With retail and wholesale cannabis prices still in freefall and no federal legalization in sight, capital-raising opportunities have dried up. Truly disruptive businesses will win in the short term as the scarce investor money still earmarked for cannabis fuels opportunistic acquisitions and ancillary business models that reduce or remove risk for operators.

Wholesale prices in Colorado fell to $709 per pound this year, hitting the lowest point since the state’s revenue department began reporting prices in 2014. According to the Portland Press Herald, the average cost of flower in Maine’s adult-use market has dropped 41 percent in the past two years. It’s happening across the country, and many investors are well aware.

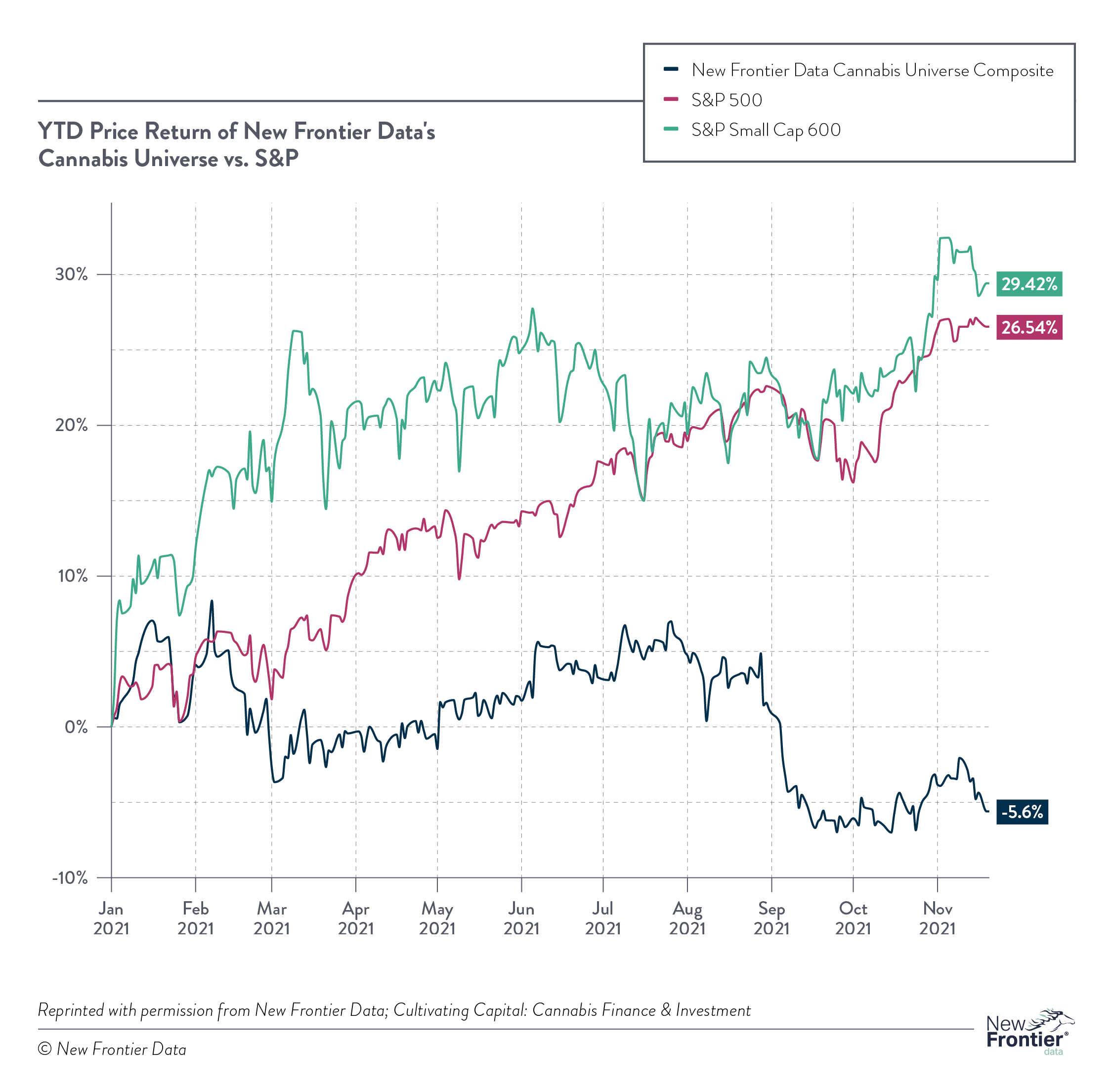

In 2021, when the S&P 500 gained more than 25 percent, the New Frontier Data Cannabis Universe Composite (composed of public-equity prices of listed cannabis companies), dropped more than 5 percent. The largest publicly listed multistate operators collectively raised nearly a billion dollars in 2021, but that number was dwarfed by the more than $1.8 billion in debt they carried.

Financial problems persist in 2022. “Capital raises are down more than 60 percent compared to 2021,” Viridian Capital Advisors noted in a recent report.

