The fastest path to growth for legal cannabis is transitioning consumers from the illicit market. Retailers are the heartbeat of the cannabis industry, but challenging regulations, high taxation, and the cash-crunched capital market have left many dispensary operators fatigued. The cure? Find a way to attract the roughly 100 million U.S. consumers purchasing cannabis products from the gray and illicit markets.

“To overcome current challenges, generating real revenue and bringing in consumers who are not yet part of the legal market is the way forward,” said Gary Allen, chief executive officer at New Frontier Data. “By working together as an industry, rallying behind our retailers, and addressing challenges head on, we can emerge stronger and more self-reliant.”

There’s a misconception higher costs in the legal market — mostly driven by a misunderstanding of taxes — keep consumers purchasing from the illicit market. But New Frontier Data’s most recent research shows the average consumer price per ounce of flower has declined 10 percent since 2010. If costs were the problem, the erosion of illicit markets would be happening faster. Price is a consideration, but it’s not the primary one.

The biggest challenge is comfort level. Consumers in the illicit market have an existing relationship, are familiar with the process, and know what to expect from the products they purchase and consume. Overcoming that inertia requires providing the same comfort level and opening their eyes to a better all-around experience with the legal market, which happens through education.

New Frontier Data’s Cannabis Consumers in America – Part 1: Dynamics Shaping Normalization revealed most consumers are most interested in knowing what effects the products they consume will have.

“The ability to provide a safe, predictable consumer experience should be a top selling point for cannabis retailers and brands,” said Allen. “The average cannabis consumer doesn’t know how many milligrams produce the effect they desire. That’s completely foreign information to them. As cannabis transitions to a pure consumer packaged goods (CPG) industry, product manufacturers need to communicate with consumers like traditional CPG brands do. Focus on the benefits and experiences a product delivers.”

Consumers want a safe, reliable experience that meets their needs. This provides licensed retailers and brands a huge advantage over the illicit market. Products sold in legal settings are more prescriptive and rigorously tested for harmful substances.

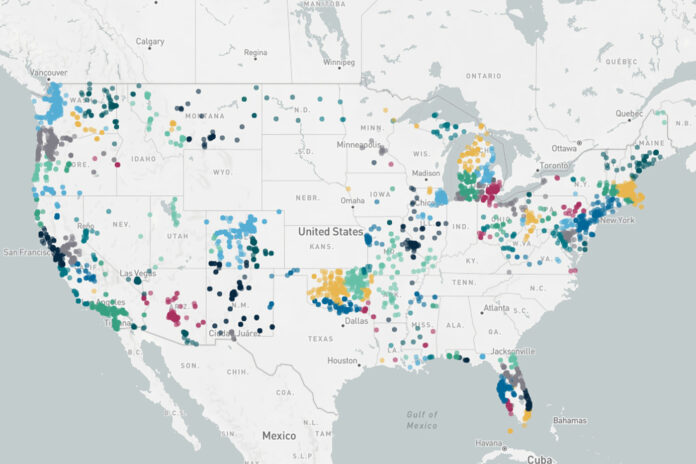

New Frontier Data maintains one of the largest cannabis consumer data sets in the industry, with more than 160 million profiled customers. Collected through dispensary point-of-sale software and more than 45,000 consumer interviews, the data provides a clear understanding of the shopping habits and preferences of today’s cannabis consumers. The results are available via NXTeck, a data-management platform designed to help retailers identify, target, and reach the fastest-growing consumer audience with efficient, cost-effective marketing efforts.

NXTeck’s tech-agnostic attribution allows retailers to measure and understand exactly how their marketing activities impact in-store activity and the effectiveness of their efforts across all channels through the same unified platform. With NXTeck, marketers can see their return on ad spending immediately, influence repeat in-store visits, increase customer dwell time, re-engage dispensary visitors, and analyze their competitive positioning and market share by geography.

Beyond maximizing existing customer relationships, NXTeck helps retailers target their audience across the right channels with the right message at the ideal time. The data-management platform provides valuable segments for dispensaries’ top personas and allows them to create custom audience segments. With the right segmentation, retailers can increase efficiency and drive more revenue by focusing advertising investment on the top consumer archetypes and profiles, targeting consumers based on product purchase behavior, and targeting competitors’ customers.

“Right channel, right time is great, but only if you have the right message,” said Allen. “Some of the most successful cannabis brands evolved their messaging in recent years. They no longer focus on potency, instead opting for benefits-oriented messages about relaxation, pain relief, etc. This aligns with traditional [CPG] brands, whose marketing isn’t focused on the volume of specific ingredients, but rather on the overall benefit to consumers.”

For the industry as a whole, more retail sales equate to more health and growth for all businesses, according to Allen. New Frontier’s data suggests if each dispensary added 1,000 customers who’ve been shopping exclusively in the illicit market, the total value for the industry would be more than $15 billion.

New Frontier Data worked with a dispensary facing a plateau in customer visits and sales. The store experienced a decrease in revenue growth despite effectively communicating with current customers and spending a considerable amount of money on marketing. Management wanted to take action and explore new ways to increase sales and bring in new customers.

They successfully leveraged location services with NXTeck to reach potential customers in their vicinity. Utilizing NXTeck resulted in an increase in new customers, boosting sales and revenue.

| Before NXTeck | After NXTeck | |

| Average visits per month | 1,078 | 3,524 |

| Monthly average sales | $153,792 | $304,473 |

“To move forward and grow the legal market, we must give illicit-market consumers a good reason to join,” said Allen. “Make them comfortable and provide a better, safer experience, and they’ll make the jump and keep coming back.”