Until recently, “the future of cannabis” meant the end of draconian drug laws, increased patient access, and federal legalization of a safer recreational alternative to alcohol. While that bright picture has not yet fully developed, innovative technology is powering future dreams of a much different kind.

Chris Beals, chief executive officer at WM Technology Inc., is among those leading the charge into future tech. WM Technology is the entity that resulted from the merger of Weedmaps—one of the industry’s most high-profile brands—and Silver Spike Acquisition Corp.; the corporation debuted on the Nasdaq exchange in June 2021 with a market cap of $1.7 billion. Already formidable, the company aspires to become the industry’s foremost tech powerhouse, a goal it most recently demonstrated by acquiring digital menu, advertising, and education ecosystem Enlighten Technologies earlier this year.

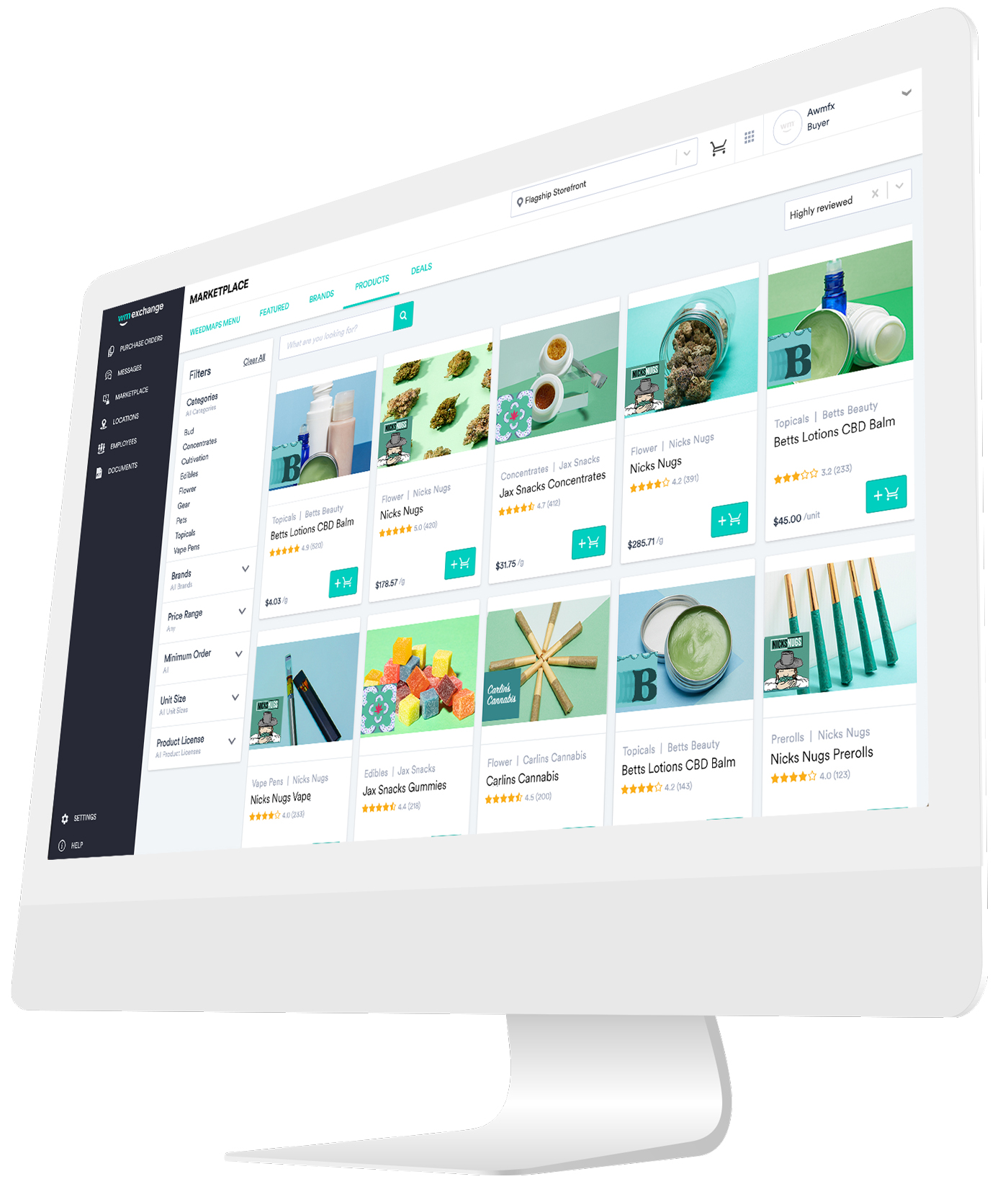

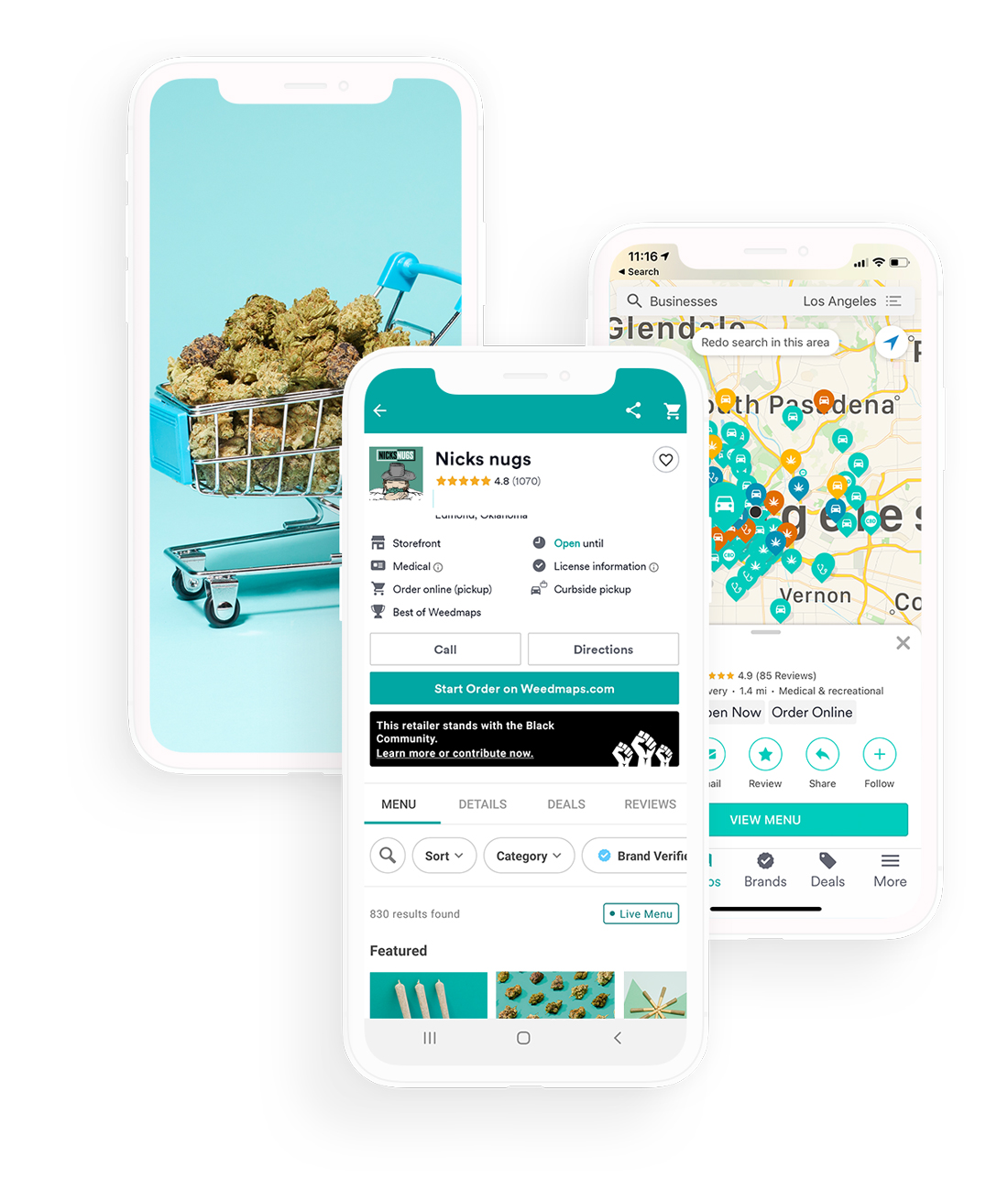

Founded in 2009, Weedmaps began life as a website where medical patients could find and review dispensaries. The site grew rapidly in both traffic and revenue, collecting 50,000 registered users and raking in $400,000 per month by 2010, according to TechCrunch. In November 2011, the company acquired one of the most valuable domain names on the internet, Marijuana.com, for $4.2 million. Today, WM Technology is a sprawling global enterprise encompassing websites, ecommerce, product delivery, a business-to-business software-as-a-service ecosystem, a point-of-sale system, digital menus, an in-dispensary TV network, and the most widely downloaded cannabis mobile app on both the Apple App Store and Google Play, among other things.

