Despite the post-pandemic decline in sales, the cannabis industry is still projected to reach north of $30 billion by the end of 2022 while providing more than 400,000 full-time jobs

and attracting new entrepreneurs in mature and emerging markets. And with new entrants, we see new trends, insights, social acceptance, and a better understanding of the marketing landscape for both customers and brands.

With the final month of Q3 approaching, we’ve asked a few dispensaries in mature markets to share their experience with the year’s rapidly shifting marketplace. While many customers in the last half of 2022 are shopping for discounts, brand loyalty also appears to play an increasingly important role in some retail settings.

Emerging Sales Trends

“[Customers] are simply seeking high-quality cannabis for the lowest price,” said co-owner of The Artist Tree, Courtney Caron.

This fact hasn’t been lost on most dispensaries according to the chief revenue officer of Dr. Greenthumb’s and Insane Brands, Travis Howard. “I’m watching the mass movement to discount-based marketing. I think in many states like CA, CO, [and] OK, we will continue to see that … even the brands not typically positioned as value brands [are] being lumped in,” he said.

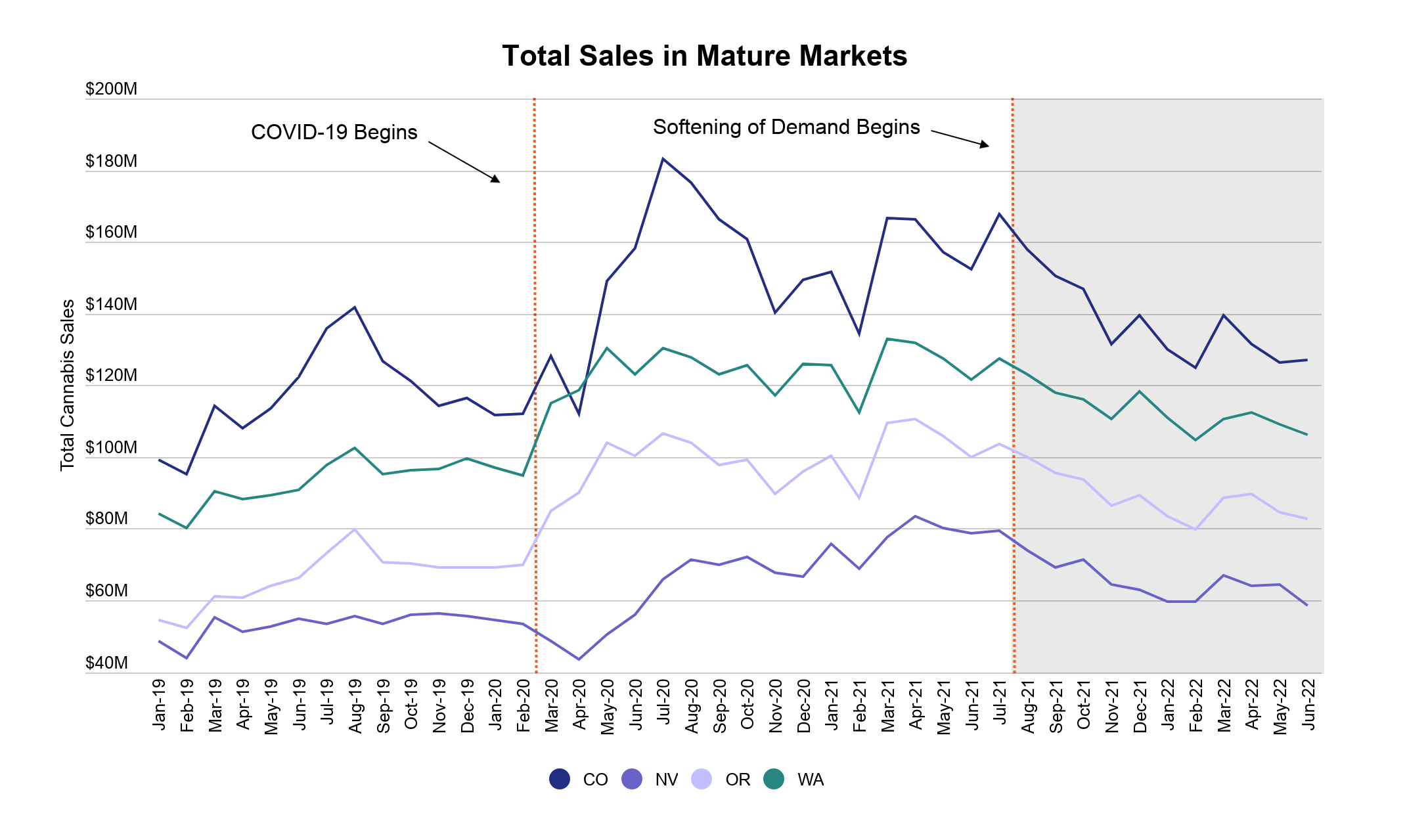

According to BDSA’s Q1 cannabis market overview, the downward sales trend we’re seeing now began as early as Q4 2021. The market research firm’s data saw growth in mature and emerging markets between Q1 2021 and Q1 2022, but “all markets covered by BDSA Retail Sales Tracking saw total dollar sales decline from Q4 2021 to Q1 2022.” A more recent report from data intelligence firm Headset on the declining growth of U.S. cannabis sales paints a similar story.

“Retailers across the board have experienced significant drops in revenue over the past several months as average ticket prices have dropped 20 to 30 percent,” said The Artist Tree Founder Mitch Kahan. When asked if these ticket price drops are related to foot traffic, Kahan pointed out that “traffic has remained relatively consistent in terms of the number of customers we see per day, however, the average spend per customer is lower.”