Investors like to bet on disruptors. As behemoth streaming services gobble up cable TV customers and retail brands across categories like footwear both increase their share of the market and substantially grow its overall size, the investors who made the right bets are winning big. All of this is especially true in a down or restrictive economy, which has encircled the industry with plummeting prices compounded by inflation and consumer belt-tightening. Operators naturally want to reduce expenses, not take on new ones. Many retailers felt the same hesitancy about embracing online marketing in its early days.

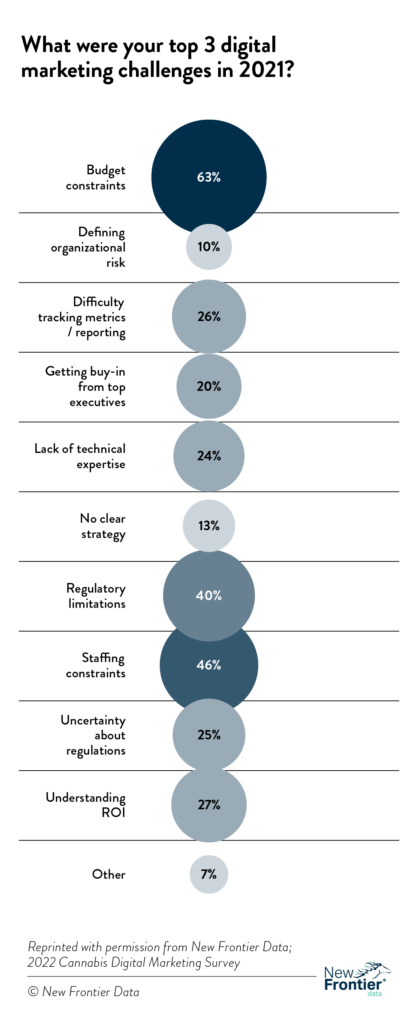

By the late 1990s, ecommerce had taken off. Most big brands had embraced selling products over the internet, but investing in targeted online advertising at scale was still a new concept. Many retailers questioned the potential of the channel and the value of the investment, and they needed to protect already thin margins—not unlike cannabis retailers today. As many struggle to get by in this market, their bottom lines won’t allow any extraneous investment beyond seed-to-sale tracking or other required compliance-related expenses. However, this also limits their growth capabilities, as useful sales optimization and marketing tech gets shelved. For the 83 percent of cannabis marketers already struggling to deliver their message to their desired audience, that’s a no-win situation.

New York University estimates the profit margins of brick-and-mortar retailers are among the lowest, averaging just 0.5 percent to 4.5 percent. Online retail fares better at 7.26 percent. While many predicted massive growth in ecommerce in the late 1990s, it hadn’t yet started to snowball, and many big retailers initially resisted making substantial investments to scale with online advertising. Companies offered innovative technologies that could transform their businesses, but business as usual largely continued for many risk-averse retailers.

In the late ’90s, affiliate marketing, where an affiliate/publisher refers online visitors to merchants and earns a commission or reward for each sale or conversion, removed the risk for retailers. If no sale or agreed-upon conversion occurred, no bounty was due. Affiliates rarely were limited in the sales volume they could drive, because the retailer knew the exact cost of each sale. Performance-based marketing agencies emerged and grew quickly. Within a few years of affiliate marketing providing the cost-per-acquisition model, performance-based, real-time auction bidding in mainstream media buying and search-engine marketing became the norm.

A slew of accounting and financial services firms sell their services for a bounty by helping businesses make sense of the employee retention credit available through the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a payroll tax credit available to many cannabis businesses. They offer free analysis and no up-front costs in exchange for a percentage or fee if they are successful. Law firms exist solely to challenge property-tax hikes and are compensated the same way. They’re confident in their ability to help, removing the risk and making it easier to become a customer.

If a packaging vendor predicts a 20-percent sales lift with a new approach that seems promising, for example, a performance-based fee could remove most of the retailer’s risk. Manufacturers willing to invest in getting their brands on shelves could reduce the risk for retailers with large discounts or arrangements to sell on consignment. Tight markets require this type of creativity.

Convincing more illicit-market consumers to buy from legal retail shops to help offset the reduced spending of consumers requires deciphering state and local regulations, local consumption habits, and the difference between what local consumers want and what’s available. It will take a patchwork of partnerships to achieve this predictive, forward-looking transformation, which complicates the performance-based pricing model but also makes consumer marketing just one area of the industry that’s ripe for innovation and disruption.

With companies already offering innovative solutions and technologies to help retailers succeed, near-term disruption in the cannabis industry will be less about the development of innovative products and services and more about reducing or removing risk for retailers with performance-based services that hold vendors accountable.

[…] legal and regulatory obstacles, but they persevered despite the challenges, determined to bring about change and establish a legitimate market. Their early efforts propelled the industry to what it is today, with 73 percent of Americans […]