The company’s evolution did not occur without controversy. In 2016, after an unintentional leak of internal Weedmaps.com data, the Los Angeles Times claimed its analysis of reviews on the website suggested as many as 62 percent were illegitimate. The site introduced automated moderation solutions to address the issue and in 2020 rolled out Verified Reviews. However, the bigger issue for industry insiders was the presence of unlicensed dispensaries on the platform after California licensing law changed in 2016. Weedmaps straddled a fine line between intense criticism from licensed retailers and pleas from previously licensed retailers who claimed to be attempting to regain compliance. The company booted the last of the stragglers after the licensing grace period expired in 2019. (Direct competitor Leafly faced similar issues at the same time.)

Beals, who served as Weedmaps’s president and general counsel until his appointment to the CEO role in March 2019, navigated the ship through those troubled waters. A graduate of the University of Pennsylvania Carey Law School, he has focused on technology and technology public policy throughout his career. He can be gregarious and charming and humorous, but he’s very, very serious about business.

Here’s what he had to say about the industry’s future.

WM Technology went public a little more than a year ago. How has that changed day-to-day operations?

We’re at almost 800 employees now, so we’ve evolved in terms of process, systems, organization, and increasing the speed at which we can ship new technology and business solutions.

WM Technoogy is acquiring companies in the tech space. What does the company’s future look like?

We want to ensure our WM Business platform can provide a “one-stop shop” suite of software that goes beyond the marketplace to help businesses find customers, fulfill their needs, and then re-engage them. We want to be the go-to tech provider for how retailers and brands interact with consumers.

Another big part of our future is how we become a software solution provider to other tech providers. I’m looking forward to expanding the universe of our clients to not just plant-touching businesses but also other tech providers who are serving plant-touching businesses.

We’re going to put a heavy focus on making sure we seamlessly stitch together the solutions we’ve already acquired and make sure they work together as efficiently as possible. Looking forward, this is a market that’s going to put a real emphasis on tech companies able to operate profitably while also achieving continued growth. To the extent that we do any additional acquisitions, there will be a heavy focus on their return on investment so we continue our streak of profitability.

What major developments do you expect to impact the industry in the next year or two? How should stakeholders prepare?

Over the next couple of years, we’ll see an explosion in the number of brands, product types, and form factors. It’s going to be important for retailers and brands to syndicate and distribute product information seamlessly and for that information to update dynamically across the different digital surfaces where consumers shop or browse. That’s why we’ve been investing significantly in omnichannel tools to help retailers and brands have their product and menu information be consistently displayed across all channels, on Weedmaps as well as on the retailer and brand websites and in physical stores.

