SEATTLE – Look out, edibles. Cannabis concentrates are about to eat your share of the market’s lunch.

Between January 1 and June 30, 2021, concentrates owned 9.5 percent of the American market, compared to edibles’ 9.9 percent according to new data from analytics firm Headset. During the same period in 2020, edibles held a three-point lead. Vapor pens and flower led both categories by a huge margin, with 21-percent and 46-percent market shares, respectively.

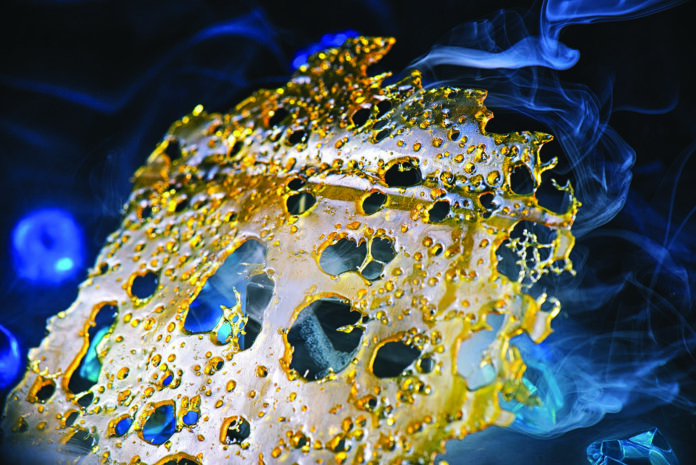

Live resin was the top concentrate segment in the United States with 33 percent of sales within the category. Wax came in second with 24 percent of sales, followed by shatter at 10 percent, rosin at 7 percent, badder/budder at 6 percent, and Rick Simpson Oil (RSO) and similar products at 5 percent. The majority of units sold (96 percent) were in 1g packages.

Concentrate prices mostly stayed below the $35 mark, according to Headset’s data. Popular categories like live resin, shatter, and wax all maintained consistent pricing during the time period, unlike the RSO segment, which showed a significant price jump from below $20 dollars to over $30 during 2020.

Rosin may have earned only a 7-percent market share, but the average item price was highest: $50. Headset analysts ascribed the phenomenon to a possible emerging consumer preference for solvent-free products.

As for demographics, Gen Z males devoted 14 percent of their purchasing power to concentrates, making them the most valuable customer. Millennial males followed closely with an 11.9-percent wallet share. Baby Boomers contributed less than 5 percent to category sales.