New Frontier Data was founded to fill the void created by a lack of vetted professional data sources for the nascent cannabis industry. Eight years later, cannabis data is everywhere. Stats and figures are routinely cited in industry news. Yet, just as so many other industries have experienced, cannabis stakeholders are asking, “So what now?”

Data is critical, but determining what data to use, why it matters, and how to use it can be confusing. Cannabis stakeholders need to make accurate forecasts and informed decisions, but different groups need different data to do so.

Consider five prominent groups and the insights each needs to best evaluate opportunities, invest resources, and succeed: product brands and advertisers, retailers, investors, researchers, and policymakers. Let’s break down what data each group needs and why they need it.

Product Brands and Advertisers

Need: Market data and prioritization, consumer data (product preferences, retail engagement), and competitor sales data. In addition, understanding how to connect with recreational and medical consumers through consumer audience targeting and the data that comes with those efforts.

Why: Successful advertising reaches the right audience at the right time with the right message. A combination of targeting data and consumer profiles makes this possible. Campaign data that tracks reach, conversions, and sales attribution shows the effectiveness and return on ad spend.

Market data helps prioritize target markets based on potential. By matching consumer profiles that include product preferences, average purchase volume, consumption preferences, and more with markets that represent similar populations, brands can prioritize markets by potential.

Retailers

Need: Current and historical market trends, local consumer and sales data for inventory purposes, local market competitive intelligence, advertising and attribution data.

Why: Two of the most critical components to successful retail sales are knowing your customers and knowing your competitors. Answers to questions like these are critical:

Who and where are my competitors?

- How does my foot traffic compare and how is it trending?

- Are competitors selling more products more often?

- What types of consumers shop in my market?

- Am I acquiring enough new customers?

Data answers these questions and can help retailers establish a critical connection with their customers. If Dispensary A tailors messaging and inventory to local consumers’ preferences and Dispensary B does not, it’s clear where consumers will take their business.

Like product brands, retailers also need advertising and attribution data. By matching customer data with third-party data, retailers can enhance their opportunity to acquire new customers of a similar profile. Attribution ensures ads get conversion credit for store visits or in-store purchases.

Investors

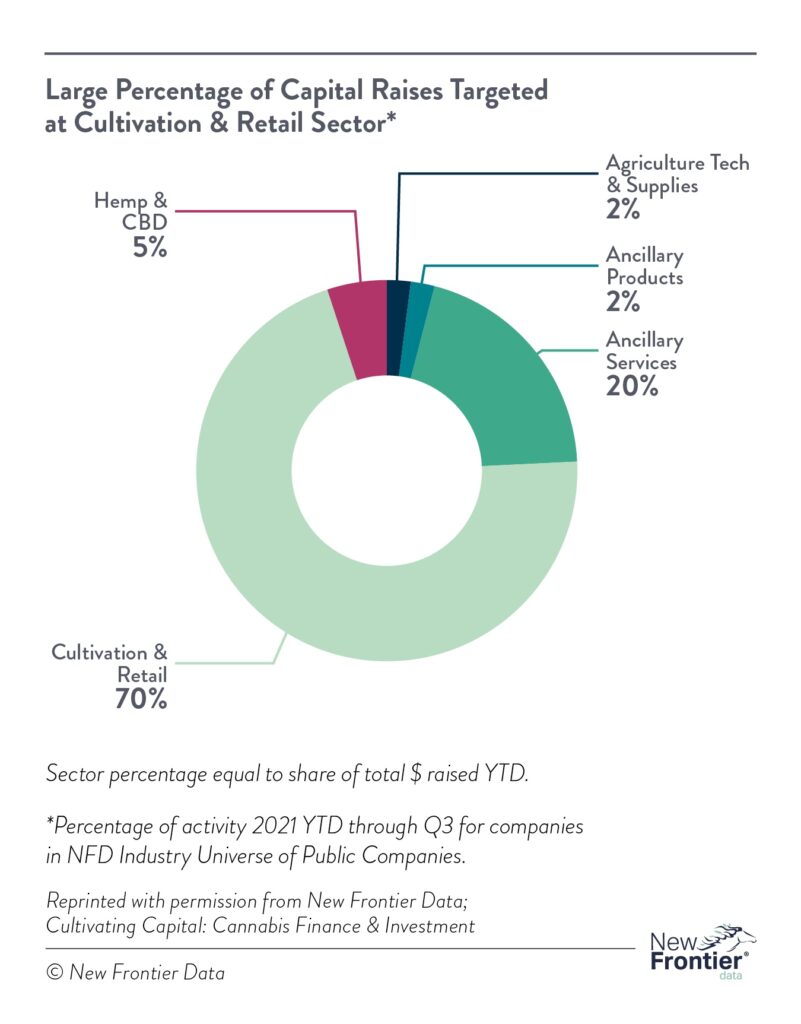

Need: Macro trends about the industry at large, including market projections; growth trends by product type, geography, etc.; regulatory guidance; stock indexes; sector performance; stock news; etc.