The sales drop has been felt across the board, but for Misha Beryburg, principal of MediThrive, there is a counterbalance in place. “We have seen about a 10 percent decrease for walk-in traffic year-over-year, which has been offset by an increase in delivery customers.” Since early 2020, delivery has been steadily increasing. According to Flowhub, online and delivery orders jumped up by a whopping 60 percent, and stores with delivery enabled sold 22 percent more than those without the service. In the first half of 2021, Weedmaps reported another 60 percent jump in delivery.

So how are dispensaries responding? For one, they’re prioritizing new customer acquisition. Elevate, a dispensary in Woodland Hills, California, on the other hand, is doubling down on its base and emphasizing deals.

“Our target customers at Elevate are the ones who can appreciate a high-end luxury retail experience with an emphasis on customer service and a wide range of products in all categories,” said Kevin Krivitsky, CEO and founder of Elevate.

To appeal to that base, the majority of their marketing efforts are aiming to put money “back into our customers’ pockets through promos, discounts, and other forms of savings,” said Krivitsky.

With this in mind, it would behoove burgeoning cannabis companies to focus on their niche base and affordable price points with data-driven marketing while bringing in new customers to increase order quantity. This will only grow in importance as more dispensaries pop up and adult-use customers become inundated with generalized marketing campaigns.

Emerging Marketing Trends

Video

The industry saw a large portion of cannabis brands utilize video advertising in 2022. According to Zahur S. Lalji, CEO of Wheelhouse Dispensary, “video marketing is picking up on social media platforms in general.” Courtney Caron from The Artist Tree says much the same, “From a dispensary standpoint, I have seen more use of video, testimonials, reviews, in-store installations, as well as advertising marketing to specific consumers through data collection,” she said.

In a recent poll on Hearst Bay Area, over 69 percent of cannabis companies intended to invest more in videos to market their content. There are a few reasons for this shift. Social media platforms like Instagram have algorithms that favor video content — or “Reels” — to compete with the popularity of TikTok. And Instagram in particular makes it difficult to advertise cannabis in any capacity as their community guidelines prohibit it; often shadowbanning or outright deleting accounts. As a result, more brands are using video content creation to grow a brand image rather than market deals or specific items.

“Videos have the ability to convey a vibe and evoke emotions more than static images. We use them in our social media and website to express the creativity and culture of our locations,” said Caron. “When watching video marketing … the consumer might see more of the art in close-up views, which could entice them into stores,” said Sean Shepherd, director of purchasing and promotions for The Artist Tree.

Wellness

Wellness language continues to play a prevalent role in cannabis marketing. Cannabis has become more socially acceptable in certain pockets, but nationwide, it still has a few hurdles to overcome. That’s why wellness — aside from it being a trillion-dollar global industry — is perfect for cannabis to co-opt.

“I have noticed an increase in consumers over the age of 55,” said Caron. “In each store I visit, I almost always see a handful of individuals within the 55 to 70 range.”

According to the latest financial results from Ascend Wellness through June 30, gross revenue increased 16.2 percent quarter-over-quarter. On top of that, their year-over-year revenue increased 20.7 percent to $117.7 million. The appeal of wellness products appears to grow in tandem with older demographics gaining interest.

In an industry quickly facing oversaturation and order price drops, the move to co-opt wellness language and marketing sensibilities is proving effective. The perceived wellness benefits of cannabis have also helped the burgeoning infused beverage market, alongside other factors like the category’s appeal in social situations.

Sociability

Companies have been trending toward “social cannabis” marketing with low-dose products, infused beverages, and edibles. According to The Artist Tree, drink companies are spending tremendously to acquire new customers. Why the sudden growth in popularity?

“For generations, people have gathered socially to consume alcohol. Cannabis beverages bridge the gap between the comfort of drinking alcohol socially and social cannabis consumption. For those who do not smoke, or are not interested in consuming a gummy or other edible, cannabis beverages fill that void,” said Caron.

Drinks allow for more unique terpene, cannabinoid, and flavonoid combinations, resulting in a larger range of experiences. Experts believe this will open up the marketability of cannabis and increase its market share. “Cannabis beverage companies like CANN have jumped on this trend with low-THC products perfect for consuming without … a hangover,” said Caron.

At the moment, beverages make up only 1 percent of all cannabis sales, but the category grows about 5 percent every month according to the data, with a market size of $52.4 million in the second quarter. Some consider this newfound focus on social cannabis to be a reaction to two years of quarantine. And as the world opens up more, a lot of industry experts are putting major stock into cannabis beverages and low-dose “social” products in general.

Favored Products

Cannabis customers are evolving and their habits vary from state to state. But if you look at California, the largest cannabis market in the U.S., flower sales have dropped 14.3 percent from June 2021 to May 2022. Similarly, there’s been a noticeable decrease in sublingual products and concentrate sales. This marks a massive customer shift toward newer ingestible products with lower THC.

From June 2020 through May 2022, sales of beverages, capsules, edibles, pre-rolls, and vapor pens have grown. Not only does this fall in line with the aforementioned rise of cannabis beverages, but it also reveals another adult-use trend: portability and convenience. In fact, portions of customers are purchasing pre-rolls of relatively good quality instead of flower. Orders with only pre-rolls have increased from 47.1 to 52.6 percent while orders with pre-rolls and flower have dropped by 21.8 percent.

Takeaways

The cannabis market is constantly shifting and growing, even when sales stagnate or drop. Successful dispensaries are focusing on their established base while attracting similarly-minded customers through more focused campaigns. The cannabis beverage market share has been increasing thanks to its ability to co-opt wellness language, target a wider demographic, and touch on the booming “social cannabis” market. As companies struggle to market across Instagram, video remains an important tool to build brand image, loyalty, and lifestyle. As we near the end of 2022, prepare for even more shifting trends and demographics.