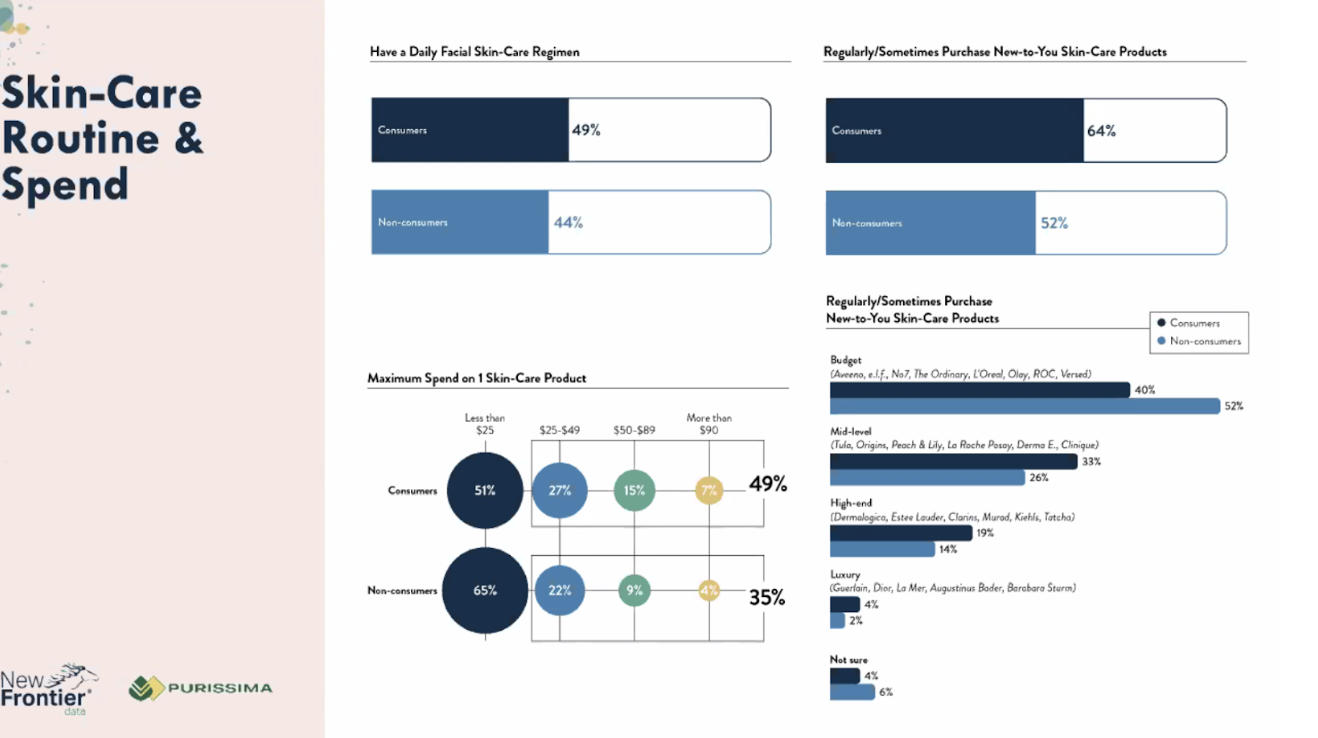

The cannabis beauty market is hotter than ever, as evidenced by recent statistics. According to data gathered by New Frontier Data, 49 percent of cannabis consumers claim they have a daily skin care routine, and 44 percent of those who don’t use cannabis say the same. Although 51 percent of cannabis consumers and 65 percent of those who don’t use cannabis currently spend $15 or less on products, there’s plenty of room for expansion, with 67 percent of cannabis consumers and 70 percent of those who don’t use cannabis claiming interest in quality cannabinoid-infused skin care products that are $125 or more.

Ample opportunities exist for brands to market to people with all sorts of cannabis and/or skin care needs. With the holidays upon us, we’re exploring ways to spark interest, start conversations, and educate consumers across the spectrum.

