For an industry that was born in backwoods and back rooms across the United States, it didn’t take long for cannabis to become a full-fledged, marketing-savvy retail machine. One Las Vegas dispensary boasts interactive LED floors and an in-house pizzeria; Portland is home to twice as many weed shops as liquor stores. Across the country, dispensary menus are bursting with everything from designer vape pens to weed-infused beauty products.

As the cannabis supply chain evolves, brands, distributors, and dispensaries all are trying to keep pace with a consumer market growing at breakneck speed. Brick-and-mortar stores and delivery operators are in stiff competition for new customers, trying to balance the needs of new shoppers and veteran users who may be looking for completely different products but always are looking for a good deal. Using new software tools and platforms, retailers are starting to build profiles of both groups in a race to better understand and target their customers. In search of the right formula, they’re investing in tried-and-true methods including influencer marketing and loyalty programs, but also are implementing newfangled technology platforms that reach millions of customers, building detailed profiles of shopping habits along the way.

As much as the retail side of the industry has grown over the past few years, we’ve only scratched the surface of what’s to come.

Reeling in new customers

“The industry is going through a transition with the rise of sophistication and professionalism in technology and manufacturing,” said Lily Colley, a marketing and business development consultant who has worked with some of the top brands in the cannabis industry, including Dixie Brands, incredibles, Acreage Holdings, and Kalyx Development. “So, what we are starting to see is a divide between the old ways and the new frontier, and sooner than later the consumer who has been questioning the trust factor will start to believe in specific brands and retailers and embrace the experience.”

To develop their marketing, merchandizing, and product development plans, cannabis brands first must understand their core customers along with the new mainstream consumers. Whereas a weed enthusiast makes buying decisions based on factors such as growing or processing methods and terpene/cannabinoid profiles, new users may go for slick packaging, celebrity endorsements, or simply the best bang for the buck. Regardless their preferences, one thing all customers care about is finding brands they can identify with and trust. Those brands soon become their go-to brands—and all of them have an opportunity to become the Marlboro, Budweiser, or Johnson & Johnson of the cannabis industry.

In response to the fickle tastes of new consumers, brands and retailers are going to great lengths to analyze their consumers’ buying habits. If young women are purchasing more vape pens than flower and customers 55 and older are the fastest-growing cannabis consumer group, how do brands use this information to position their products to reach the diverse demographics?

“Up until now, retailers have been the ultimate gatekeepers and the direct communication with consumers because of the limits on advertising,” said Colley. “But savvy brands have leveraged influencer marketing and [public relations], and when consumers read about a brand from authorities, that’s what they start to believe. Some people pooh-pooh social media, but it’s an important tool and you won’t have a successful brand without it.”

One marketing tactic cannabis companies have developed is presenting products meant to provide specific sensations, such as vape pens that “calm,” offer “bliss,” or “arouse.” In a recent report, BDS Analytics and Arcview Market Research predicted a 13-percent increase in concentrates and vape pens and a 14-percent reduction in flower sales between 2017 and 2022.

Convenience is another major factor in the cannabis marketplace. Half of cannabis consumers say their purchase decisions are influenced in a big way by the convenience of the consumption form.

Findings like these underscore the importance of investing in data collection and analytics that allow companies to drill down into customers’ preferences and buying habits. Colley advises her clients to invest early and often in budtender education, strategic marketing, and partnership agreements with retailers. All can pay big dividends in customer loyalty.

As a new breed of consumers enters the market and find themselves overwhelmed by countless flower, extract, and edible options, budtenders are a critical cog in the cannabis retail ecosystem. The fact is not lost on brands and distributors, who go to great lengths to forge relationships with the folks on retail’s front line, who provide hundreds of recommendations every day that might make or break a brand.

420 meets the 7-10 split

Those looking for a symbol of the cannabis industry in 2019 need look no further than their local bowling alley. Indus Holdings and its California distribution wing have been sponsoring budtender bowling teams across the state to meet up, check out new products, and let the good times roll. It may not be the country club, but baby steps are appropriate for an industry that, not long ago, held most of its important meetings in hotel rooms, danky warehouses, and barns.

Headquartered in Salinas, California, a hotbed of canna operations, Indus Holdings Inc. has acquired a portfolio of brands and built cultivation, manufacturing, and production facilities in California, Oregon, and Nevada. Its distribution wing supplies more than 500 dispensaries in California alone, and co-founder and Chief Executive Officer Robert Weakley said the bowling teams the company sponsors are an entertaining way to build and maintain relationships with retail partners.

