Just six months ago selling pre-rolls was an afterthought—a “freebie” consisting of glorified “slush” or “trim”—but that’s no longer true. Now, thanks to a new clutch of upstarts with smart packaging, marketing savvy, and top-shelf flower, the branded premium pre-roll market is heating up.

No trim here

Sitting front and center atop three beautifully lit, wood-and-glass retail cases inside Buds and Roses dispensary in Studio City, California, are two eye-catching pre-roll displays: Hepburns and Nativ, both solventless (made with no butane) ice-water hash and top-shelf flower. The Hepburns—currently in about forty dispensaries in California ($45)—and their petite Altoids-meets-sardine tins of five “heps” emblazoned with Alice in Wonderland imagery have become an underground sensation with hipsters in Los Angeles’s Silver Lake hills and cannabis “hepbetters” in San Francisco.

“I’ve heard that you can tell the people in the know at work these days because they have a Hepburns sticker on their water bottle,” said Allie Butler, founder of Hepburns. Each tin comes with a sticker.

Nativ pre-rolls come in a bespoke black-and-steel-grey box that easily could have AUDI or OO7 on it. Each J is placed inside a handsome tube topped with a cork ($20 dollars each).

“We are targeting the high-end patient,” said Jason Osni, the company’s co-founder. “We decided to make strain-specific pre-rolls, with all the flower coming from small-batch farms. No trim here!”

A Buds and Roses budtender said sales have been brisk.

“Both [brands] have been selling,” he said. “People come in asking for them when we are sold out.”

Nativ, based in Venice, California, has seen sales triple since its launch in January 2016. Osni isn’t surprised.

“I really felt that if you put top-shelf flower in a nice, branded package that is consistent, you could find an audience,” he said.

That audience seems to be materializing—right now. Dispensaries are taking notice and slowly changing their tune: Ok, maybe selling branded premium pre-rolls won’t cannibalize our in-house sales but, in fact, might enhance the variety of the shopping experience.

Return of the cool

Keilani Yanagihara, a popular budtender who only recently moved on from Malibu’s High Tide 99 dispensary, feels pre-rolls have made a significant leap in 2016. High Tide 99 now carries a smattering of top-shelf pre-rolls: Chong’s Choice ($60), Jay’s ($80), and Happy’s ($15).

“We’re in a new age where everyone would rather ‘have someone else do it,’” said Yanagihara. “We’re seeing high demand.”

And it’s not just in California. As the pre-roll start-ups continue to up the ante with superior flower and trendy branding, Colorado, Washington, and Oregon have seen sales grow dramatically, too.

“In the past six to eight months, the pre-roll market in Washington has grown substantially,” said Danny Khuu, director of purchasing at The Evergreen Market dispensary in Tacoma, Washington. “The industry as a whole is embracing the growth. We see new, innovative products being introduced on a regular basis, from hash-oil-infused pre-rolls to kief-and-hash-oil-infused, and even ones that are rolled with palm leaves and aged in bourbon.”

Currently, Evergreen carries about ten different pre-roll brands. “We find pre-rolls that come in the ‘doob tubes’ seem to outsell those that come in mylar bags,” Khuu noted. “Packaging matters in this industry, and nowhere is it more evident than the pre-roll market.”

Class, pack, and roll

When Allie Butler was dreaming up packaging for Hepburns, she kept returning to a desire for something recyclable and repurpose-able. “I loved this tin when I first held it in my hand because of the unique ‘click’ it makes when it seals shut,” Butler noted.

As for the design, Butler aimed for a vintage psychedelia vibe meets Art Nouveau meets Alice in Wonderland. “I hope it draws them in and helps them fall in love and feel like part of a secret club.”

San Francisco’s 7×7 magazine gushed, “Seriously, these are the classiest joints you’ll ever smoke. Hepburns are more than just pretty packaging. Butler brings passion and care to each hand-rolled cone, which are arranged neatly in fives in sweet little tins that you carry almost anywhere.”