Brand products also can vary widely from state to state, from the look of the package and contents to the labeling information. Each state that opens up for adult use is crafting its own local rules. Typically, you see consumer goods vary country by country, not state by state. That’s another reason why the work we are doing to let brands centrally administer their product catalog across different states is going to be so critical.

Looking ahead, I expect an increase in the number of West Coast retailers and brands that start to open up shop and seek expansion on the East Coast. Tech companies will help them attack those states compliantly. Also, as additional licenses are issued and competition increases, we’ll see an increase in businesses looking to operate as efficiently as possible, which will be reliant on technology.

More technology means more data. What role will data play going forward?

Historically, we’ve had a really hazy understanding of what kinds of products certain segments of the population gravitate toward, mostly because that kind of data hasn’t been available. However, with Weedmaps being in its fourteenth year, we sit on a wealth of data brands and retailers can leverage to market their products and services. The next phase will be using that data to help retailers and brands know what products to stock and develop.

Another way I see data helping the industry is in the supply chain. If you think about a contamination outbreak in traditional agricultural products such as lettuce or dairy products, the process to trace where that outbreak started still involves people with clipboards standing in a field. In cannabis, we’re literally growing a large-scale agricultural product, so there’s tremendous potential to elevate supply-chain tracing.

Will customers have new ways to purchase cannabis in the future?

In the very near future, I expect we’ll see an increasing consumer demand to try new products that are similar to those they’ve gravitated toward in the past. We’re working to further refine the consumer experience on our platform to meet that demand, recommending products based on one’s purchase history or similar consumers’ preferences. Longer-term, I suspect there will be a world where we can begin matching up clusters of different products by their terpene and cannabinoid profiles and using that to help suggest products to consumers based on how the product will interact with that specific individual. I think this could open a really exciting set of possibilities for consumers to try new products they otherwise never would have tried or products that could be really impactful for a certain medical condition.

We have barely scratched the surface in terms of understanding the effects of different types of cannabis, how different compounds impact various groups of the population, why certain individuals have a less-than-favorable experience with certain products, and so on. In my view, there is a very exciting future ahead of us as we become more intelligent with how to quantitatively recommend products to individuals based on data and user profiles. This potentially could get to a far future state where products are recommended based on the genetic profile of the individual.

I hear people talking about genetic testing on their endocannabinoid systems to find specific products for them, but I think it’s still going to be some time before we see that come to pass with any accuracy. Over the years, I’ve seen purported systems come and go, using science and technology to improve the process for genetic and strain breeding, but we haven’t seen what generates the best results. I also think a lot of the ideas around doctors scientifically prescribing certain products based on endocannabinoid systems are still too early, both from our understanding of how different people react to cannabis and because of federal prohibition and restrictions on which products can be prescribed.

Augmented reality (AR) and virtual reality, especially in the form of the metaverse, are getting a lot of chatter. Are they likely to impact the industry anytime soon?

In my opinion, it will be some time before cannabis can meaningfully intersect with the augmented- and virtual-reality spaces. As other brands and consumer goods determine how to have frontage and relevancy in the metaverse, so will cannabis brands. For AR specifically, I can see how consumers may want to virtually experience how, let’s say, their products are produced, but this audience is limited, in my view.

Do you see a role for cryptocurrencies and non-fungible tokens (NFTs)?

Possibly. Cannabis has focused on circumventing the problems with non-cash payments, but I think a lot of those efforts would run afoul of the federal regulations around banking up to and including federal money-laundering laws. This was why doing cashless ATM transactions drew the attention of Visa and Mastercard.

I could see how crypto would allow for easier and more secure payments but, unfortunately, the Achilles heel is when it permits the circumnavigation of some requirements, such as knowing the purchaser or the use of the funds. I’m not necessarily sure that’s the type of challenge retailers and brands need in the sector at this point in time.

I believe there is potential for NFTs in the longer term, perhaps in the realm of validating supply chains or intersecting those supply chains with ownership or the sourcing of cannabis genetics. However, for an industry that is already under so much pressure—whether we’re talking about how to navigate individual state regulations or taxation—our focus needs to be centered on the essentials necessary to build on the foundation already in place in order for the industry to survive.

