WASHINGTON – The cannabis-friendly Secure and Fair Enforcement Regulation (SAFER) Banking Act is on its way to a floor vote in the Senate after the Committee on Banking, Housing, and Urban Affairs passed the bipartisan legislation. The 14-9 vote represented the first time the Senate has addressed banking reform.

The SAFER Act closely resembles similar legislation, the Secure and Fair Enforcement (SAFE) Act, that has passed the House with bipartisan support seven times. Both bills would provide “safe harbor” protections to financial institutions that serve state-legal cannabis businesses. Removing the threat of federal regulatory action might encourage banks, savings and loans, and other institutions not only to provide basic banking services (including bank accounts and access to credit card networks) to industry businesses but also issue loans and offer other financial instruments.

“Regardless of how you feel about states’ efforts to legalize marijuana, this bipartisan bill is necessary,” said Senate Banking Committee Chairman Sherrod Brown (D-OH). “It will make it safer for legal cannabis businesses and service providers to operate, to protect their workers first and foremost, and to operate in their communities.”

Although cosponsor Steve Daines (R-MT) opposes legalization, he said, “the current all-cash model of legal cannabis businesses makes them targets for theft, for tax evasion, and for organized crime. The key to addressing this risk is by ensuring that all legal businesses have access to the banking system.”

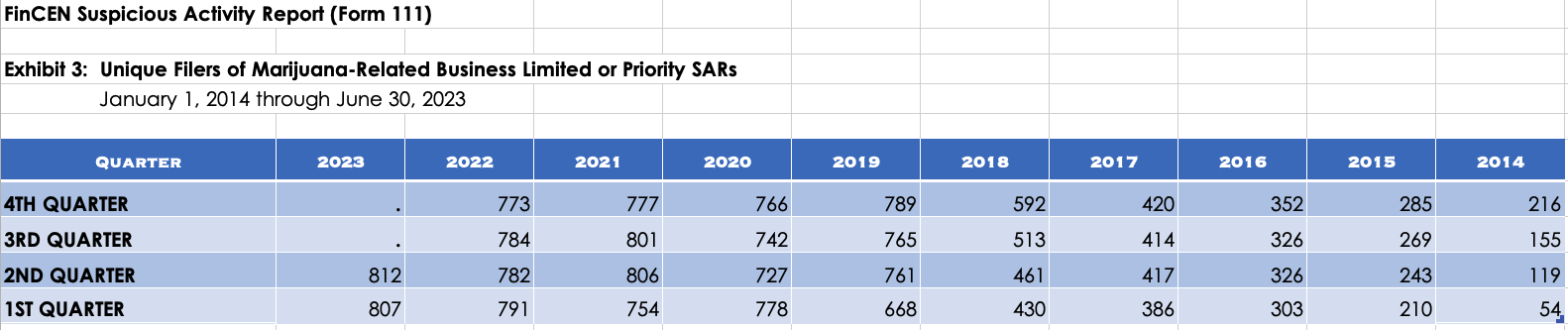

Federal restrictions have made banking access one of the biggest challenges faced by state-legal cannabis operators. In fact, more than 70 percent of the businesses surveyed last year by Whitney Economics said “lack of access to banking or investment capital” was their top challenge. And no wonder: Despite contributing $15.16 billion in tax revenue from recreational sales in 2022, state-legal cannabis businesses were limited to 773 financial institutions by the end of the year—down from a peak of 789 industry-friendly banks and credit unions in 2019.

After a few years of contraction, the latest industry banking data provided by the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) for Q2 2023 shows growth for the second consecutive quarter. As of June 20, 812 unique financial institutions filed either a “marijuana limited” or “marijuana priority” suspicious activity report (SAR), effectively acknowledging their relationships with licensed cannabis businesses.

While 812 represents an all-time high for the industry, it’s only a 2.9-percent improvement from 2019. In the past four years, the total number of states (including Washington D.C.) with legalized recreational cannabis has grown by 118 percent from 11 in 2019 to 24 in 2023.

Making matters more challenging, the number of FDIC-insured commercial banks in the U.S. has declined consistently over the past two decades. According to Statista, 4,135 FDIC-insured commercial banks existed in 2022, down nearly 9 percent from 2019 and 50 percent from 2000.

Unfortunately, the latest wave of support and congressional action for banking reform comes just days before Saturday’s deadline to avoid a government shutdown. Cannabis banking likely will be a back-burner issue until after Congress passes the 12 spending bills required to fund government agencies for the next year.

Changes to the SAFER Banking Act are expected during floor debate. Senate Majority Leader Chuck Schumer (D-NY) said he’s “committed” to including the Gun Rights and Marijuana (GRAM) Act and Harnessing Opportunities by Pursuing Expungement (HOPE) Act before a Senate vote. GRAM would restore gun rights for medical marijuana patients, and HOPE would provide support for state-level expungement of nonviolent cannabis-related crimes.

While any changes to the bill will require approval from the House, the lower chamber consistently has proved its willingness to support bipartisan banking reform. The bill now waits for a vote to be scheduled in the Senate where it needs 60 votes to pass. Democrats and Independents hold a 51-49 majority in the Senate, but with eight Republican co-sponsors the road ahead looks reasonably clear.

Nevertheless, the legislation won’t represent a “magic bullet” for the industry. Because cannabis remains federally categorized among the most dangerous illegal drugs, banks that decide to work with the industry will face onerous regulatory provisions.

“Since cannabis is still listed as a Schedule I drug under the Controlled Substance Act, the current guidelines and regulations will require that banks and credit unions continue to fulfill [federal Bank Secrecy Act] obligations outlined in the 2014 FinCEN guidance, which can be quite extensive,” said Safe Harbor Financial Chief Executive Officer Sundie Seefried. “Financial institutions will be required to file regular reports, requiring substantial resources to ensure compliance from financial and small businesses and demanding precious operational resources.

Still, it represents a net positive for the industry, according to StateHouse Holdings Inc. CEO Ed Schmults.

“The passage of the SAFER Banking Act is a significant step in the right direction for the industry at a time when it is needed most,” he said. “By pulling the cash component out of businesses and into banking institutions, SAFER should, in theory, eliminate the public-safety risk related to the all-cash nature of the cannabis industry. We expect that, over time, the cost of capital for Cannabis companies will begin to come down, as well.”

Beyond allowing state-legal cannabis businesses access to basic banking services, the SAFER Banking Act would extend safe-harbor protections to community development financial institutions and minority depository institutions. It would clear a path to provide tailored resources for cannabis businesses through federal funding alongside private-sector investment to fuel economic growth and opportunity in some of the most underserved communities.

The bill also would prevent federal regulators from:

- Prohibiting, penalizing or discouraging a bank from providing financial services to a legitimate state-sanctioned and regulated cannabis business or associated business (such as a lawyer or landlord providing services to a legal cannabis business).

- Terminating or limiting a bank’s federal deposit insurance primarily because the bank provides services to a state-sanctioned cannabis business or associated business.

- Recommending or incentivizing a bank to halt or downgrade providing any kind of banking services to these businesses.

- Taking any action on a loan to an owner or operator of a cannabis-related business simply because of the debtor’s relationship to cannabis.

The SAFER Banking Act also would protect banks, their officers, and employees who provide financial services to state-legal cannabis businesses from criminal prosecution, liability, and asset forfeiture.

[…] Senate Takes Long-Awaited Step Toward Cannabis Banking Reform […]