“It’s fun to get budtenders out there, meet them, share product and marketing materials, and have informal conversations,” said Weakley. “Budtenders still make most of the decisions on buying, and users who don’t have as much experience will ask them, ‘Hey what do you like and recommend?’ We don’t have access to full-page [consumer] advertising or Facebook ads, so we rely on budtenders to educate people.”

Beyond schmoozing, cannabis brands, distributors, and retailers across the U.S. are using new technology platforms, data analytics tools, and loyalty programs to gain a better understanding of customers’ buying behaviors.

With a variety of new software platforms from which to choose—Jane Technologies’ IHeartJane.com, Lucid Green, and Muncheez, to name a few—retailers and vendors are gaining new, targeted insight into their customer bases, identifying buying trends, and building customer profiles using precise analytics based on the same type of marketing intelligence brands in other markets have employed for decades.

These platforms are becoming their own ecosystems, removing the budtender as a gatekeeper while incentivizing customers to educate themselves. They’re also collecting data on consumer preferences and product offerings. Muncheez, for instance, connects customers to cannabis brands and retailers. The software is built around the Muncheez Media Network, Muncheez.com, and the Muncheez app, which work in unison to drive customers to the cannabis brands and retailers that sign up for the service. The software also provides business tools for demand generation, customer acquisition, digital marketing, local search, and couponing.

“We’re building a system that’s brand-to-sale technology with programmatic advertising and provide reach to consumers on a broad level, targeting users between 25 and 75 [years old] with a platform brands, consumers, and retailers can trust,” said co-founder and Chief Executive Officer Sheldon Owen. “A CBD brand might want to know if there are people in Northern California buying more vape pens over edibles or more topicals versus tinctures. That type of product information is valuable to brands. It helps them decide to scale up or down and provides other insights to help make better processing decisions.”

Hannah Davis is chief marketing officer for Los Angeles-based Mammoth Distribution, which specializes in vape products for the California market. Mammoth recently signed a deal with Jane Technologies to promote one of its top brands, Heavy Hitters. Now, when consumers go to the Heavy Hitters website, they can find all the stores where the products are available and order for pickup or delivery. “For us, it’s a new way to connect directly to consumers,” she said. “Currently, there is no ecommerce situation in the industry, so the data is always secondary and we have to ask retailers to get data back to us. But through IHeartJane.com, we’ll have access to understand the type of people buying our products and the related basket data.”

Owen said, “Retailers want to give their customers menu options that are tailored to their purchasing habits, and data and intelligence can fulfill both philosophies for brands and retailers.”

