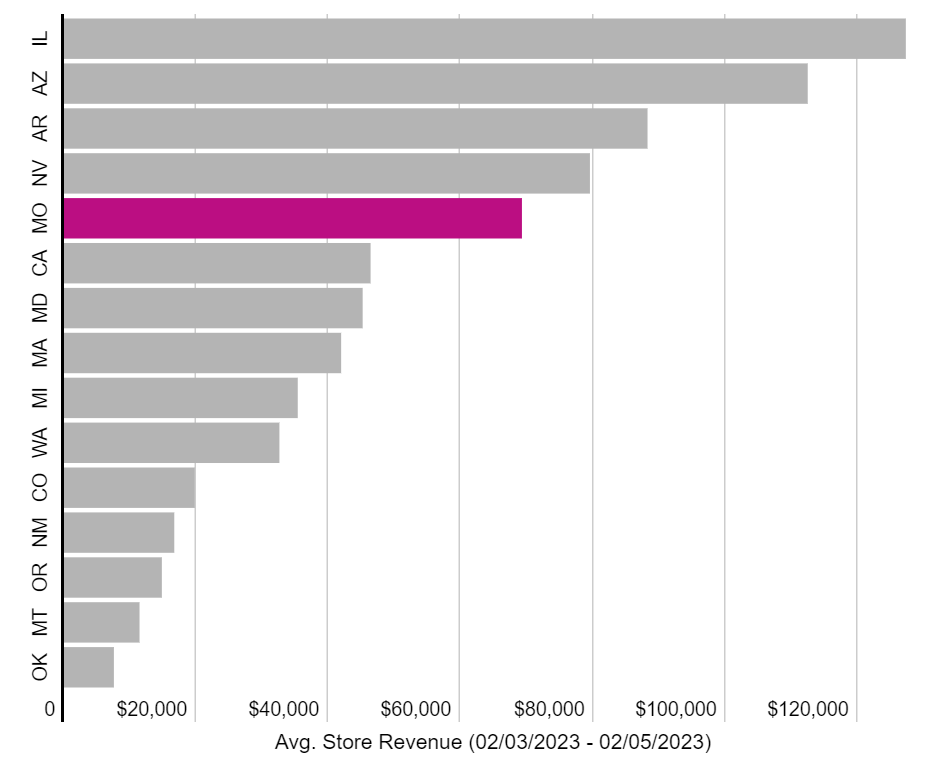

In terms of relative revenue, Missouri retailers enjoyed the fifth-best average store sales in the nation between February 3 and 5, landing behind Nevada, Arkansas, Arizona, and Illinois. Missouri retailers outpaced the mature markets in California, Washington, Colorado, and Oregon by more than 50 percent.

Through a partnership with Leafly, Headset is able to monitor inventory levels to measure supply and demand, showing the number of items being removed from retail menus. The first week of adult-use sales in Missouri showed a “record number of items go out of stock,” the data firm reported, pointing to demand outpacing supply. However, it’s worth noting the market opened three days earlier than expected, potentially impacting the ability of suppliers to fill orders and merchants to stock shelves in time.

While the excitement for buying cannabis at adult-use shops is likely to decline after a highly-anticipated opening weekend, one significant potential advantage for Missouri retailers is their proximity to states where adult use isn’t legal. Missouri shares a border with non-recreational cannabis states Kansas, Kentucky, Nebraska, and Tennessee. It also shares a border with medical-only states Arkansas, Oklahoma, and Iowa. In similar examples, in counties with legalized cannabis like Asotin, Washington, which shares a border with Idaho where cannabis is illegal, per-capita spending was more than three times the state average.