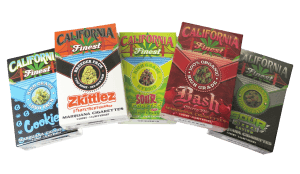

By all accounts, the first cigarette-style branded pre-roll to hit the market was California Finest, which launched in January of 2012. CF also was purportedly the first to individually wrap each joint for freshness and use all RAW paper products. The design was colorful, fun, bold, and cool. The company was, ostensibly, the first to realize that putting top-shelf flower in a cool, branded pack could be profitable.

“The pre-roll market has basically adopted the standards that California Finest established for weight and quality of product,” said Scott McPhail, 38, California Finest’s founder and chief executive officer. “Our consumers are the connoisseurs that enjoy the latest exotic strains and exclusive collaborations” ($50-$250).

According to McPhail, the company has seen a ten-fold increase in sales year-on-year and is eyeing more growth through licensing deals.

“My marketing plan is to keep full control of California Finest without any outside corporate influence and investors,” noted McPhail. “I plan to expand nationally and internationally through licensing deals.”

Brandon Stelle, 24, the director of sales at Illuminatus, understands the value of packaging and branding narrative in today’s marketplace. “Our design is built around the mythology of the Illuminati and the idea of a new world,” he said. “Illuminatus means ‘the enlightened,’ and we see this as an enlightened time for cannabis culture.”

Stelle admits that Illuminatus’s growth is slow, but that’s by design. “We’re currently in ten dispensaries in California,” he noted. “We chose to keep our distribution relatively small while we build the infrastructure, but we anticipate being in sixty dispensaries by the end of the year. We also have plans to expand into Nevada and Colorado.”

Illuminatus is unique—from the presentation to the product. The company uses custom hemp paper tubes along with a filter for a cool, smooth smoke. The proprietary indica and sativa blends are made using premium flower, and every Illuminatus pack comes with a free T-shirt. Illuminatus also provides dispensaries with branded lighters, doob tubes, and an “awesome” countertop display.

Two other brands on the rise are CHIEF and Canna Sierra, both in about thirty to forty dispensaries. Reb Grant, 36, an industry veteran, is the creative director for both. The companies launched in October 2015 and have seen their sales double since March 2016. For the design and packaging, Grant was inspired by wild and beautiful places and a deep love and respect for the Sierra Mountains.

“We named the sativa Mt. Whitney in an homage to the highest peak in the lower forty-eight states,” Grant said. “My goal is to design an iconic American cannabis brand.”

To be sure, Canna Sierra is going all-out to incorporate the adventure lifestyle into the brand. The company is in the process of sponsoring a local mountaineer who is attempting to set a record for the 100 Sierra Peak List: summiting 100 of the biggest mountains in America in record time. He fully supports cannabis, and Canna Sierra’s team hopes the partnership will help defeat negative stereotypes as well as encourage people to get outside and be active. Following in the footsteps of brands the staff admires, like Patagonia, Canna Sierra is committed to donating 1 percent of revenues to support environmental groups with an emphasis on the Sierra Mountains.

The power of the flower

So what has really changed in six months? Yes, branding, packaging, and creative logos are front and center, but the biggest change has been the power of the flower. Less than a year ago, putting shake in pre-rolls was the norm. The lesson: Don’t put the packaging before the flower.

“You can’t just put crappy bud in a cool box and expect it to sell,” said Osni. “This is about changing the stigma of pre-rolls.”

Canna Sierra, too, takes pride in delivering consistent, high quality, strain specific, pure flower—always tested.

“Chief is a premium brand that uses nug-run indoor flower and tests between 21-28 percent, with a $50 MSRP,” noted Grant. “It works best in retail that has a $50-plus cap or caters to patients who seek a branded product. Canna Sierra is a blend and tests between 11 percent and 18 percent with a $35 MSRP.”

A happy beginning

Rom “Happy” Roy, 42, CEO of Happy Humboldt, launched his master strain pre-rolls in 2015 and has seen sales quadruple.

“I have a great appreciation for master strains and their effect on the ‘endo-cannabinoid’ receptor system,” said Roy. “Our pre-rolls are lab-tested for safety. There are no pesticides, fungicides, or chemical or solvent residues in any of our products. We pass all the tests.”

Happy’s Humboldt pre-rolls—kief/hash—have at least 330mg of THC per roll, while Happy’s pre-rolls are smooth hybrids, featuring a fully designed matrix of terpene profiles, prepared fresh every two weeks in micro-batches.

