Compliance Is At The Heart Of This Electronic Payment Hub For The Entire Cannabis Supply Chain.

Longtime friends and business associates Kenneth Burke and Keith Marks founded PayQwick in 2014 for the best of all reasons: to solve a problem. “In 2012, we noticed an increasing number of cannabis dispensaries opening around Los Angeles, so we researched the industry and were shocked to learn cannabis businesses were operating exclusively in cash,” recalled Burke, who began his career as an attorney thirty years ago, focusing largely on regulatory compliance, securities work, and business transactions. “Obviously, this created a tremendous risk for violent crime and is a very inefficient method for doing business,” he added.

Marks also is an attorney, but has spent his career as an entrepreneur focusing on investment banking, real estate finance, and the downstream petroleum business. “Keith and I realized there existed a tremendous need for normal business practices, including a compliant, efficient, and legal alternative to cash,” said Burke. “In response, we founded PayQwick out of a desire to increase public safety and to bring normal business practices to the cannabis industry.”

Burke spoke recently in Los Angeles about his company’s solution to the industry’s cash-only problem and the essential role compliance plays in that solution.

What is the PayQwick model, and why is compliance such an important part of it?

Kenneth Burke: PayQwick is a compliance-based electronic payment hub that enables state-legal marijuana commerce to transact throughout the entire supply chain, from seed to sale. Because cannabis remains a Schedule I controlled substance under federal law, cannabis businesses have almost zero access to financial services like bank or credit union accounts and merchant services. The keys to accessing banking services for cannabis businesses are strict compliance with both state law and the guidelines issued by the U.S. Department of Justice (DOJ) and the Department of Treasury’s Financial Crimes Enforcement Network (FinCEN).

The guidelines consist of DOJ’s 2014 second iteration of the Guidance Regarding Marijuana Related Financial Crimes (the “Cole Memo”) issued by Deputy Attorney General James M. Cole and FinCEN’s 2014 BSA Expectations Regarding Marijuana-Related Businesses (the “FinCEN Guidance”). The Cole Memo gives local attorneys general guidance regarding how to exercise their prosecutorial discretion when deciding to enforce the Controlled Substances Act against marijuana businesses. The FinCEN Guidance gives financial institutions guidance regarding how to legally work with state-licensed cannabis businesses.

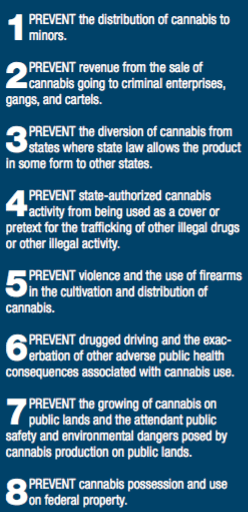

The Cole Memo and the FinCEN Guidance both heavily emphasize the importance of complying with each state’s cannabis regulations. To ensure PayQwick and its cannabis clients are operating in compliance with the Cole Memo and the FinCEN Guidance, we created specialized compliance assessment programs for each state that incorporate the requirements of the Cole Memo, the FinCEN Guidance, and state cannabis laws. We conduct regular onsite inspections of our clients’ premises and their business practices to ensure our clients are operating in compliance with state law and are not implicating any of the eight enforcement priorities listed in the Cole Memo.

PayQwick is licensed as a money transmitter in Washington, Oregon, and Arizona, which means we must operate in compliance with federal and state banking laws, including the Bank Secrecy Act and the Anti Money Laundering Control Act (BSA/AML).

In sum, compliance is PayQwick’s backbone because, as a financial institution dedicated to serving the cannabis industry, we simply cannot operate legally unless we and our clients comply with all state and federal regulations.

How many consumers and businesses use your service? In how many states do you operate?

The exact number of our clients is proprietary information, but it is several hundred. We have been operational in Washington State for nearly two years and are a licensed money transmitter in Oregon and Arizona.

What are your growth projections? Do you plan to expand your services?

We plan on expanding our services to every state that has 1) legalized medical or adult-use/recreational cannabis and 2) a statewide seed-to-sale traceability system. As of right now, we plan to expand to Colorado and Arizona this summer, followed by Alaska, Nevada, Florida, and California by the end of 2017.

In what areas of compliance does the industry perform best, and in what areas does it need the most improvement?

From what we have seen, the industry is excelling at security and protection issues. Our clients’ surveillance systems cover all the areas they need to cover. Naturally, this is important because security and safety are major concerns in the industry.

The area that needs the most improvement is having retailers check IDs at the point of sale, not just upon entry to the dispensary or retail store, and having cultivators and manufacturers label their goods in strict compliance with state law. The labeling requirements often are complicated, which can lead to inadvertent errors.

What is the Cole Memo?

The Cole Memo identifies the following eight enforcement priorities for DOJ attorneys.

You’ve been lobbying a lot of late, in state capitals as well as in Washington, D.C. What do you mean to accomplish with those efforts?

You’ve been lobbying a lot of late, in state capitals as well as in Washington, D.C. What do you mean to accomplish with those efforts?

We believe one of the most important things professionals in the cannabis industry must do is educate legislators and regulators regarding the current state of the industry. Cannabis businesses today are highly sophisticated operations that benefit their state economies in myriad ways, including diminishing the black market and generating hundreds of millions of dollars in tax revenue. We, as an industry, best understand our needs. So, there is no one better than industry members to educate those drafting the laws and regulations that govern the cannabis industry.

We hope that through our lobbying efforts, we can educate state and federal lawmakers regarding the current state of the cannabis industry and what is necessary to further normalize it. Specifically, we want to help create legislation that will make it safer and easier for financial institutions to service cannabis businesses so the industry can curb its cash-reliance.

When the barriers to full-service banking for the cannabis industry finally come down, will there still be a market for “alternative” billing services such as yours?

We hope the barriers for banking in the cannabis industry will come down sooner rather than later, because that would be good for not just our company, but for the whole industry. Realistically, however, that scenario is still five to seven years away.

Even when banks begin openly serving the cannabis industry, there will remain a critical demand for services like PayQwick because cannabis will always be a heavily regulated industry and banks will need a partner like us to backstop their BSA/AML compliance obligations. Therefore, PayQwick’s focus on ensuring our clients’ compliance with state and federal law will continue to be essential for banks serving the industry. Moreover, PayQwick’s business-to-business electronic payment hub will continue to be the most efficient method of payment among cannabis businesses and ancillary service providers like landlords, attorneys, and vendors. Businesses can pay each other using our smartphone or tablet computer app with just a swipe of their finger. It’s that easy. Finally, PayQwick enables state and local taxing authorities to collect taxes electronically instead of in cash, which serves a crucial need, as well.

We all are pioneers in the cannabis industry. It is incumbent upon us all to relentlessly stress compliance and transparency in everything we do. Only then will we be able to sustain and grow our industry in the face of the many detractors and obstacles that inevitably lie ahead.