Marketing know-how

Self-care-themed items are popular last-minute gifts or stocking stuffers for the holiday season, and with 64 percent of cannabis consumers and 52 percent of those who don’t use cannabis interested in regularly purchasing new skin care products, beauty brands have a great opportunity to continue pushing into the mainstream.

“We’re seeing that cannabis consumers are more likely to have a skin care routine, which means they’re more likely to spend money on skin care and to buy these types of products,” Amanda Reiman, New Frontier Data’s chief knowledge officer, said during a recent webinar. “It’s the perfect intersection: People are committed to cannabis as a wellness too, just as people are committed to skin care as a form of self-care and wellness.”

Although 49 percent of cannabis consumers report having a daily skin care routine—more than the 44 percent of those who don’t use cannabis—there isn’t a drastic difference in general attention to skin. This creates a great playing field for skin care brands to get into cannabinoid infusion and for cannabis brands to get into the skin care game.

On both ends of the spectrum, education is key. Consumers need to know the importance of skin care and how cannabis-infused treatments may address some of the issues they experience.

When marketing your cannabis beauty brand, clear categories and easy-to-understand educational materials will be your strongest allies if you wield them carefully and intentionally.

Selling infused skin care to cannabis consumers

New Frontier Data’s research revealed cannabis consumers are more likely to be interested in skin care than consumers who don’t use cannabis—especially when that skin care product is infused. Perhaps cannabis consumers are more likely to care about any infused product, no matter the category, or they are more likely than their non-cannabis counterparts to pay attention to wellness products and routines in general.

