When the Jardin cannabis dispensary opened in Las Vegas in 2016, discerning customers might have noticed something different about the weed shopping experience. Maybe it was Snoop Dogg sitting on a throne in the corner, taking pictures with fans and signing autographs. Or perhaps it was the hip-hop DJ and food trucks out front, and the wall of high-definition video displays with eye-popping images inside. The new pot shop in town sure wanted to make a splash for its grand opening in Sin City, and it may have landed the best cannonball since Caddyshack.

Jardin is hardly alone in its pursuit of canna extravagance. Dispensaries across the United States have been upping the ante and creating showrooms worthy of Tiffany and Gucci, giving customers some razzle-dazzle and a good reason to get off the couch. Stores with elegant interior design and interactive displays are becoming more the norm as they compete like any other brick-and-mortar dinosaur that wants to survive in the Amazon era.

When you look beyond the shiny display cases, digital menus and polished budtenders—sorry, “cannabis consultants”—you’ll start to see a future that looks more like an outing to the local mall than a gritty adventure to Dr. Feelgood’s office.

Cannabis in the digital age

While dispensaries in the past often were designed to be incognito, the new wave of retail space and architecture is all about interior design and over-the-top customer service. The Green Easy in Beverly Hills features blue velvet chairs, white marble floors, and crystal chandeliers. The Silverpeak in Aspen, Colorado, resembles a high-end ski lodge and is located down the street from Prada and Gucci. Native Roots, the most successful cannabis chain in Colorado, features a modern industrial design with cement floors, graphic wallpaper, and plenty of metal.

Look beyond the façade, though, and the first thing you’ll notice at most of the stores is seamless integration of smart technology devices that begin creating experiences for customers the minute they walk in the door. Incorporating interactive displays, digital menus, express kiosks, vending machines, and customized point-of-sale platforms, today’s cannabis retail operations are a far cry from the mom-and-pop shops that sold cannabis primarily as medicine over the past twenty years.

“Cannabis companies are faster to adopt new technology than any other industry I’ve seen before,” said Jeremy Jacobs, chief executive officer for Eyechronic and chairman of Enlighten. “It has to do with the nature of where the business was before, and it’s a younger generation that are digital natives. So, the adoption factor is huge.”

With business partner Colby McKenzie, Jacobs created Enlighten as a comprehensive in-store multimedia platform that includes text marketing, brand videos, instructional videos, and entertainment videos, all streaming to thousands of screens across 700 cannabis shops in three countries. The screens are situated on walls and interactive tables in showrooms and breakrooms, and they display everything from product menus to dispensary events and loyalty points programs. The components add up to “engagement,” a word that gets tossed around like a shiny new ball in today’s retail-speak.

Of course, before any of the gadgets and systems can be engaged, customers must enter the door. Debby Goldsberry, CEO of Magnolia Wellness in Oakland, California, has watched weed customers come through her door for the past twenty years, as the co-founder of Berkeley Patients Group in 1999 and then other dispensaries she has managed since. These days, she’s most interested in media and marketing technology to offset limited options for advertising in mainstream channels.

“We can’t advertise on Facebook or Google, so we’re looking at things like the iBudtender platform to promote our live menu to clients,” Goldsberry said. “We need more ways to get stuff in front of people and get them in the door, because word of mouth is the number-one way we get people here now.”

For brick-and-mortar shops, survival in the face of real-world and online competition requires more than just swanky interior designs to keep customers engaged. The atmosphere inside stores must entertain and educate new customers and veterans alike. Jacobs points to old-school retail companies like Target and Best Buy, which have survived the Amazon assault by offering learning centers and video displays that make the in-store experience more meaningful, edifying, and rewarding.

Denver’s Euflora cannabis dispensary was one of the first to come out swinging with a full-fledged technology platform, which Enlighten helped design, and it’s a model MedMen (among others) later adopted. The platform is built around entertaining and interactive elements that engage consumers on a deeper level, putting products and related information at their fingertips.

More recently, some cannabis shops have taken the business model to the extreme by putting the machines front and center and the employees in a supporting role.

Putting the brakes on budtenders

When the 805 Beach Breaks dispensary in Grover Beach, California, opened its doors in May 2018, customer engagement was a high priority. The owners took an unconventional path toward that goal. What they built represents a bold play, even in the tech-savvy climate on the California coast.

