Ask around, and you may hear 2023 is the most challenging year yet to operate a dispensary. With capital largely evaporating, licensed and illicit competition increasing, and customers conditioned to shop for deals, running a profitable store is becoming harder.

As customers increasingly search for better deals, dispensaries have to defend their margins against downward pressure by eking out gains in operational efficiency and retaining existing customers.

Since retail locations are where the customer interacts with the supply chain, problems flow upstream from retail. Struggling stores spell trouble for brands, distributors, cultivators, and service providers. That’s why it’s extremely important for every cannabis business that retailers thrive and turn a tidy profit. We spoke to retailers, tech founders, and service providers across the country to explore the tools needed to run a successful dispensary.

Cover the bases outlined below, and you will have sufficiently modernized your dispensary in key areas that either will generate revenue or cut costs—or, in some cases like kiosks and cash alternatives, do both.

An alternative to cash

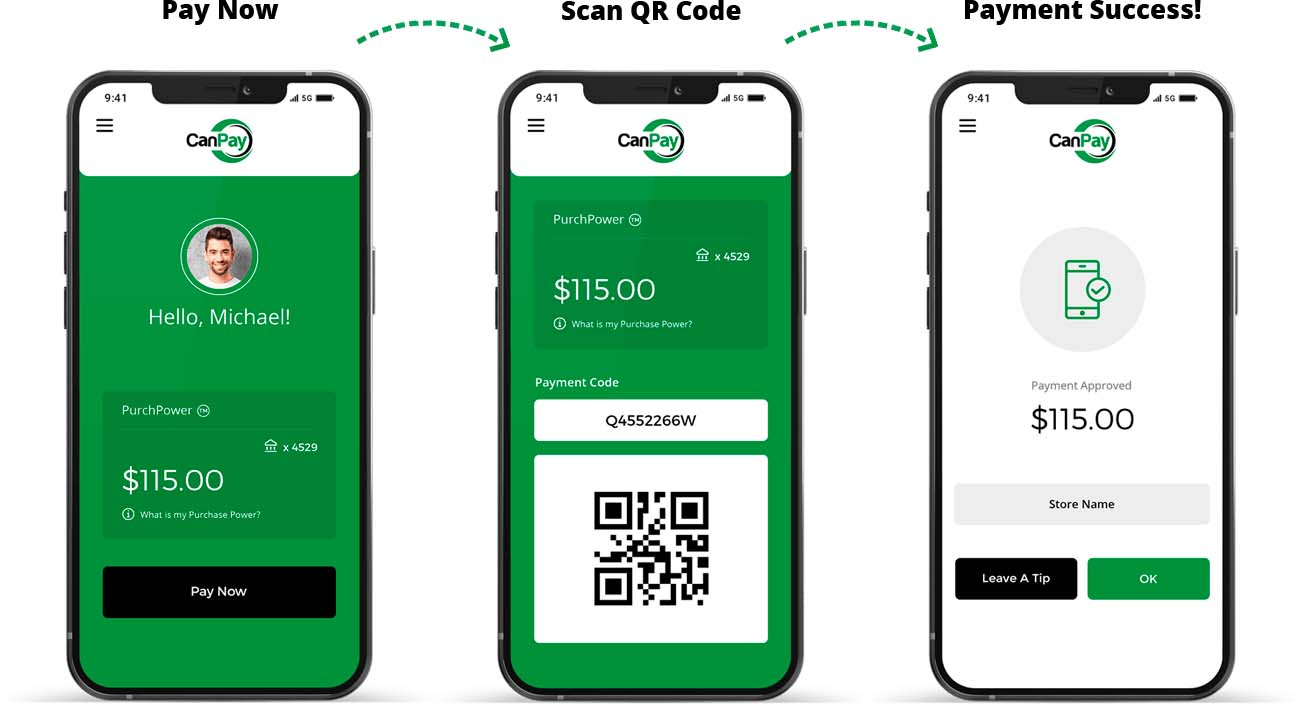

Offering an alternative to cash can increase sales by an average of 33 percent, according to Flowhub’s data. No other single change a dispensary can make will deliver such a considerable lift in revenue. The challenge is picking a system that is both efficient and compliant. After payment-processing companies shut down the cashless ATM path late last year, options for accepting alternative payments shrank and became less clear.