Cannabis superstores

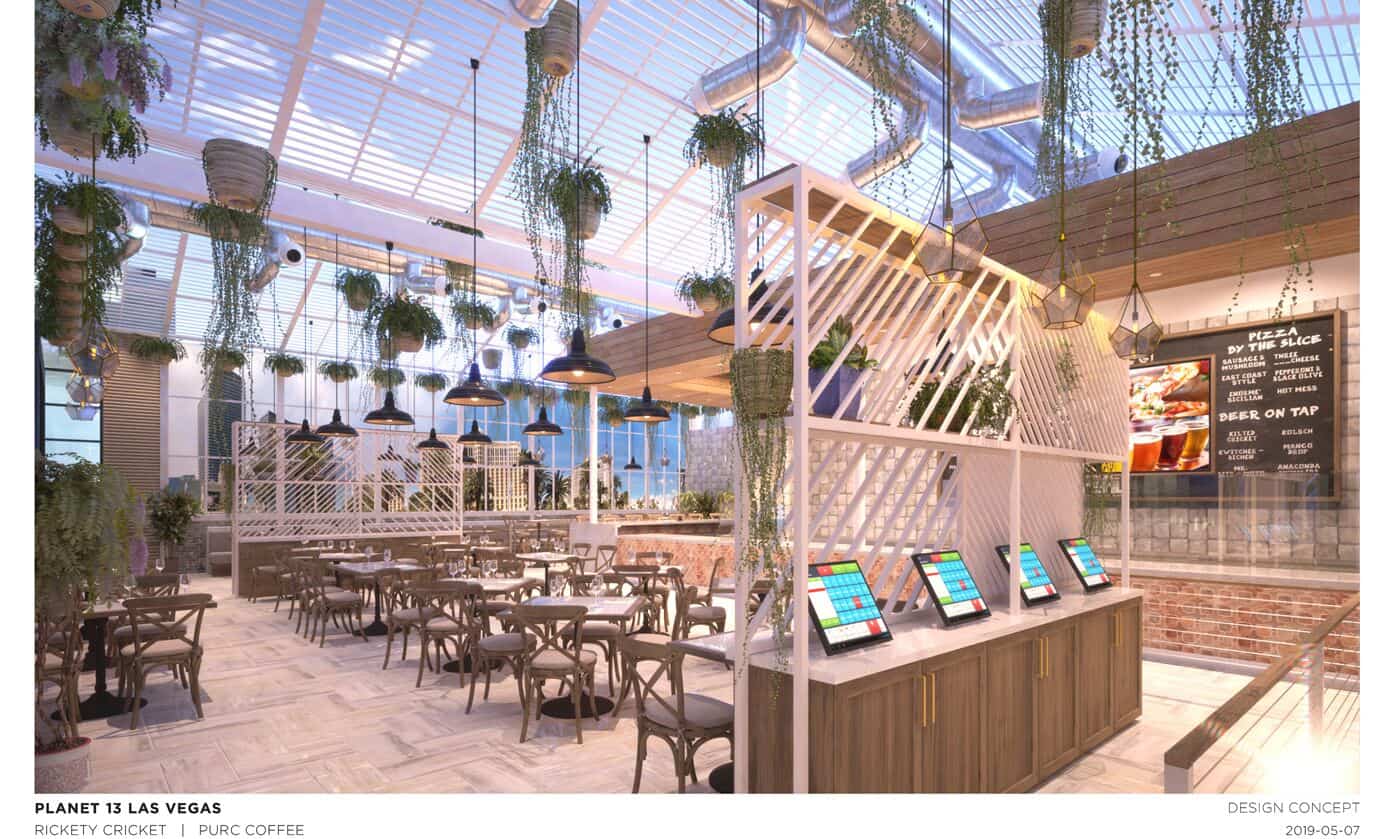

With about 16,000 square feet of retail space, Planet 13 in Las Vegas is a touch bigger than the average cannabis dispensary. When it expands later this year, the dispensary will add a pizzeria, café, and event space that will consume another large chunk of the 112,000-square-foot building. With more than 100,000 customers dropping by each month, Planet 13 is creating an entertainment complex that will rival some casinos on the nearby Strip.

In true Vegas over-the-top style, the display floor is tricked out with glowing sculptures, sensor-activated LED floors, interactive laser graffiti, and 3D displays. With NuWu, Jardin, and Planet 13, Vegas boasts a trifecta of cannabis superstores that are simultaneously refined and splashy.

“With this second round of states coming into retail, we’re going to see much bigger and more sophisticated stores,” said business development consultant Colley. “Planet 13 looks like any other crazy retailer in Vegas. With its interactive floor and giant fountain out front and experiential shopping, it’s like walking around a jewelry store. They are even paying taxi drivers $15 cash for dropping off tourists. It highlights that new retail operators are financed in a serious way and have investors to answer to with major war chests and best practices.”

David Farris, director of marketing for Planet 13 Holdings, said customers spend an average of $90 per visit—twice as much as at some other cannabis shops in Sin City. He attributes the store’s success to the time and effort spent designing Planet 13 for a more elegant, entertaining experience that keeps shoppers hanging around. “Some people like to shop on their own, whereas others like to spend thirty minutes with a budtender, and we cater to both,” he said.

“What was normal before was white boards where you checked out a 7-11 style menu, but we’re getting away from that with more direct communication with the customers,” he continued. “We help them try new things and get a more hands-on and immersive experience instead of just standing in line and pointing at letters on a wall.”

When most cannabis companies talk about building a vertically integrated company, they mean starting up a grow and opening a store to sell the resulting flower and concentrates. But for Cookies, the San Francisco-based brand built on the back of its genetics, lifestyle brand, and hip-hop celebrity founder Berner, creating a vertical has been a more comprehensive process.

Parker Berling, president of Cookies California, compares the customer experience at Cookies shops to what Nike has done with its Niketown stores across the U.S. “At most cannabis shops, you’re handed a menu and then a sealed bag for the products, whereas at our Melrose store (in Los Angeles) you see people huddled around with all these flower strains on a table, and they are having this intimate experience with the product. The percentage of customers at Melrose that are coming from out of state is mind-boggling, so it’s really becoming a destination for our fans.”

Soon enough, customers won’t have to fly to L.A.: The company is expanding its footprint to a dozen markets across the U.S. and internationally. “Because we are a brand based on genetics, we have to find a partner we feel can produce our products, and then the retail follows,” Berling said. In June the company announced a partnership with Maryland’s Culta brand, which will be the exclusive cultivation, manufacturing, and distribution partner for Cookies throughout the state. As Cookies expands, staying focused on customers and their evolving tastes will be a core focus.