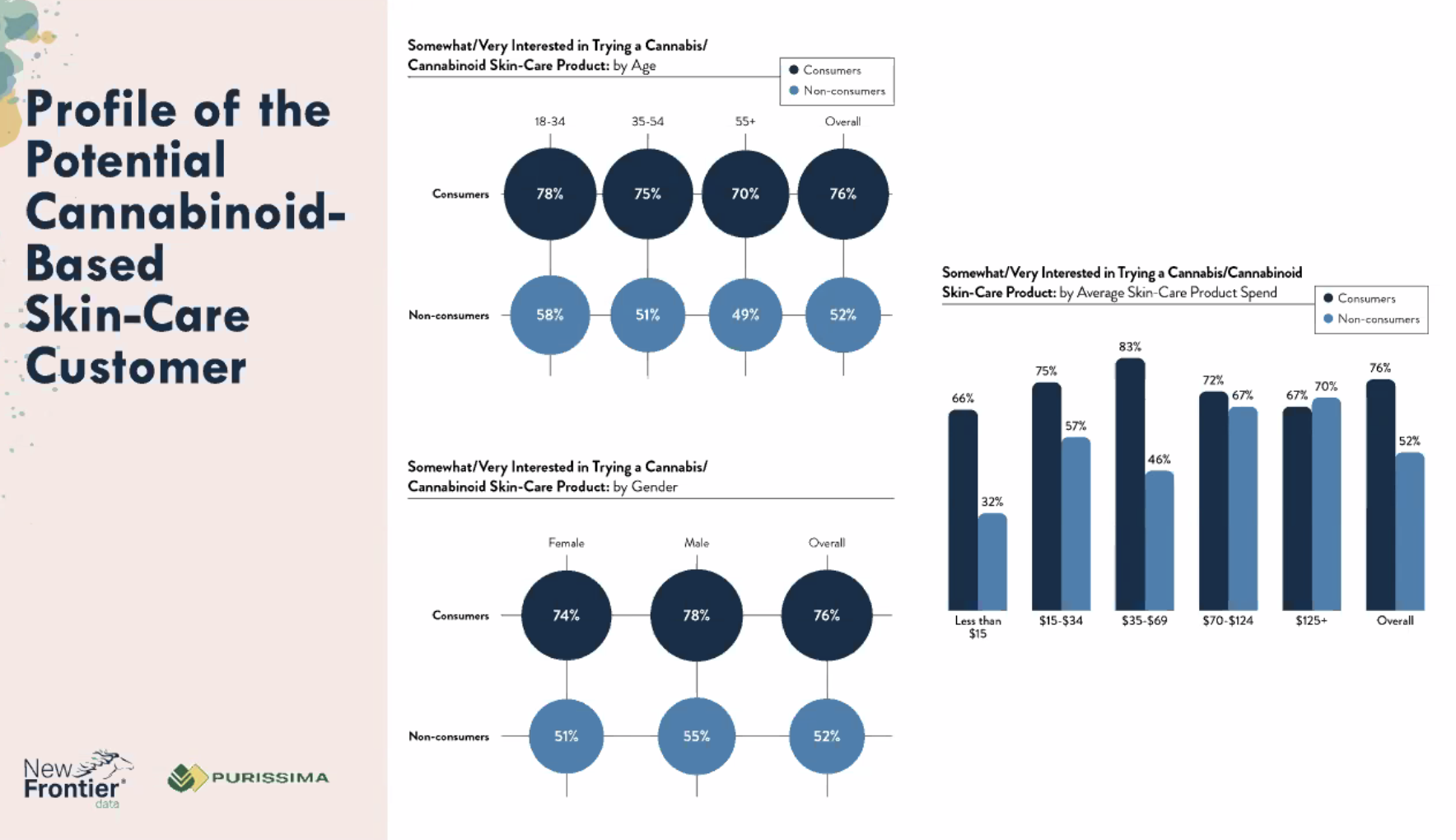

Whatever their reasoning, 76 percent of cannabis consumers are interested in trying infused skin care, regardless of the price tag. In fact, 67 percent of consumers are willing to try infused skin care products selling for more than $125, while only 66 percent are interested in trying a similar item priced at less than $15.

This is significant, as it shows cannabis consumers are not only aware of skin care as a powerful wellness tool, but also are trusting enough of both industries to opt for higher prices in exchange for quality products.

Another surprising statistic New Frontier Data uncovered is cannabis consumer skin care interest by gender: 78 percent of male cannabis consumers report interest in trying infused skin care. The key player here, of course, is cannabis. Men continue to outweigh women when it comes to cannabis consumption, so it makes sense men would be interested in trying an infused skin care product or regimen.

Cannabis beauty product marketers will be wise to keep these statistics in mind. There’s a real opportunity to create high-quality products that speak to men.

Selling infused skin care to those who don’t consume cannabis

Individuals who don’t use cannabis are less likely to seek cannabis-infused skin care, but at 52 percent, there’s still plenty of opportunity to spark interest and maybe tap into a latent market.

