The last wave of cannabis investment—what I call Cannabis Investment 4.0—that kicked off in 2020 largely has been a failure for businesses and creditors alike. The combination of scarce and expensive capital, intensified lenders’ scrutiny, untrusted return-on-investment forecasts, and a historically critical need for “scale or die” capital have created a lose-lose environment that threatens the continued growth and maturation of the industry as a whole.

It’s time to reset our approach to cannabis investment and usher in a new era of higher business standards and more equitable investment and debt financing for founders, shareholders, and creditors alike. At a time when the industry offers unique, recession-proof market opportunities, it could not be more tragic that something as solvable as lack of operational and financial transparency is preventing basic capital flow.

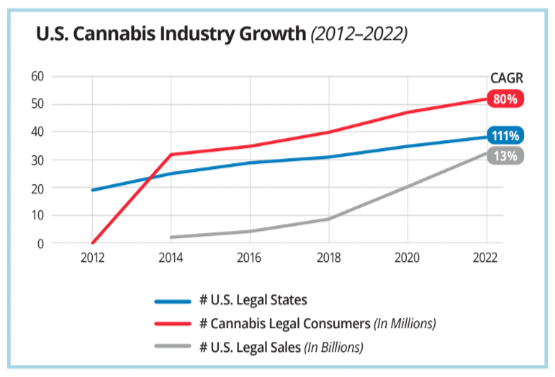

The industry has shifted and evolved at dramatic, arguably unprecedented speed over the past decade and, unsurprisingly, so has its investment environment. This unusual market phenomenon transformed an illegal practice into one of the most promising industries in recent history, and it now has a unique opportunity to identify and analyze its drivers, catalysts, and hurdles to ultimately shape its next evolutionary phase.

In the industry’s infancy, high-net-worth individuals fueled cannabis investment with angel investments of up to $250,000 without performing much due diligence. Although costs for this capital were low, investor expectations were high as startups in the United States dug in to get the industry moving.

Over time, investment amounts skyrocketed to upwards of $10 million as mainstream institutional investors became more involved. These investors brought more due diligence to the industry, began to raise the costs of capital, and further ballooned their ROI expectations. The needs of cannabis businesses shifted in stride with these changes, from start-up expenses to organic growth to growth by acquisition.

The pandemic raised excitement levels and expectations even further. Many U.S. states deemed cannabis an “essential business,” consumers spent stimulus money on medicinal and recreational use, and stock prices rose. Soon after, as consumers returned to more typical routines and inflation set in, consumer spending dropped nearly 10 percent per transaction nationally year over year, according to New Frontier Data. Cannabis stock prices quickly were impacted, capital flow began to dry up, and debt financing, the only remaining funding source, became prohibitively expensive.

Due to ongoing federal prohibition, cannabis businesses lack access to the resources traditionally available to operators facing efficiency, financial, and/or scale challenges, including Chapter 11 bankruptcy and other government-subsidized opportunities to shore up capital. Today, as operating expenses mount, credit is defaulted on, and capital is unattainable, many businesses and creditors are facing asset liquidation and full entity dissolution, likely via receivership. For the first time since its birth, the industry faces not only slowing growth but also potential contraction.

Lacking federal protections further prohibits businesses from acquiring additional capital on fair terms from other lenders. Inherent in the federal bankruptcy debt relief processes of debt consolidation, refinancing, and other restructuring are safeguards that ensure disclosure and transparency. When businesses emerge from federal bankruptcy, new creditors have a clear view into their operational and financial performance, allowing for potential renewed capital flow and survival of the business.

Consequently, what businesses, investors, and debt holders need is the operational and financial transparency necessary to reduce investment risk, better manage exposure, and allow cost-effective capital flow into an industry at the brink of true maturation.

An investment reset must introduce and ensure new paths to such transparency. The long-term promise of the growing U.S. and global cannabis markets shows plenty of incentive for businesses, investors, and debt holders alike, and the alternative is nothing short of tragic

The industry must mandate the introduction and adoption of a more rigorous and systematic approach to risk evaluation and ongoing monitoring of businesses. Operational and financial transparency will give all stakeholders equal opportunity to compete for capital and investment opportunities. Fewer shareholders will abandon their investments without good reason, and more businesses will stay healthy and flourish. Economies and communities alike will benefit as businesses stay open and their workers stay employed.

Cannabis Investment Evolution (2012–2022)

| 2012–2016 | 2016–2018 | 2018–2020 | 2020–2022 | 2022– | |

| Investment Environment | 1.0 | 2.0 | 3.0 | 4.0 | RESET |

| Investment Amount | $50K+ | $1M+ | $10M+ | – | $1M+ |

| Investment Source | HNWI | MJ-Focused Small Funds | Family Offices & Institutional | High-Cost Lenders | Equity & Debt |

| Due Diligence | Low | Medium | Medium | High | Mature |

| Investment Cost | Low | Medium | Medium/High | High | Credit-Rating Based |

| ROI Expectation | 10X | 10X+ | 15X | – | 3X – 7X |

| Use of Funds | Startup | Growth | M&A | Scale & Survival | Profitability |

| Geo. Focus | U.S. | U.S. & Canada | North America & Europe | ? | Global |

| Risk (Financial & Legal) | Low | Medium | High | High | Mitigated |

| OPEX | High | High | High | High | Monitored |

| CAPEX | Medium | Medium | High | High | Monitored |