Aeropay and CanPay are among a handful of companies that use contactless bank-to-bank automated clearing house transfers to provide compliant cashless solutions. The mobile apps function much like electronic debit cards and are accepted at a growing number of dispensaries. Each standalone system works with a network of compliant banks that know exactly what customers are purchasing, so no subterfuge is necessary (as was the case with some cashless ATMs).

A growing number of point-of-sale providers are integrating third-party cashless services or developing their own. After launching its proprietary solution, technology company dutchie reported seeing a 25-percent increase in transaction sizes as well as a 49-percent increase in customer frequency at client dispensaries.

Loyalty rewards

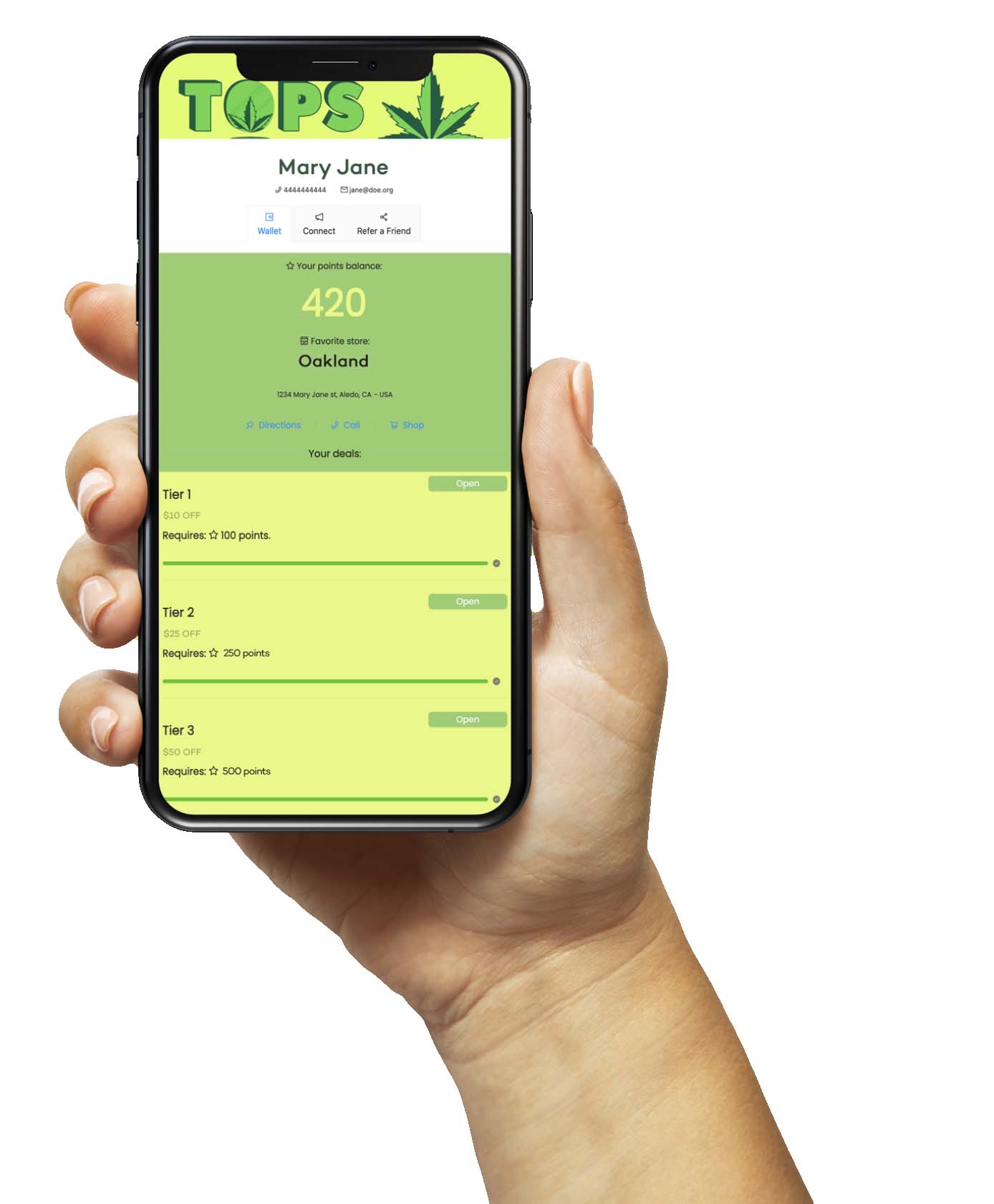

Acquiring new customers is said to be seven times more expensive than retaining existing ones. Combine that with the Pareto Principle, which posits 20 percent of a business’s customers provide 80 percent of its revenue, and the importance of keeping customers happy is easy to see. Loyalty rewards programs are one way to make customers feel valued (and therefore happy), and they’re relatively easy to implement.

