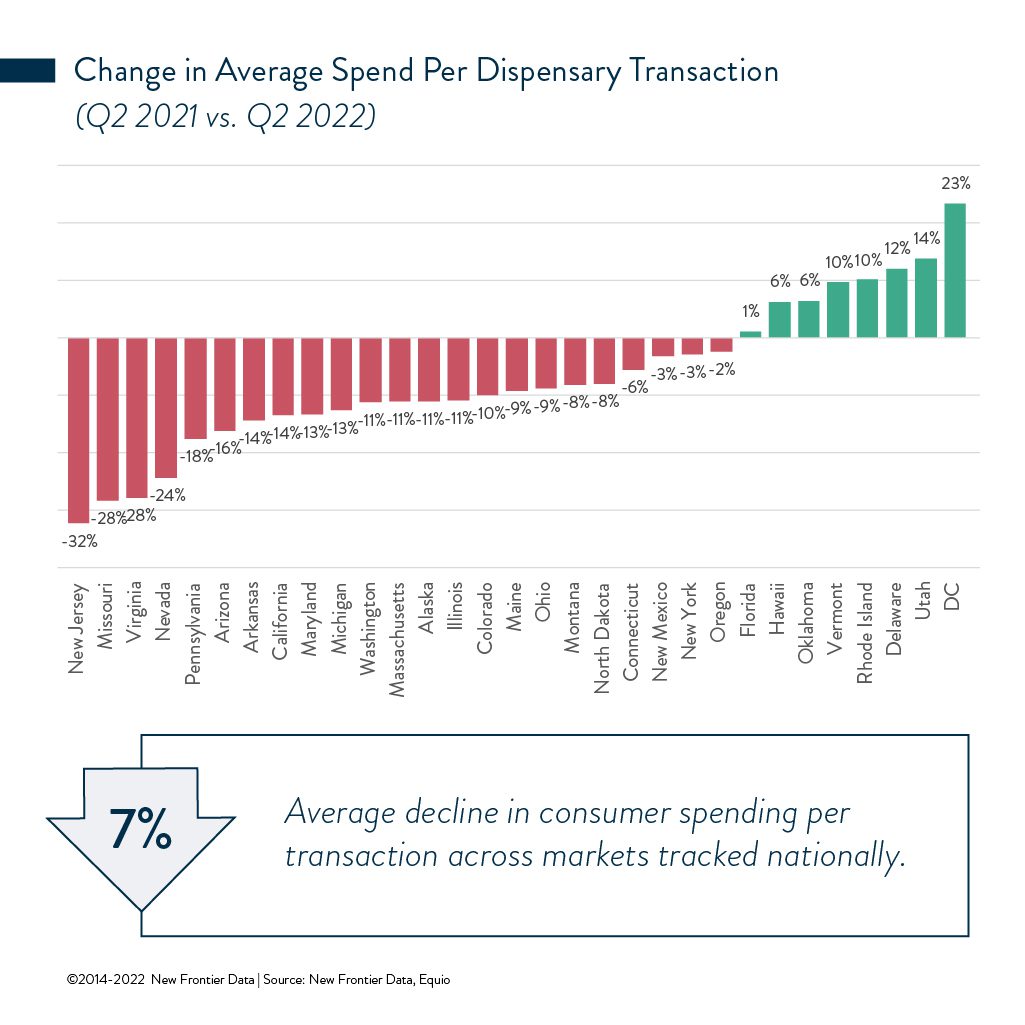

Cannabis analytics firm New Frontier Data recently made a sobering discovery as it relates to current economic conditions across the United States. According to the data, on average there has been a 7 percent decline in cannabis consumer spending per transaction across the country.

On the surface, this may seem like a troublesome development, but from a more positive perspective, this window into the consumer psyche could be a poignant teaching moment for retailers, cultivators, and manufacturers across the industry.

“In 74 percent of the markets we looked at we saw decline, and across all the markets we looked at, we saw an average of 7 percent decline from 2021 to 2022,” said John Kagia, chief knowledge officer at New Frontier.

Kagia added that the shifting economic environment and inflationary pressure that consumers are facing, along with the likelihood that the U.S. is going into a recession, will continue to have an impact on cannabis consumer purchasing decisions. However, it’s still difficult to determine how this volatility will affect consumers in this area.

“Cannabis isn’t necessarily going to behave like a lot of other consumer goods. For the medical patients, cannabis is an essential and a lot of patients are not going to compromise on their medicine,” Kagia said. “Some recreational consumers might view cannabis as leisure spending. But you will see the inverse for other rec consumers who might have been spending more on restaurants or travel, but with decreased spending power they may choose to spend money on cannabis [and stay home].”

Kagia also said that while brand and dispensary loyalty is growing, it’s not at a point where consumers are married to one store or a brand they trust above all others like we often see with popular grocery store items as an example. Because of this, consumers are likely looking for deals and discounts more than ever, or cannabis brands that may offer more affordable products.

One of the biggest factors in saving money may benefit the tax-free illicit market, pushing some of the youngest consumers back to illegal sources. “These consumers have literally just made the transition. Just a few months [earlier] they were using unregulated sources,” he said. “If they had a good, consistent supply in the unregulated market, some may be tempted to, at least, get some of their products from [there].”

There are some valuable strategies Kagia feels the cannabis sector can adopt in order to weather the storm. “[This] presents an opportunity for brands and retailers to start thinking about value products in this space,” he said.

“Products that conserve the cost-conscious consumer I think will do quite well. For brands, we think this is a really important time to understand who your target and most-loyal customers are and start thinking through what sorts of incentives and/or discounts will secure their loyalty.”

He added that revisiting the approach to product pricing and being conscious about the role purchasing incentives will play in consumer decision-making is something that should be examined by both brands and retailers with great detail.

Like any sector, however, there are players that are clearly in the lead when it comes to sales. Is there something cannabis companies can learn from them?

“Because of how quickly the market is evolving, I don’t think that the winners and losers of this race have been determined yet,” he said. “We are seeing an investment and an interest in understanding the consumer that exceeds anything we have previously seen. The most successful brands and retailers are those that have an intimate understanding of who their customers are, what motivates their [cannabis] use, and animates their consumption behavior.”