Technology can move retail significantly forward when focused in the right direction. Predictive analytics, audience-building, consumer profiling, and advertising attribution all offer sophisticated decisioning to help brands and retailers invest more effectively. The technologies should inform product development and inventory management, yet companies too often create products and introduce them into the market without understanding whether they will sell. Instead, the industry has an opportunity to adopt tried-and-true strategies from more mature markets including consumer packaged goods, quick-service restaurants, and other franchise-heavy industries.

Brands in more mature markets learned the same lessons long ago as impactful technologies emerged and evolved. Now, they let data guide their product development, deployment, and marketing strategies. Demographics, socioeconomics, geography, and consumer profiles for particular markets provide invaluable insight into consumer demand, regional preferences, and potential sales. New products then are introduced in representative test markets to verify sales potential, where sales data informs which adjustments will be needed before rolling a product out to other markets.

As McKinsey & Company research explained, “Successful product development requires teams to engage with experts across disciplines while aligning four critical development lenses: business, design, consumer, and technical.”

By following this model and applying advanced technologies, companies can take advantage of the gains made in other industries, shorten their learning curve, and begin putting more strategic retail strategies to work faster.

Which tech for what purpose?

Currently, retail brands can tap into several technologies, but deciphering which ones to use and for what purpose can be overwhelming. The following examples cover some of the most useful technologies currently available and how best to deploy them.

Retail performance analyzers provide data about sales leaders by brand or product, ways to optimize product pricing for increased sales, and curated retail strategies for consumer engagement. By examining current and historical sales data, retailers can spot trends such as prolonged product popularity versus flash-in-the-pan sales boosts from promotions or deep discounts. They also can spot market voids or oversaturation to help determine whether to compete in a saturated market or fill a gap with a niche product.

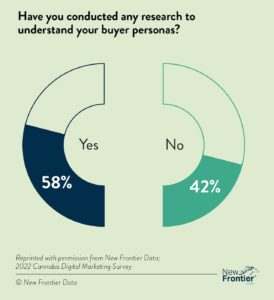

The Cannabis Marketing Association and NXTecK, New Frontier Data’s adtech division, conducted an open online survey of industry marketers to better understand and benchmark the current state of marketing practices with a focus on digital. The results, published in “2022 Cannabis Digital Marketing Survey: How Cannabis Marketers Are Chasing Their Share of a $32 Billion Market,” revealed 42 percent of respondents haven’t conducted any research into buyer personas. Without understanding who they’re selling to, product retailers are navigating blind.

Predictive analytics engines forecast which products are likely to perform best based on previous sales data, the addressable market, consumer profiles, and other factors. These technologies remove manual processes from data analysis for faster and more accurate predictions. Often powered by artificial intelligence or machine learning, these powerful tools examine volumes of data from numerous sources and inputs, providing product developers and retailers with a better understanding of what their customers and potential customers think about their current offerings—and how those sentiments might inform future offerings.

Audience builders zero in on the right slice of the addressable market to define the ideal consumers to target and engage. Once the data have informed product development and defined the ideal markets for distribution, it’s time to engage consumers. Marketers can apply the same consumer profiles used to develop the product at scale to target consumers who fall into that profile within the designated markets. Using the attributes of the profile can narrow down a broad, untargeted audience (say, cannabis users in New York) for more accurate targeting (e.g., users in four major cities in New York who use flower, vapes, and pre-rolls). The targeted group of consumers should be more receptive to marketing messages for a new product if retailers used data to define their target consumer profiles.

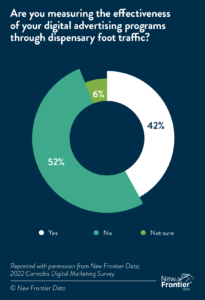

Similarly, if ads are driving foot traffic but sales are slumping, that’s valuable data about product pricing, store placement, and product performance relative to customer expectations. Retailers need this data to decipher which adjustments can help boost sales.

Disparate systems or a single package?

Several companies specialize in a single aspect of this technology ecosystem, while others offer a comprehensive package that covers them all. Separate systems may have an advantage thanks to individual technologies being more robust or advanced but may struggle to communicate across systems. The packaged systems’ advantage lies in the ease of use and access, but the offerings within each may not be as capable as their singly focused competitors. There’s no “right” answer about which approach to take, but if the chosen approach is not meeting the organizational demands for sophisticated retail decisions, it is time to reevaluate that approach and the technologies involved.

The most important thing is for product retailers to examine the lessons already learned by more mature industries and apply them to their own product development, deployment, and marketing to shorten the learning curve and grow sales.

[…] will be invaluable in shaping its future. Data-driven insights, research, and market analysis will guide decision-makers in optimizing their strategies and operations. Cannabis will emerge as one of the largest U.S. consumer markets, driven by the […]

[…] promotions, and monitor customer behavior. These broken-down analytics help dispensary owners make data-backed decisions and answer the questions they should ask as they assess their business. For instance, “How is […]

[…] of market differences, data is a powerful tool that can help retailers stay on track and become fruitful, profitable, and successful businesses. […]

[…] important because it will allow content creators to communicate better with potential consumers. Black creatives must gather data regarding the types of content that their audience enjoys, the times they tend to consume content, […]