“At this moment in the industry, it’s important to reward the customers who are coming to our stores and spending money,” said Angela Pih, head of marketing at StateHouse Holdings. StateHouse has introduced what it calls the TOPS Reward Program, which gives customers an impressive 10 percent cash-back credit on all purchases across fifteen Urbn Leaf and Harborside stores. “You get one point for every dollar, so for every 100 points you get $10 credit,” Pih explained. “You can earn double points at certain times of day, 1.5 points on certain products, and if you hit the 1,000-point threshold, you get the secret, off-menu options other people can’t access.”

Stores in competitive markets or in states with thriving illicit markets may benefit from offering customers rewards that encourage them to return instead of shopping around.

A directory listing

Weedmaps and Leafly are two of the largest online marketplaces serving cannabis consumers. Since launching in 2008, Weedmaps has been a definitive resource for all things cannabis, while Leafly stands out for its exhaustive categorization of strains and cannabis knowledge.

On the business-to-business side, Weedmaps has morphed into a comprehensive suite of ecommerce-enablement and compliance tools for brands and retailers. It boasts around 5,500 monthly paying customers and around 11.5 million unique website visits per month.

Because so many consumers—especially new ones—visit online marketplaces and directories, stores are bleeding revenue if they’re not listed.

Kiosks

A growing number of consumers now considers cannabis just another consumer packaged good. As in every other store they patronize, when they visit a dispensary they want speedy transactions and limited interaction with salespeople. Kiosks provide a solution.

Kiosks increase operational efficiency. “With a self-ordering kiosk, you can staff for the slow times but still be covered during the busy times,” said Amber Erickson, head of marketing at Seed, which provides tablet-based kiosks that allow customers to browse and order without human assistance. “This will save significant cost on staffing without sacrificing service or consistency.”

Kiosks also can help boost sales. Erickson said one of Seed’s Massachusetts customers added wall-mounted touchscreens and saw a 26-percent increase in cart size for self-service orders. “With built-in upsell capability and a no-rush environment, customers are more likely to buy more,” she said.

Seventy-five percent of customers surveyed by Seed said they would use a kiosk.

Shops within shops

In-store merchandising has improved immeasurably since the industry’s early days, when the best options were a primo spot on the chalkboard and a four-by-six postcard by the checkout. Although most dispensaries now offer shelves or wall decals to brands, pop-ups and shops within shops have started springing up at high-volume retailers. These “internal boutiques” offer brands small, semi-permanent installations where they can express themselves and drive visibility. The concept was borrowed from department stores, where beauty and fragrance brands have used it to great effect.

Dispensaries like Urbn Leaf, Airfield Supply, and Planet 13 are proponents of the concept, and all of them use the tactic to generate revenue from brands looking to turn the popular stores into branding machines.