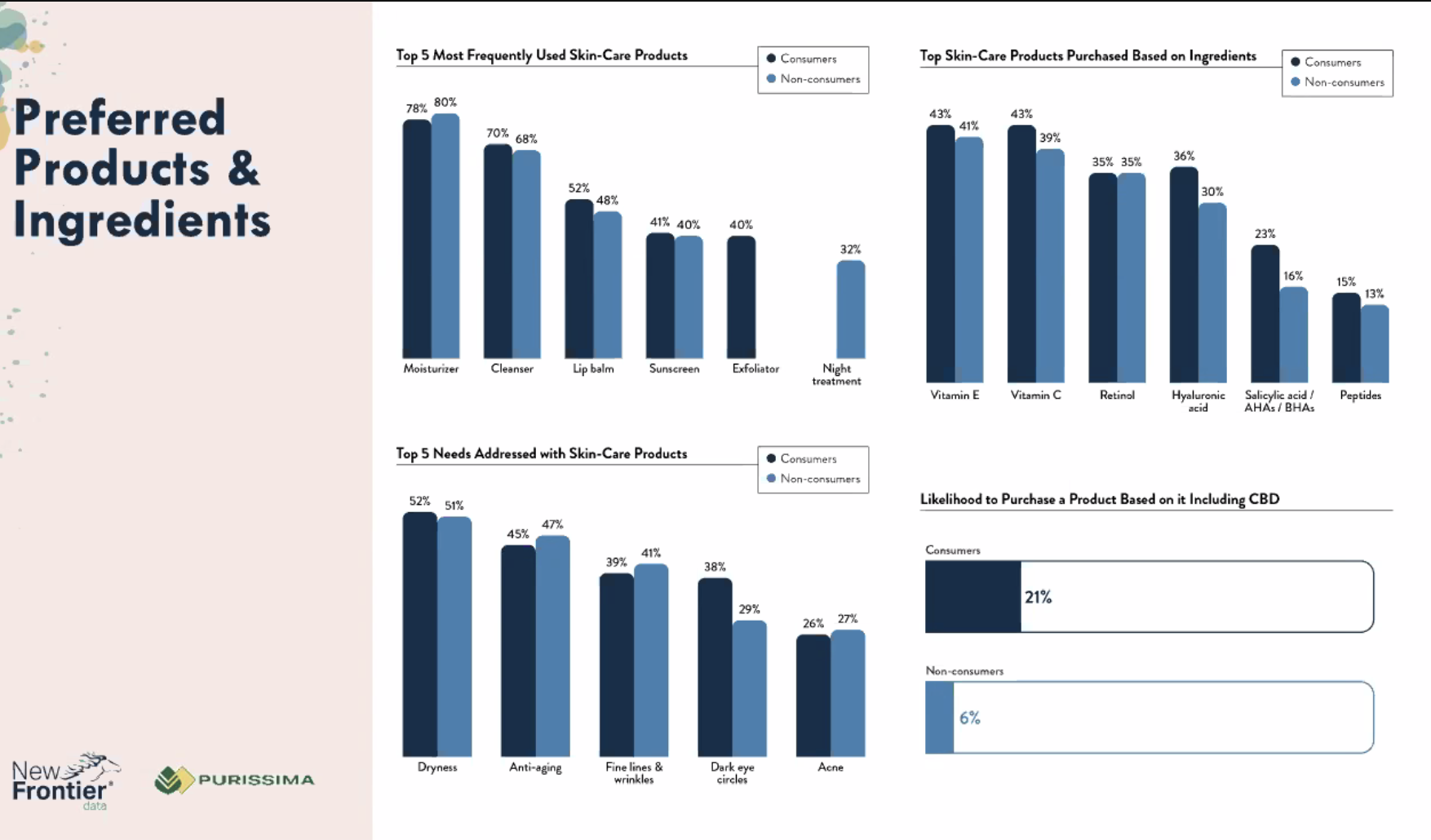

Although non-consumers are less likely to purchase a product simply based on the fact it includes a cannabinoid like cannabidiol (CBD), there’s one important thing non-consumers and consumers have in common: they tend to gravitate toward skin care products to address the same issues including dryness, anti-aging, fine lines and wrinkles, dark eye circles, and acne.

Because of this, it makes more sense for cannabis beauty brands to focus on non-cannabis ingredients and overall product efficacy if they’re trying to draw more sales from the untapped non-consumer crowd.

“To market to a skin care consumer who doesn’t consume cannabis, it’s important to focus on other skin care ingredients in your product that are not only popular but also have a proven benefit. Your product isn’t a purely cannabis-based solution: it’s a synergistic formulation that includes effective skin care ingredients and, now, cannabis ingredients,” said BLUNT SKINCARE founder and CEO Stas Chirkov.

“When including cannabis ingredients in our products, education can be a challenge. It’s a lot of information and there’s still a lot of unknown. We entered the market with three different skews: different colors, elements, marketing tactics, and price points that speak to different levels of consumers without being intimidating or overwhelming.”

Education is definitely key, especially for skin care enthusiasts who want to understand how cannabis might work into and benefit their existing routine.

“Fifty-three percent of beauty consumers are really looking into product ingredients and efficacy, so educating and driving awareness toward cannabinoids as a formulation booster is essential for delivering the results brands and companies are seeking and consumers are demanding,” said Karen Raghavan, vice president of brand development at Purissima.