“When you open one of the individual containers, the fresh, tasty smell gets your mouth watering,” noted Roy.

Roy also believes in meeting his customers—and sampling, which many high-end branded pre-roll companies don’t do because of thin margins. He’ll often go out to a dispensary and talk with customers.

“We also are happy to work with collectives to create in-store specials, as we have at Grace and High Tide 99,” Roy noted. He provided the dispensaries with stylish, log-like retail displays hand-made from walnut logs with lichen and moss.

Louie Cazarin, the CEO of Louie the XIII (where “quality is king!”) is going as top-shelf as he can ($140-$160). He uses high-quality, potent Og Louiethe13th Kush pure flower. Cazarin sees corporate America getting into the marketplace soon and wants to stake out his territory—and reputation—for a superior, handcrafted pre-roll.

“We take the flower, we strip every stick and leaf so you have pure flower, and then we grind it down with great precision so you can get the smooth and flavorful taste,” he said.

Right now, there doesn’t seem to be any general consensus about the size of the branded premium pre-roll market. An even bigger question is how to reach the customers.

“These consumers are everywhere,” noted Khuu. “Maybe it’s a mom running errands who decided to stop by for a couple packs of the sativa pre-rolls for the week. Or the young couple getting a hash-infused pre-roll to share at a concert. Each of these consumers is buying convenience, and convenience sells.”

Golden years

Then there’s Shine Papers: “luxury at your fingertips.” The approach is slightly different: The company makes empty pre-rolled cones wrapped in 24-karat edible gold. Don’t worry; the gold is not inhaled. In fact, the gold stick to the ashes, slowly leaving behind a tiny, powdery treasure in the tray.

“We have partnered with the best producer-processors,” said Lewis Nelson, operations manager for Shine. “They produce remarkable quality, and when it’s wrapped in gold it just screams luxury. That was our intention—connecting Shine’s high-grade image to those that are producing high-grade cannabis.” Recently, California Finest and Shine teamed up to provide an exclusive new hybrid strain, Sour Cookies Kush, rolled in Shine’s rolling papers.

Innovation is everywhere—but do the customers exist yet? Everything comes down to consumer demand. People “love” premium joints in cool packaging; however, that kind of product carries a high retail price. Real connoisseurs usually roll their own. So, who’s looking after the masses?

“We serve the masses,” said Ben Arons, 40, president of Triple J Mini Joints. “The people who love our product don’t also buy a premium pre-roll. They want to medicate and then function, without wasting a half-gram of kush. Our top-shelf product is for high-rollers who like the novelty and ease of what we do rather than the premium herb we put in it.”

Arons is unabashedly bullish on the future for the mass pre-roll market. The company’s sales are up 35 percent. Recently, the company significantly invested in a production infrastructure and administrative technology, and staff has increased by about 40-percent since 2015.

#ThatsAWrap

Not everyone sees the marketplace as a stable, solid profit center—at least not in the near future. Obstacles such as the law, interstate distribution, and industry immaturity need to be sorted out first.

“Yes, many companies are making their own branded pre-rolls,” said Daniel Kempton, who founded CannaWraps in 2012. The company markets do-it-yourself pre-rolled cones complete with a filling tool. “But, legal obstacles and interstate distribution are inhibiting any one company from dominating. I expect someone will follow the Cheeba Chews model and set up multi-state production for their brand of pre-rolls until there is national acceptance.”

CannaWraps came to market billed as the first DIY pre-roll cone not to use glue. The glue line is what makes joints tend to run, so CannaWraps earned a reputation for smoking more evenly than others.

And that’s not all. “We are the only brand that offers brown and white cones,” noted Kempten. “We’re the only brand that lets you choose any pre-roll length. We’re the only brand that lets you choose your filter length. And we’re the only brand that offers customization. The quality of our paper is unsurpassed and can be traced to a sustainable paper mill in Europe. To top it off, we’re also cheaper.”

Legal issues are on everyone’s mind. However, combining shrinking restrictions with a brand-obsessed culture seems a perfect recipe for halcyon times in the pre-roll market.

“The demonization campaign is ceasing slowly, and the stoner image is being replaced by the positive views on alternative medicine,” said Roy of Happy Humboldt. “This is already creating an environment where folks are able to relax more and use pre-rolls to self-medicate.”