An SEO strategy

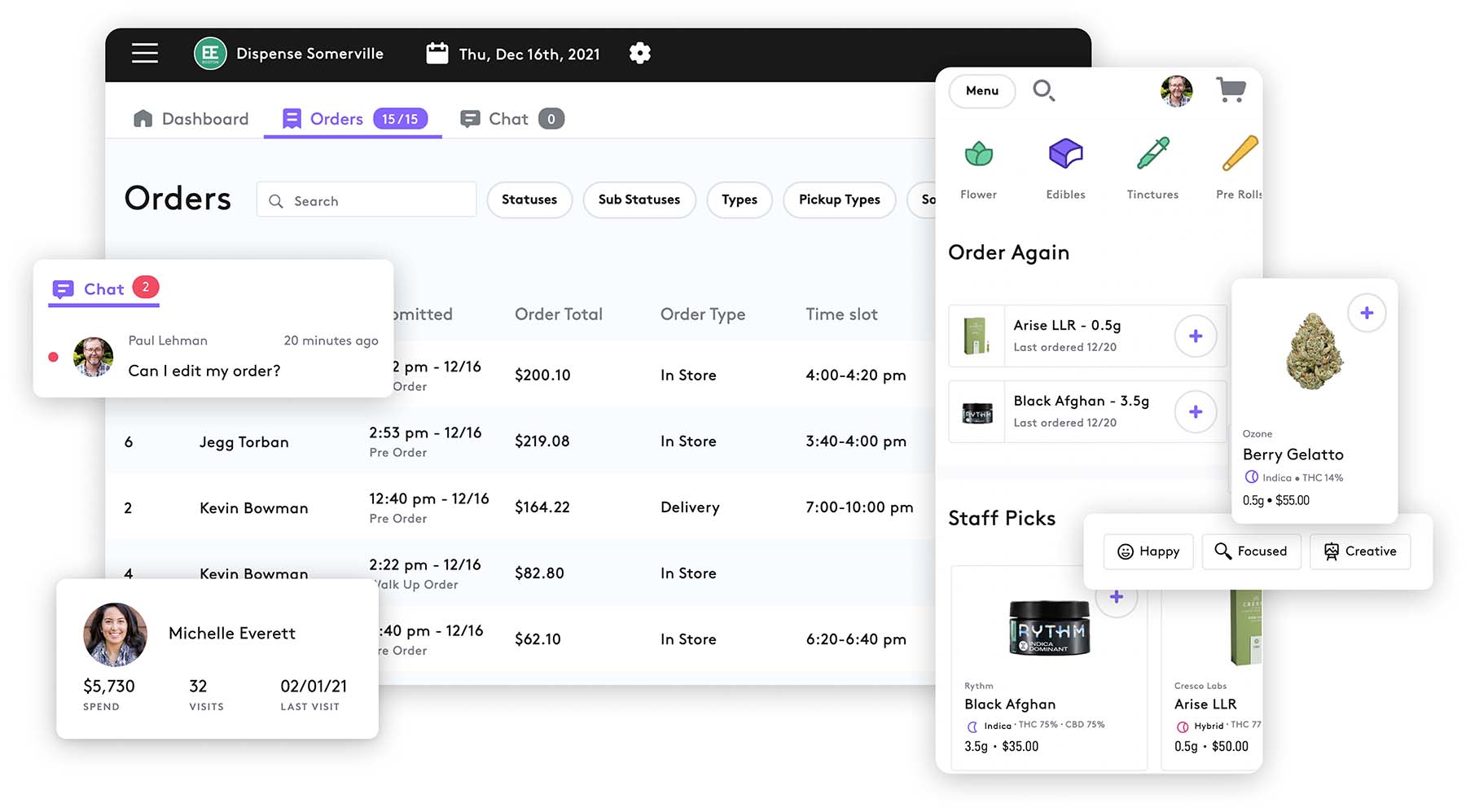

A search engine optimization (SEO) strategy today means a lot more than placing the obligatory “Cannabinoids 101” blog post on your website. Menus comprise one area where some dispensaries are discovering previously unrealized SEO gains and, consequently, increased website traffic. In highly competitive markets, a better search engine ranking can mean more foot traffic or online orders for the store.

The majority of third-party-provided ecommerce menus are iframe-based, meaning they consist of an HTML element that loads another HTML page inside the page users are viewing. Search engine spiders consider the content within an iframe to belong to the ecommerce provider’s website, not yours. While iframes won’t hurt your SEO ranking, they don’t result in all that valuable menu content counting in your favor, either.

One company trying to help dispensaries capitalize on the SEO value of their menus is Dispense, which creates menus that load natively onto a website, allowing the dispensary to capture the full SEO benefits that come from connecting customers with the products they seek.

“Our goal is to be more like Shopify than Amazon,” said Business Development Manager Jeremy Johnson. “We’re just in the background enabling you to sell cannabis.”

Ethical products

More than ever, consumers expect the retailers they patronize to walk the talk, especially when it comes to social and environmental issues. Carving out shelf space for social-equity brands and brands owned by people of color is a great place to start. Such displays go beyond virtue-signaling, though. They also provide an opportunity for dialogue and education.

“A lot of customers still don’t know what social equity is,” said Ramon Garcia, co-founder of the Original Equity Group. “Once we tell them it’s like fair trade and they are investing in businesses that are building generational wealth in communities of color, people are happy to support it.”

While current trends favor high-potency indoor flower, the conversation about sungrown, environmentally sustainable flower is picking up, too. Stores like The Woods in West Hollywood have made elevating sungrown flower a core tenet of the business, and other establishments are following suit. “Sungrown flower is how the industry started,” said Sam Campodonico-Ludwig, co-founder and president of Aster Fams, “so when retailers aren’t providing access to organic, outdoor options, they are not paying respect to those who came first.”