Why: These data serve as key performance indicators about where, how, and when to invest. That investment could be buying stocks of publicly traded companies, joining a private-equity fund, or investing directly into a promising startup. To minimize risk and maximize their return on investment, investors need a clear understanding of historical data and future projections, whether on the broader market level (global, national, state, etc.), product preferences, or which non-plant-touching ancillary services are most in demand, depending on their investment interests.

Researchers

Need: Historical data, but the type of data depends on their motivation: socioeconomic, taxes, jobs, crime, health, environment, and much, much more.

Why: Researchers have the greatest variance of data needs, but all require volume, velocity, and veracity. Volume enables them to identify and reduce anomalies. Velocity of inbound data ensures early identification of new trends or trends counter to historical analysis. Veracity gives researchers confidence in the data and their own findings.

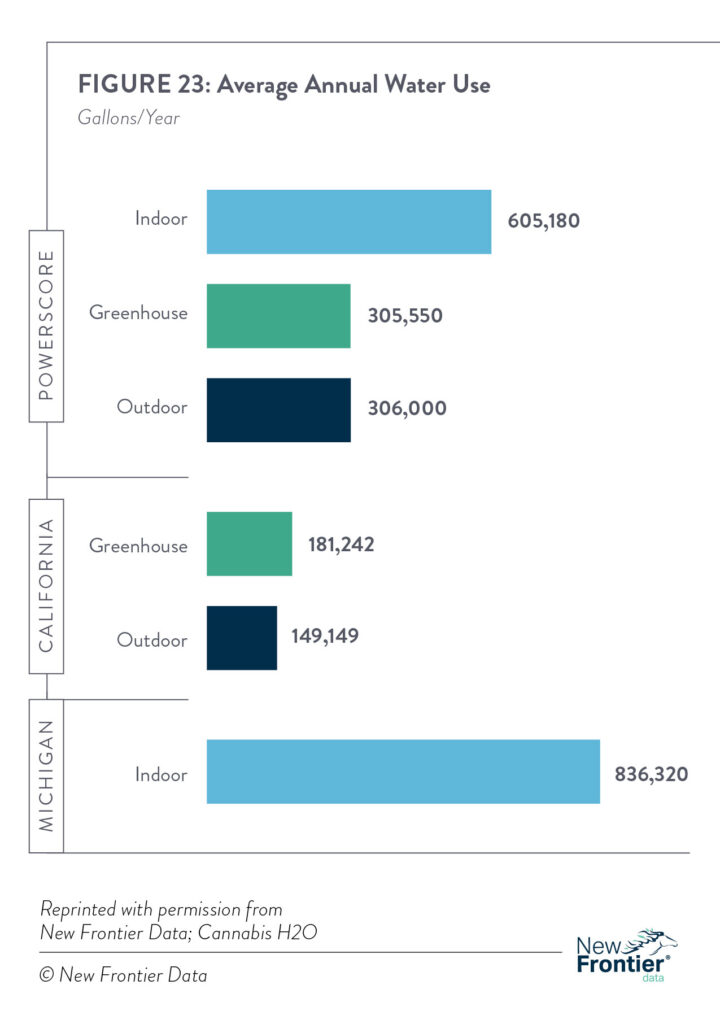

For example, an environmental researcher examining the impact of water consumption in grow operations needs to account for variables including type of operation, location, environmental conditions, regulations, and so on.

Policymakers

Need: Finance, consumer trends, taxation, and safety data.

Why: Policymakers need a clear understanding of the impacts their policies could have on their communities. Setting policies — licensing structure, taxation rates, health conditions that qualify for medicinal use, etc. — not rooted in data can lead to unexpected or negative outcomes, hurting the industry and community.

For example, states that overburden consumers with excessive tax rates limit the transition of consumers from illicit to legal markets. While some consumers may be willing to pay excessive tax on infrequent or small purchases, most of those who consume regularly or in high volumes won’t be willing to pay hundreds more than they do when they purchase from the illicit market. Policymakers must know the sweet spot for taxation that brings consumers into the legal market and helps the ecosystem thrive.

Where and how to get data

Consider these tips when collecting data for forecasting.

Gather as much first-party data as possible. Compile customer data from point-of-sale systems, loyalty programs, website visits, and other direct interactions with consumers.

Look for trusted track records both within and outside of cannabis when using third-party data. Providers like Lotame and Smart offer reliable and robust consumer profiles and targeting data, and both recently expanded into cannabis.

Go beyond the headlines. When reading news coverage, go beyond the stats cited in any article and explore where they were sourced. Usually, stats are plucked from a larger report to support a narrative, but the report offers critical context and findings that may help.

Connect with organizations dedicated to the collection and analysis of data on a particular topic. The Resource Innovation Institute (RII), for example, hyper-focuses on the issues of resource efficiency and sustainability in cannabis. For data about those topics, RII may be the leader.

Be mindful of report methodologies. When examining reports, carefully read the methodology to uncover how rigorous the steps were for gathering and interpretation. If two reports cover the same ground but deliver different findings, it’s important to know why. A report with a large sample size and rigorous methodology typically is more trustworthy.

[…] has emerged as a game-changer for the industry, offering enhanced productivity, improved decision-making, and increased efficiency. One significant application of AI is predictive analytics. By analyzing […]