“Part of the dream of this company and this industry is we have this incredible opportunity to collect consumer data and build rich customer profiles,” said Berling. “We know who our consumers are, and with that data we understand what their preferences are and what the mix of products being bought are. That 100-percent drives our product strategy and what we focus on.”

Brand-building 101

Research firm BDS Analytics reports brands are beginning to dominate markets in every state. “Brands that are building loyal fan bases and producing quality products that deliver on promised physio- and psycho-experiences are excelling,” according to the company. In particular, concentrates, edibles, and topicals are big sellers. “In Colorado, Oregon, and Arizona, the top five edibles brands in each state own more than 40 percent of the market, and the story is the same with concentrates,” a recent BDS report revealed. “And individual brands have the potential to achieve explosive growth. Sales for one brand in Oregon rose 19,179 percent between 2016 and 2017.”

Whereas dispensaries once bought products of all types from producers and slapped their own logos on packages, today’s operators use sophisticated marketing techniques—often borrowed or adapted from similar industries—to create slick brand images and identities with inspired approaches to design, packaging, and advertising. Of course, creating a winning design is only one component of the game, and brands that want to excel must parlay marketing efforts into sales.

“There is starting to be a lot of data produced in the market for the first time, and historically that was one of biggest complaints,” said consultant Colley. “So now we have all this data, but how to use it is what is hard. Some of these technology platforms focused on retail disruption will be companies that get their real value in presenting data so it’s digestible and actionable and drives sales.”

Planet 13’s Farris said his company has evaluated different software platforms, but issues of compatibility with point-of-sale software often arise. Planet 13 is taking a wait-and-see approach. “Our in-house systems are pretty robust, so we can pull data to better understand our customer base and see what they are buying and where they are from,” he said. “It’s hard when you run marketing campaigns to see if those campaigns are working or not. We’ve seen a lot of people from the Santa Ana area in our store, so that went into our decision to locate our new store there.”

Is pay-to-play a winning bet?

Some companies jump-start their brands by using a tried-and-true marketing device used in many other industries where products with similar profiles compete for customer loyalty and product placement becomes a key consideration. About half the dispensaries in California now require “slotting fees,” or payment for shelf space. The pay-to-play environment gives brands that can afford the expenditure prime placement and additional marketing support in the retail environment.

“Generally, everyone in the industry is open to [slotting fees], and that’s the direction it’s going,” said Mammoth Distribution’s Davis. “Sometimes the fees are really high, so it’s a ‘no’ for us. But it’s [a return-on-investment] equation. If [paying slotting fees] is going to be beneficial to our sales—and we have seen that—then most of our brands are good with [paying the money].”

Beyond educating budtenders about the nuances of a brand and its products, some slotting fee arrangements guarantee prime product placement in the store and other forms of direct promotion and marketing, such as providing customers with an iPad loaded with a distribution company’s brands and featured products.

“As consumers are walking into the store, they often don’t know what they’re shopping for,” said Davis. “We want to guide that decision-making and help them find the best product for their needs. We have certain retailers where we do slotting fees, but we prefer to work on larger partnerships, stuff like exclusive products or making sure they are first to get new strains coming out. We might pay to place in a store, but we also want to make sure it’s a mutually beneficial relationship that helps them become more profitable.”

Weakley echoed this sentiment, saying Indus tries to negotiate more creative partnerships that go beyond the scope of slotting fees. When Indus sales agents visit dispensaries, they promote their “Sweet 16”—sixteen brands the company wants every dispensary to carry and give prime placement.

“We really like to supply retailers with marketing support, whether that’s patient appreciation days or other incentives to buy products,” said Weakley. “With slotting fees, the problem is [consumers] don’t understand them, so we prefer collaborations that help grow both businesses versus just writing a check each month to carry our brand. We want to make sure we have strong partnerships moving forward versus a short-term aisle-cap-type play.”

In the past few years, Weakley said, the widespread legalization of cannabis, combined with the push for more sophisticated marketing, has drawn mainstream professionals who just a few years ago would have scoffed at the idea of working in cannabis.

“A few years ago, if you were trying to get a [consumer packaged goods] executive to run a cannabis company, they would have said ‘you’re crazy,’ but now we get phone calls all the time,” he said. “So, having these executives thinking through how stores are laid out and how brands are built, it’s a great time to be in the industry and watch it really take shape.”