Something Instagrammable

Whether it’s a mural from a local artist, a quirky neon sign, or a lush living wall, having something pretty for customers to take photos of (or in front of) is good for business.

Marketing a dispensary on social media can be incredibly challenging, and there’s always the risk an account could be shut down if a platform believes the content violates its terms of service. One way to get around this is to encourage customers to broadcast the store by creating a selfie-worthy opportunity they can’t refuse.

Gi Paoletti, a commercial designer and founder of Gi Paoletti Design Lab, has worked on a number of design-forward stores, including Stiiizy’s flagship location in downtown Los Angeles. She has leveraged the power of art and photo walls to great effect in her designs, and about 85 percent of her clients now want similar features integrated into their spaces.

“When you think about making an entire space Instagrammable, you’ve got to consider what’s going to inspire someone to want to take a picture and share it with their friends,” Paoletti said. “What’s going to create that wow factor?”

Planet 13 may be the most social-media-famous dispensary in the world, and not by accident. From the parking lot to the cash stands and everywhere in between, the chain’s reputation for spectacle lives in irresistible photo ops that evoke local character and draw Instagrammers like magnets. According to Vice President of Sales and Marketing David Farris, the branding benefit is priceless.

Non-spammy communication

Dispensary owners, it’s 2023. You have to manicure your customer lists, make a concerted effort to learn your customers’ preferences, and not spam them into replying “STOP” before they’ve even considered your awesome Terpy Tuesday deal.

Market-leading multistate operator Trulieve takes its customer communications very seriously and has developed a meticulous system of segmentation to ensure it is always aiming for the bull’s eye as opposed to spamming en masse.

“We’re constantly learning about our customers through their buying patterns and their responses to messages we put out,” said CEO Kim Rivers. “The level of hyper-personalized targeting we can do today really helps our customers feel we’re seeing them, we understand who they are, and we’re speaking more directly to them.”

The tactic appears to be working. Trulieve maintains a gross margin of 56 percent and celebrated its nineteenth consecutive quarter of profitability at the end of 2022.

House products

Every major retail chain—Kroger, Walmart, Target, and others—has developed in-house product lines that compete with the name brands. Dispensaries should be no different.

“In order to become more efficient and more profitable as a retailer, you have to offer private-label brands,” said Andreas Neumann, chief creative officer at Jushi. “But it’s really important the quality is high.”

Retailers also must be cognizant of competing against their brand partners. California dispensary chain Embarc recently dipped its toes into branded products by way of a collaboration with flower producer Traditional. The move allowed Embarc to partner with a vendor instead of competing and enabled both sides to play to their strengths (Embarc with branding and distribution, Traditional as a cultivator).

“The goal is not to compete with brand partners but to highlight them, support them, and be collaborative with them,” said Nic Magbanua, Embarc’s marketing director. “We love opportunities to tell our story with brand partners we like, because I don’t think storytelling is done enough in this industry. All I hear are discounts and promos.”

He said success with an in-house line requires knowing what the audience likes, having the shelf space for displays, and encouraging the staff to push the products. Just make sure respect for brand partners remains at the forefront, and never let house products exceed 50 percent of the merchandise mix, he advised.

[…] Dispensary owners everywhere hastily dusted the cobwebs off their neglected websites. A handful of ecommerce menu providers, third-party directories, and delivery services helped brick-and-mortar stores get their ships in order almost overnight while scaling their own operations on the fly. […]

[…] How can retailers effectively prepare for the holiday rush? Here are three top ways to ensure success. […]

[…] matter how simple or complex you want to keep your email strategy, segmentation is one of the most crucial components, allowing you to organize and communicate with your customers based on specific preferences or […]

[…] continued market expansion, gaining traction as a dispensary isn’t getting any easier. For operators trying to succeed in major cities with legal adult-use […]

[…] the price for similar products in medical versus adult-use shops. As more states come online, some notable trends reveal a predictable trajectory for both medical and adult use as the markets mature. In some […]

[…] Like many others, I’ve been grinding away, constantly adjusting to the latest rules, regulations, trends, management, you name it. As it was for tech startups during the early dotcom days, our mantra in […]

[…] those values, and don’t be afraid to be authentic in your storytelling to make the connection for consumers. Tell your story the way it happened. Not all struggles or […]