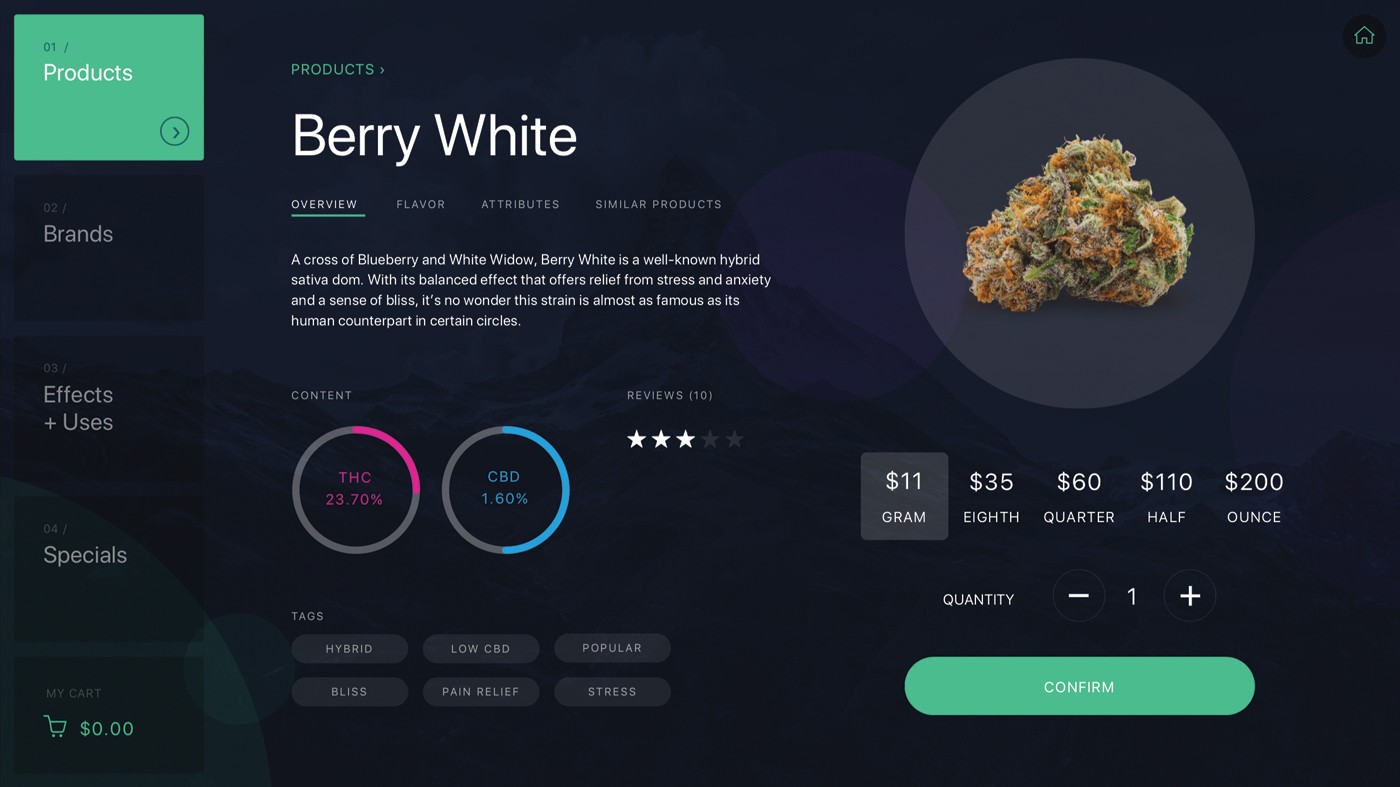

When customers walk into the store, they are greeted by cannabis consultants, who then play second fiddle to the real attraction: eleven “interactive smart displays” designed by Peak Beyond, a Bay Area startup focused on transforming consumers’ product exploration and shopping experience. With niftily packaged products on shelves around the store, customers can pick up any item and place it next to a display, which then offers detailed information provided by the brand. Not every state allows shoppers to handle cannabis products, but in California Peak Beyond is a compelling engagement tool.

About 60 percent of people who touch a product will purchase it, explained Bill Stark, vice president for business development at Peak Beyond. Doing the math, if Beach Breaks sees 500 consumers per day and each handles six products on average, that amounts to 3,000 product interactions, which could produce a 40-percent increase in basket size compared to a more traditional shopping experience.

