NEW YORK —

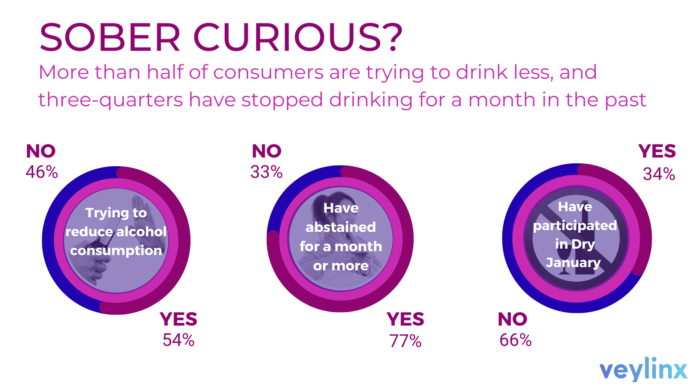

New research from consumer insights platform Veylinx suggests that abstinence events like “Dry January” are more than just a social media fad. More than three-quarters of Americans say they’ve temporarily given up alcohol for at least a month in the past. Almost half (46%) of drinkers are trying to reduce their alcohol consumption right now, and 52% of them are replacing alcohol with non-alcoholic beverages. Consumers identified improving their physical health and mental wellbeing as the main reasons for drinking less.

“Driven by younger consumers, the non-alcoholic beer, wine and cocktails category is surging in popularity. People trying to cut down their drinking are finding more and more alternatives on retail shelves and in bars and restaurants,” said Anouar El Haji, CEO of Veylinx. “Our research found that they’re willing to pay premium prices for non-alcoholic versions of ready-to-drink cocktails. The rise of the ‘sober curious’ movement gives brands countless opportunities for growth in this segment.”

Veylinx, which uses behavioral research to measure consumer purchasing habits, tested the fast-growing non-alcoholic canned cocktails market to learn who is buying these drinks and why. The study also measured demand for versions enhanced with functional benefits like mood boosters, detoxifiers and CBD.

Overall, people who currently drink alcohol are actually willing to pay more for non-alcoholic canned cocktails than non-drinkers. And people who say they want to reduce their alcohol consumption do indeed show stronger demand for non-alcoholic cocktails.

For these consumers, demand for non-alcoholic canned cocktails is 13% higher than demand for the version containing alcohol.

At premium price points, the disparity between consumers who are trying to drink less and the general population is even more pronounced: demand from these consumers for non-alcoholic canned cocktails is 71% higher at $20 for a four-pack.

CBD, Mood Boosters, and Other Variations

Among the canned non-alcoholic cocktails tested, CBD and mood boost versions perform best, while natural detox and zero-calorie variations lag behind. Adding CBD to a $12 four-pack of non-alcoholic canned cocktails increases demand by 13%, and adding natural mood boosters increases demand by 9%. For men, the CBD-enhanced version is the most popular, driving 16% more demand than a standard non-alcoholic cocktail. The zero-calorie variation generates the most demand among women, outperforming the base version by 14%.

Younger Consumers Driving the Trend

Demographics and consumption habits impact demand: 21-35 year olds, light drinkers and people who have previously given up alcohol for a month or more show the greatest demand. Younger consumers, in particular, are the most interested in all of the non-alcoholic concepts.

Demand for non-alcoholic canned cocktails is 48% higher among 21-35 year olds than over 35s

Spiking the drinks with CBD boosts demand by 18% among 21-35 year olds.

The mood boost version—blended with natural adaptogens and nootropics—drives the highest demand among over 35s, generating 29% greater demand than the standard non-alcoholic version.

Previous participants in Dry January show 65% greater purchase interest than those who haven’t previously taken part.

Taste, Price and a Chance to Try Are Keys to Adoption

The ability to try before purchase and better taste are the key ways to attract more consumers to the category. Consumers said that their main reasons for not purchasing non-alcoholic drinks are flavor, price, and because they have never tried them before. Aligning with this, added health benefits, ability to try before buying, and better taste were cited as factors that would convince people to buy these drinks in the future. A fifth of consumers want to first try before committing to a purchase.

To download more detailed results from the Non-Alcoholic Canned Cocktail study or for more information about Veylinx, visit https://info.veylinx.com/non-alcoholic-cocktails.

About the research

Unlike typical surveys where consumers are simply asked about their preferences, Veylinx uses behavioral research to reveal how much consumers will pay for a product through a real bidding process. Consumers reveal their true willingness to pay by placing sealed bids on products and then answering follow-up questions about their reasons to buy or not to buy. The research was conducted in October 2022 among U.S. consumers ages 21 and over.

About Veylinx

Veylinx is the most realistic behavioral insights platform for confidently answering critical business questions during all stages of product innovation. To reliably predict demand, Veylinx captures insights through a Nobel Prize-winning approach in which consumers have real skin in the game. This is a major advance from traditional market research practices that rely on what consumers say they would hypothetically buy. Veylinx’s unique research methodology is trusted by the world’s most innovative consumer goods companies, including Unilever, PepsiCo, Nestlé, General Mills, Reckitt and Kimberly-Clark. www.veylinx.com.