Closed accounts. A lack of payment processing. Solutions that are short-lived or too good to be true. Running a business in this industry can feel like a perpetual uphill battle in an attempt to be treated like a “regular” business.

But here’s a plot twist. The hero of this tale isn’t riding in on a horse, but instead a pig. A piggy bank, to be exact. Meet Greenbax Marketplace (GBX), a pioneering banking solution dedicated to simplifying cannabis banking.

“At GBX, we’ve been partnering with cannabis customers since 2017 to provide the right plan based on their needs with the mutual understanding that we are here to help them grow and expand while we do the same,” said Greenbax President Carole McCormick.

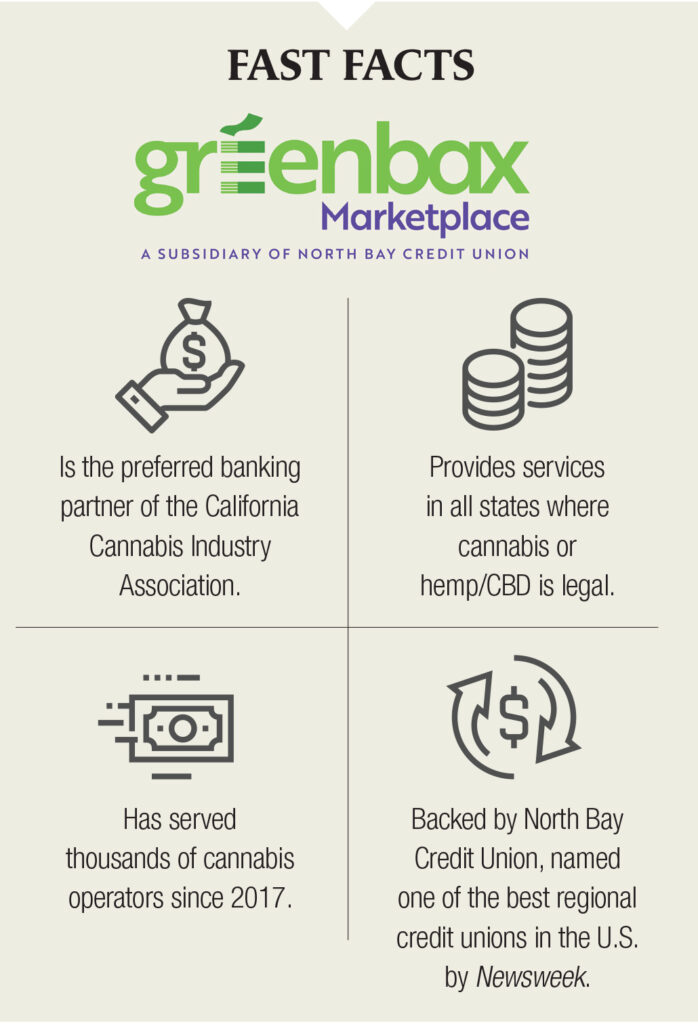

Backed by North Bay Credit Union (NBCU), which has operated in Northern California since 1948, Greenbax provides financial services considered ordinary in traditional sectors but often are unavailable to cannabis operators. At GBX, cannabis businesses are treated just like any other business.

“Being owned by NBCU gives us many advantages,” McCormick said. “Besides offering bank accounts, Greenbax facilitates non-cash payments via its GBXPay platform, allowing our customers to pay or receive funds via electronic payments—automated clearing house or ACH debit, in other words—or secure wires.”

And payment is just the beginning. Running an all-cash business is not merely inconvenient for operators and customers. Storing large sums of cash in a business open to the public effectively puts a target on dispensaries.

“We send insured armored cars to the retail location for cash pickup and delivery to secure vaulting facilities where it is counted and validated before being transported to the Federal Reserve for credit to the account,” McCormick said.

While security is paramount to knowing your money is safe, equally important is transparency: knowing your money is also safe from hidden fees and “nickel-and-diming” that can trap operators into paying more for standard banking services. Greenbax is a safeguard for clients’ funds—from seed stage through growth.

Whether to grow products or their business, operators traditionally must self-fund or attract venture capitalists. But with NBCU’s backing, Greenbax offers another financial service companies in the sector often have trouble accessing: business loans.

“Because of our unique relationship with NBCU, we can provide lending solutions that can be challenging to find in the cannabis space,” McCormick said. “Additional lending opportunities are handled by referral partners we have established as part of our marketplace.”

The marketplace is an exclusive benefit for GBX customers, comprising an extensive collection of service connections such as human resources, insurance, and lending. Many extend special offers and rates.

“Our customers know they can come to us for trusted referrals to others we work with in the industry and know they will be taken care of,” McCormick said.

Another way Greenbax takes care of customers is with interest-bearing savings accounts. Accruing interest on savings is a standard practice that can provide additional revenue. Unfortunately, this is another banking perk too often off-limits for cannabis businesses. “Our interest-bearing savings accounts pay interest every month,” McCormick said. “We have several clients that don’t pay anything for their banking services because they have established an interest-bearing savings account they use to offset any fees they incur.”

In addition to savings accounts, a key banking staple that is often overlooked encompasses debit cards that offer business customers the convenience of cashless payments.

“Our NBCU-branded debit card allows our customers to pay for things like office supplies and any other non-cannabis product purchases,” McCormick said. “We are launching a Greenbax-branded debit card with the same parameters very soon.”

Although the company has built its reputation on providing “business as usual” services for unusual businesses, GBX breaks with tradition in one key way: In an era when corporations increasingly force customers into interactions with artificially intelligent chatbots when they need customer service, Greenbax Marketplace takes a great deal of pride in ensuring honest-to-goodness humans are available to provide client support.

“We are all about efficiently using technology but not at the expense of the customer relationship,” McCormick emphasized. “We want our customers to be able to take care of their needs using our technology solutions, but for those times when only a real person can help, we have a dedicated operations team that can be reached by phone, email, slack, teams, and text. If [customers] want us, they can get to us.”