“Sometimes people are hesitant to ask questions, so we’ve uninhibited them with these displays,” said Peak Beyond CEO Jeff LaPenna, who recalled receiving a call from the owner shortly after Beach Breaks opened. “I’m short-staffed,” the owner told LaPenna, “but it doesn’t matter, because the customers are crowding around the displays and helping each other make purchases—and upselling too!”

The behavioral data Peak Beyond collects via its smart displays may end up being the system’s most valuable asset. A three-month pilot program at Denver’s Euflora created a unique environment that promoted new PAX pods, complete with signage and smart displays. Not only did the experiment increase sales, but the featured pods also sold about five times better than other pods in the store, Stark said.

“It’s a huge boon for a brand to get any data, and PAX was more excited about seeing the data than the sales lift,” said John Capogna, Peak Beyond’s chief technology officer. “It enables them to learn more about their customers and come back with a better pitch next time.”

While so-called “pop-ups” have become a popular way of marketing in the cannabis industry—whether at an informal location or an in-store event—they are expensive to conduct and brands come away with very little data. With Peak Beyond’s platform, Stark boasted, clients can see how long a customer watches a video, which products they compare, what marketing materials they read, and what combination of products they purchase.

At this point in the retail game, companies that understand data about their market, their customers, their employees, and more are best positioned to develop winning sales and engagement strategies.

Data = smurfs

When Amazon changed the rules of the retail world in the 1990s and drove thousands of brick-and-mortar shops out of business, its biggest wrecking ball was data collection, algorithms, and analytical tools, which enabled the company to curate a shopping experience that is ultra-convenient, customized, and makes product suggestions based on shopping history.

Eyechronic’s Jacobs has done some deep thinking about the Amazon model over the past decade. With the 800-pound gorilla of web retail in mind, he’s created companies that specialize in delivering an integrated and customized multimedia consumer engagement experience, and then leveraging the resulting data to help store owners build and retain their customer base.

He divides cannabis users into groups based on their buying habits. “Loyalists” shop in the same stores on a regular schedule and buy similar products during each visit; “die-hards” like to check out everything, spending more time in shops with bells and whistles and lots of products. And then there are “smurfs.” These intrepid folks usually are tourists from other states who smurf their way from store to store, visiting as many shops as possible during their canna vacations. Jacobs didn’t draw his conclusions about customers based on observation or anecdotes. He merely compiled data from stores across the U.S. and examined it with proprietary analytics tools.

“TrafficWise [Enlighten’s analytics platform] knows every cellphone that walks into the store, how long it’s there, and how frequently it returns, and now I can understand almost anything about that consumer,” Jacobs said. “We make a lot of different devices and collect a ton of data from a consumer standpoint. All this information is database-connected, and all those dots can be connected. We’re the guys that can connect them.” He noted cellphones are tracked if consumers have opted in to one of Enlighten’s services.

The company’s technology platform includes interactive signage to inform and educate customers and employees, a retail analytics portal, and complementary tools that help stores and brands optimize and tailor marketing pitches and product offerings. The goal is helping retailers reach a targeted demographic with engaging messages at the point of sale.

“Eventually, the most sought-after product will be frictionless loyalty, so they know [specific consumers are] in the store and can send offers via text, based on location,” said Jacobs. “Nobody offers that yet, but it will take over as the most important product, so I’m excited about that one. You know, technology is the most useful when it disappears into the background and just does its job.”

Know what the customer wants before they do

Anne Forkutza has worked in customer experience and digital strategies for the past decade with some of the biggest brands on the planet, including Nike, Electronic Arts, and Starbucks. As the director of experience at retail software developer Cova, she now is tasked with cracking the code for customer engagement in cannabis shops.

Cova produces a suite of tools—reporting dashboards, inventory management, express checkout kiosks—that integrate with its flagship point-of-sale system. When Forkutza looks at the current state of the cannabis retail market, she sees a fast-changing landscape.

“We are beyond the pot shops, and it’s less about the differences and more about the parallels to traditional retail,” she explained. “For people who hesitated to go into a dispensary before, it’s now more approachable. The audience is changing, and the way they’re shopping is changing too. That means the retail store needs to change with them.”

