WASHINGTON – Two individuals behind the company WeedGenics are accused of running a Ponzi scheme and spending tens of millions of dollars on luxury cars, residential upgrades, and adult entertainment.

The U.S. Securities and Exchange Commission (SEC) obtained an emergency order on May 23 to suspend what they allege is an ongoing fraud and Ponzi-like scheme by Integrated National Resources Inc. (INR) which operates as WeedGenics. According to the SEC, owners Rolf Max Hirschmann and Patrick Earl William raised more than $60M from about 350 inventors to expand their business but instead used the majority of the money to enrich themselves and distribute $16 million in Ponzi-like payments.

According to a district court complaint filed on May 16 in the Central District of California, Southern Division, Hirhsman and Williams began to lure investors in June 2019 with a guarantee of up to a 36-percent return on their investment. They claimed the funds would be used to expand WeedGenics facilities that supposedly cultivated cannabis in Adelanto, California, and Las Vegas. However, neither Hirhsman nor Williams owned nor operated any facilities.

Instead of investing the funds as promised, the accused transferred the money through multiple accounts to pay for dining, adult entertainment, jewelry, luxury cars, and residential real estate.

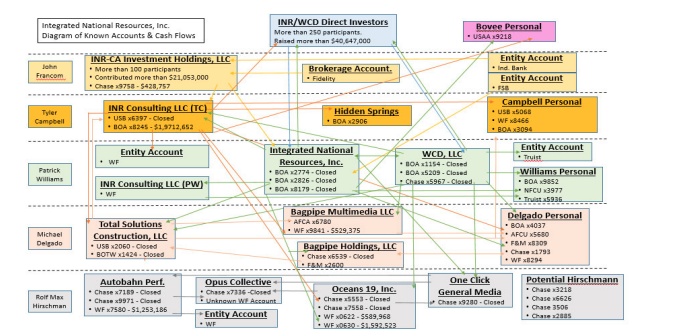

- The diagram shows the circuitous path—if not intentional morass—of investor money flow, statuses of the various accounts (i.e., open, closed, approximate amounts remaining) as of April 2023, and the interconnectedness of defendants and RDs.

To avoid detection, Hirschmann used the name Max Bergmann to serve as the fictitious face of the company and communicate with investors in what the SEC called a “sham.” Some of the funds were used to further the rap career of Williams, who performs under the name “BigRigBaby.”

“Rolf Hirschmann and Patrick Williams allegedly had no real company, no product, and no business, yet despite this, they promised investors everything and then delivered nothing,” said Michele Wein Layne, director of the SEC’s Los Angeles Regional Office. “This action demonstrates that, despite the defendants’ extensive efforts to avoid detection, the SEC has the ability to uncover fraud to protect investors.”

The court granted emergency relief against INR, Hirschmann, Williams, and more than a dozen other named defendants. The relief includes a temporary restraining order, an order to freeze their assets, and the appointment of a temporary receiver over INR and the other defendants. A hearing is scheduled for June 2 to determine whether the court will issue a preliminary injunction and appoint a permanent receiver to manage the businesses while it is under investigation.

The case is Securities and Exchange Commission v. Integrated National Resources, Inc. dba WeedGenics, Rolf Max Hirschmann aka “Max Bergmann” and Patrick Earl Williams.