High prices and a lack of noticeable effects have stopped nearly 20 percent of consumers from continuing their cannabidiol (CBD) regimen. However, savvy brands are still finding ways to attract new customers in an environment plagued by regulatory uncertainty that makes it difficult to plan for the future with confidence.

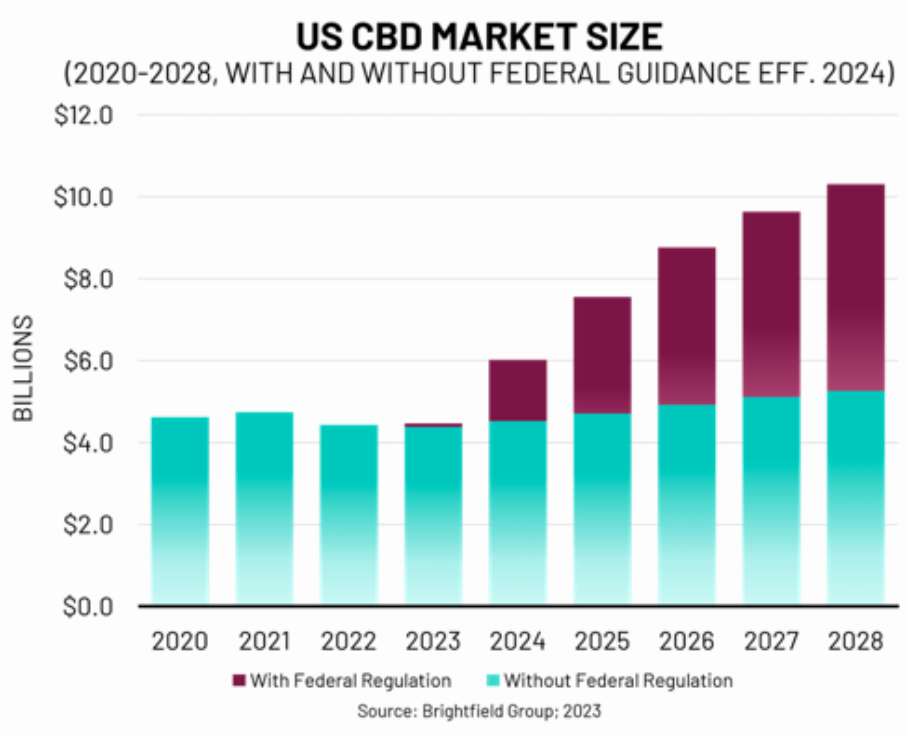

Brightfield Group’s recent market research report, Striving to Thrive in U.S. CBD, dives into two forecast possibilities for the industry: one with increased federal guidance and regulation, and one without. While the latter will result in a still-niche sector, articulate federal guidance means the market will grow from its $4.4 billion earnings in 2022 to $10.3 billion by the year 2028.

This type of regulatory pivot would open CBD manufacturers to a whole new world of possibilities, ultimately growing the cannabis ingestible space, increasing global plant acceptance, and getting more mainstream retailers involved in distribution and sales. But brands shouldn’t hold their breath for a new CBD landscape.

Know your CBD consumer and attract new ones

The prospect of increased federal CBD regulation is exciting, but in order to prepare for the worst while still hoping for the best, brands should envision a near future where everything stays the same: i.e., the market remains somewhat niche in its uphill battle for mainstream acceptance.

With a status quo projection in mind, the market is expected to hit $5.2 billion by 2028. While the lack of federal guidance continues to stifle CBD’s potential, companies can feel confident in focusing on what they’re doing right today and how they can lean into their success to optimize sales efforts.

“Without a regulatory framework for CBD in place, the distribution channels where CBD is sold are expected to remain largely the same,” said Matt Zehner, insights manager at Brightfield Group. “While this does pose some limitations, it also makes it clear where companies should be focusing their sales efforts.”

Understanding your existing consumers is paramount to success, but it’s important not to ignore how much of the CBD market is subject to fluctuation. Consumers cycle in and out of CBD usage depending on their needs, so it’s important to pay attention to loyal buyers while also recognizing who your newest consumers are and how you can convince them to stick around.

“Lots of Americans continue to use CBD,” said Zehner. “The percentage of respondents to Brightfield’s wellness survey that report using CBD has remained just about flat over the past year.”

The year’s CBD purchase numbers might continue to hover in the same neighborhood, but that doesn’t necessarily mean the same people are buying the products. CBD consumers tend to cycle, so when a group stops purchasing CBD products, they’re likely to be replaced by new consumers.

“The CBD sales decline we saw in 2022, and expect to see in 2023, is better attributed to how macroeconomic conditions like high-interest rates and inflation have negatively affected consumer spending on CBD,” said Zehner. “As the economy starts to stabilize and consumers start to return to more normal purchasing patterns, the CBD market should pick up again, though year-over-year growth is expected to be small for non-pharmaceutical products.”