A big part of that change is happening via technology designed to make the in-store experience more memorable through educational, self-discovery displays, touchscreen menus with express checkout, digital signage, entertainment videos, and more. Forkutza envisions recommendation engines that will take new consumers through a journey of sorts, leading them to the right products for the right occasions. This level of customization and personalization is what Cova’s product designers strive for as they build an integrated retail technology platform.

On the client side of the equation, Cova is trying to help dispensaries predict and recommend items based on purchase history and buying behavior, information that is bundled into outreach, marketing, and promotions. The new tech devices also can help staff work more efficiently by allowing different ways to take, fill, and transact orders.

A close look at all the technology devices already in play at cannabis shops makes one wonder if the machines are taking over. But as with most business these days, it’s about finding the right balance between technology and human interaction. “It’s not about technology replacing that human interaction. It’s intended to connect, strengthen, and enhance that relationship,” Forkutza explained.

Magnolia Wellness’s Goldsberry also noted the importance of having well-trained and educated staffers who can guide customers along. “I think people like to interact with their budtender, because part of buying cannabis is the social experience and you get a boost of energy from the person providing it,” she said.

The curse of the machine

In any nascent industry, trying to predict which technologies will take off and which will be left behind is folly. That said, traditional retail shops are a good place to look for clues. It’s hard to imagine automated vending machines won’t play a more prominent role in cannabis soon, particularly for shops that have long lines, impatient customers, and overworked budtenders.

But it’s been a bumpy start, to say the least, for early entrants in the vending game. American Green was one of the first out of the gate, but soon got derailed with its ill-fated project to turn a town near Las Vegas into a weed production hub and tourist center. Oakland-based Grasshopper Kiosks looked like a promising new player until software problems, jams, incorrect change, and other issues prompted many of its trial clients to send the machines packing. And then there was MedBox, an early player that had plans to be the “Walmart of weed” but crashed and burned after a Securities and Exchange Commission investigation revealed 90 percent of its quarterly revenue resulted from “sham transactions.”

The curse of the weed vending machine runs deep.

“You have only one opportunity to introduce a product for the first time, and my plan is to deploy when this machine is working seamlessly,” he said. “We cover our tracks in terms of how they function in the field, and the market is only growing. I want to be part of that future. To me, it’s about coming out with a minimum viable product and then evolving the technology from there.”

The Greenbox can vend multiple items in a single transaction and incorporates a dynamic upsell feature: If someone buys a PAX cartridge, for instance, the machine could suggest a battery purchase, as well. Johnson said the machine is designed to hold about eighteen to twenty-four SKUs, which would allow clients to offer products in each of the most popular categories (flower, edibles, oils, etc.).

Johnson recently placed an order for fifty of his machines to be assembled and expects to start rolling them out to dispensaries and other retail outlets soon. Los Angeles’s Erba Collective will be one of the first installations.

For CBD-only machines, the possibilities are even greater. CBD products coming soon to a carwash near you?

“So far, the feedback we’ve gotten has been great, and people love the design and the robotic arm,” he said. Whether the robotic arm has any curse-breaking abilities remains to be seen. And whether it’s vending machines, automated kiosks, or drones dropping products directly on a consumer’s porch, the future of cannabis retail looks to be on a parallel path with other retail markets.

“A lot of what we’re seeing in general retail is going to bleed into cannabis retail, and that is the end consumer being more empowered with different ways to educate themselves and having multiple ways to order items,” said Forkutza. “Whether they reserve online, buy online and pickup, or buy online and ship to home, prepaying for items or self-checking-out, the future of retail is more options for that end consumer to shop and buy and educate.”

Best buy cannabis

So, the future for cannabis retailers is…Target? Best Buy?

Considering the challenges legacy retail giants have had to overcome since the advent of online shopping and Amazon’s Prime revolution, it’s no small achievement they survived and even are expanding their footprint in some markets.

For cannabis operators who hope to succeed in the retail space, at least one lesson is clear: As consumers become savvier about weed in its various forms and functions, shopping will be less about preferring sativa over indica and more about where and how they want to use their go-to products. Retailers that guide them along the path and offer compelling loyalty points and incentives along the way will win.

“Look, if you’re not talking and thinking about the stuff that I’m talking and thinking about in retail, you’re going to lose,” said Jacobs. “People are spending millions of dollars, real business people, and they’re building these amazing retail and distribution models. So, if you don’t make an experience in your store, you’ll be telling stories five years from now about how you used to be in the cannabis business.”