Nelson from Shine added, “I would compare this to the early craft beer marketplace, which has been explosive over the past decade. Not everyone will want it, but it’s trending—and trending for all the right reasons.”

The success of the branded pre-roll market most likely will come down to four things: quality control, marketing, distribution, and scalability. Right now, companies are planting the seeds: finding the right investors, name, logo, packaging, message, consistency, labeling, and business plan, and generating enough sales to expand slowly.

“Don’t forget the price point,” Yanagihara said. “Make these things accessible, because people love convenience—and they’ll sell. We aren’t lazy; we’re busy.”

WHOLESALE INFO

WHOLESALE INFO

*Hepburns: Hepburns.com (@the_hepburns)

*California Finest: CaliforniaFinest.com (@californiafinest_420)

*Shine: ShinePapers.com (@shinepapers)

*Louie the XIII: [email protected] (@OgLouiethe13th)

*Canna Sierra/CHIEF: SierraCollective.com; (415) 894-7734 (@CHIEFTHC @CANNASIERRA)

*CannaWraps: DanksLife.com (@CannaWraps)

*Nativ: NativBorn.com (@nativborn)

*Illuminatus: IlluminatusBrand.com (@illuminatusbrand)

*Happy Humboldt: [email protected] (@happyskind)

*Triple J: 420minis.com (@originalminijoints)

By Danny Khuu, director of purchasing at The Evergreen Market dispensary in Tacoma

- Grind, grind, grind. If you are using sugar leaf or trim in your pre-rolls, grind the material down to a “coffee grounds” size to ensure an even burn throughout the entire experience. While packaging is super important, quality often trumps all else. Give your customer a quality product, and they will always come back. You have to be consistent with each and every pre-roll.

- Packaging and presentation. There are lots of products out there, and you have to stand out and shine on the shelves. Create packaging and branding that can separate you from your competition. Again, our top-selling pre-rolls come in a flip-top box similar to a cigarette pack, and it contains multiple pre rolls. I would suggest doing something along that line.

- Roll right. Some pre-rolls may end up being packed too tightly and not burn right. Others might be packed too loosely and will have material fall out in the packaging. Most of these will end up “running” or “canoeing” while being smoked. Both are equally bad and will turn your customers away.

How has the pre-roll marketplace changed since you launched in January?

When we first started the business plan for Jay’s pre-rolls in April 2013, branded pre-rolled joints seemed to be something everyone was dreaming about but no one had heard of. Our goal was to become one of the pioneers and deliver a rolled cannabis product that customers would actually enjoy consuming.

What makes a branded premium pre-roll really good?

At Jay’s, our products are created on a foundation of much more than just high-quality cannabis. We’ve put years into breaking down each element of a premium-quality pre-roll and focusing on developing equipment and processes around each of them—everything from the growing methods and moisture content of our cannabis down to the ground cannabis particle size, packing density, and even the watermarks and materials of the papers we use.

You’ve now started a pre-roll packaging company.

Yes. We are currently working with brands and dispensaries producing branded and packaged pre-roll products. Through our in-house design team, we can take a company that has nothing but the cannabis they are growing and deliver a full-service solution for branding, logo, package design, pre-roll production, and finished product delivery.

WHOLESALE INFO: JaysPreRolls.com

G Marks the Spot

How has the pre-roll marketplace changed since you launched G Stiks in 2013?

When we launched, all pre-rolls consisted of trim or shake at best. My vision for G Stiks follows the cigar model. My wife came from a family of the best Cuban tobacco blenders. That sparked my creativity to blend our seven secret strains to make up the composition of a G Stik. We would offer consumers indica, sativa and hybrid proprietary blends of 100-percent flower pre-rolls.

How many dispensaries carry your products?

Today we are in more than 700 dispensaries in California and are just getting started in Washington State.

How are sales?

Through the roof!

You’ve also launched a groovy custom pre-roll stand.

This will be the first custom pre-roll stand that I know of in the industry. We have always been industry leaders, and we love to remain that way. It has different color lights that will change the color of the G.

FOR WHOLESALE INQUIRIES: GfarmaLabs.com