Understanding why consumers move away from CBD

To coincide with 2022’s decline in CBD sales, Brightfield found that the number of CBD brands also declined—now well below 2,000, which is approximately half of the 3,500 active brands during the industry’s peak in 2020.

“The consolidation we’ve seen in the CBD industry is due to two things: companies trimming back their product lines and brands going out of business,” said Zehner. “Columbia Care discontinued its Pitbull-backed N2P product line by the year’s end, and mergers and acquisitions were negatively affected as well. For instance, Simply Better Brands canceled its deal to acquire Jones Soda in June 2022.”

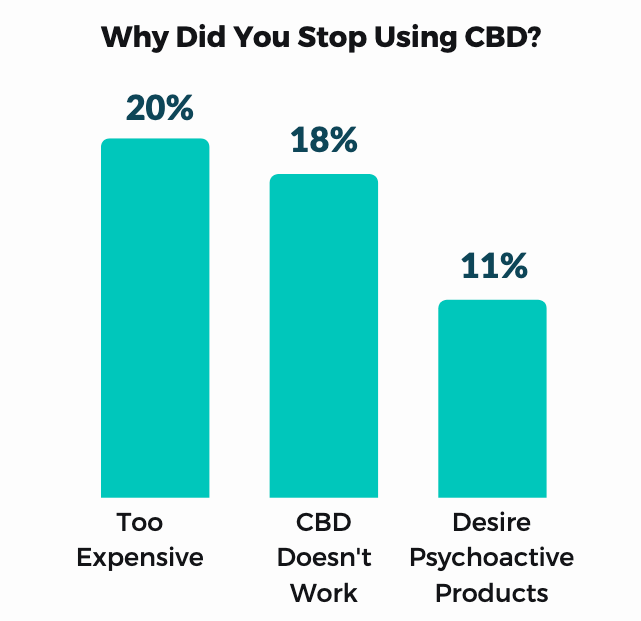

Last year’s market conditions encouraged brands and industry analysts to take a look at consumer trends in an effort to figure out why they stopped purchasing CBD, and the results were tied to sky-high pricing, the increased allure of other cannabinoids, and a lack of noticeable effects from CBD products for many consumers.

“Despite the price compression the CBD industry has seen in recent years, products being too expensive ranked as the top reason consumers stopped using CBD products in H2 2022 surveys,” said Zehner. “While significantly cheaper than they were directly following the 2018 Farm Bill, CBD products continue to cost more than the average comparable supplement or functional food product.”

While many loyal consumers might be willing to pay top dollar for CBD products, nearly one-fifth of former CBD consumers cited a lack of noticeable effects as a key reason for ceasing their use. This may or may not speak to the quality of the product. With so many brands trying to cash in on the CBD market, corners are being cut in product development, and one less-than-great experience can turn off a consumer for good.

Another competitor for the CBD market is the increase in demand for more psychoactive components of the plant in addition to other hemp-derived cannabinoids.

“For the near future, we see the CBD industry growing at double-digit CAGR,” said Sky Wellness Chief Executive Officer Thom Brodeur. “We also see mud in the water where CBD product sales are slowing compared to the rise in sales of other psychoactive products, like Delta-8 THC, Delta-9 THC, THCO, HHC adaptogens, and even ‘light’ psychedelics. That said, with more federal and local legislation pending and/or looming on those other psychoactives later this and early next year, we believe CBD product popularity and sales will begin to slowly rebound.”

Tips for CBD brand differentiation

For CBD brands to successfully keep their current consumers interested and attract new ones, they’ll need to lean into differentiation—especially if federal regulation does come more into play and more competition hits the horizon.

This looks like establishing authentic roots that consumers can connect with, being consistent, and, of course, opting for exceptional product quality and customer experiences.

Sky Wellness was born as a CBD company, meaning the decision to incorporate CBD products into its offerings was central to its inception. But there isn’t just one way to do it. From celebrity-backed brands to THC-focused brands moving into the space, there are plenty of opportunities to establish a clear presence.

It’s also useful for CBD brands to lean even further into wellness, incorporating other ingredients and adaptogens like melatonin or ashwagandha that might draw health-focused consumers into the plant-based realm.

“This [holistic] approach has multiple benefits,” said Zehner. “Including additional active ingredients can both boost efficacy and allow firms to piggyback off consumer knowledge and familiarity with these functional ingredients. It is also helpful in developing need-state-oriented products— goods designed around specific occasions of use or frames of mind.”

As consumers continue to learn more about CBD and its potential effects, they’re more likely to come to the dispensary counter knowing exactly what they’re trying to remedy, from chronic pain and anxiety to inflammation and energy levels. This is good news for brands that can move away from generalized, intro-educational products and cater more specifically to their audience, which in turn is more likely to keep new and existing consumers coming back.

“For instance, creating a nighttime product that combines CBD with melatonin makes it more likely to help induce sleep and makes it easy for consumers to integrate the item into their existing routine,” said Zehner. “This method can also serve to educate the masses about the potential uses of cannabinoids and helps to appeal to a wide pool of wellness-minded consumers who may view these CBD products as an alternative to traditional supplements.”