Can other blockchain technologies benefit the industry?

I think there’s real potential for blockchain technology, specifically when you look at things like the track-and-trace systems currently in place. Cannabis has one of the most interconnected and tracked supply chains, so when it comes to product sourcing or lab result tracking, there could be a real opportunity to use technology to more seamlessly track products and their attributes. It’s exciting to think about what this kind of technology could bring to not only this industry but also to traditional agriculture.

I’d also be remiss if I didn’t say track-and-trace adds a lot of complexity to the industry, so I think we also need to be asking ourselves constantly, as technology providers, “Is this making life easier for consumers and businesses?”

How do you see technology impacting cultivation? Will the internet of things play a role in increasing efficiency?

Cannabis cultivation is a much more manually intensive form of cultivation than most other agricultural goods. Whether it’s trimming plants, removing the fan leaves, managing pests, or curing and drying the product, every single step of producing a quality product requires manual intervention. It’s going to be hard, I think, to automate the parts of cultivation that require a trained eye.

In terms of greenhouse and climate control, there’s an outsized role for sensor systems to integrate with the internet of things (IoT). At a micro level, it’s important to control things like humidity, airflow, and temperature so there’s this natural synergy for IoT to understand and automate those levels. There’s also the relationship between growing conditions and different parts of the canopy, and then your yield, THC percentage, etc.

Should we expect to see technological advances in lab testing?

My hope is we’ll see a loosening of some of the overly rigorous testing requirements currently in place in some states. They greatly drive up production costs and often have little relation to public health. In many states, they are so strict that pesticides used on traditional agricultural crops can float for miles on the wind, land on outdoor-grown cannabis, and cause it to fail these ultra-minute testing thresholds.

Currently, New York has a requirement for THC-based taxation. It’s almost impossible for me to fathom the burden and the load of testing that will be needed to enact this. Perhaps it will drive greater automation in the lab testing space, similar to human blood lab testing. But the technology still needs to be developed, and it’s difficult to automate lab testing currently.

What about delivery?

Delivery is the future of the industry in most states and, like with almost all other goods, we’ll continue to see an increase in consumer demand for the convenience of online shopping and delivery of goods directly to one’s home. Given the increase in competition within the space, coupled with current gas prices, data will become even more essential for delivery operations to run their businesses efficiently.

Retailers with physical storefronts also will have to provide or partner with other companies to provide delivery services, as it will benefit their bottom line in the long term. We have to remember unlicensed operators always do delivery, so states that don’t allow delivery are just providing a good reason for consumers to shop on the illicit market.

New technology development requires sophisticated engineering. Is the industry able to attract that kind of talent?

Speaking from experience with Weedmaps, attracting top talent has changed materially. In the past couple of years, we’ve been able to attract top talent because there’s a growing realization that we’re solving complex data and engineering problems. That’s a big part of what attracts good engineers: solving problems that are intriguing and also driving meaningful, visible change. That’s true of the cannabis sector. We’re also seeing people realize there’s not this stigma or black mark on your resume when you work in the industry, which has helped to open a lot of doors.

Do you expect new legislation or regulations about data or technology use?

Politics has and likely will continue to have a far more outsized role in cannabis than in any other industry. Here in the United States, each state opening up is akin to a new country opening up since each state is vertically integrated and sets its own laws and regulations. At the same time, we’re also seeing an acceleration of states revising their laws so there’s little synergy with neighboring states, perhaps in an attempt to thwart interstate commerce once federal legalization does come.

In regard to data regulation, there are already states where the plant is legal and specific requirements dictate how consumer data is used. A good example of this is the California Consumer Privacy Act. Looking abroad at Canada and the European Union, there are also fairly rigorous data privacy laws that are applicable to the cannabis space.

With legalization continuing to move forward, we’ll see some states get it right and some states get it wrong in terms of legislation, particularly when it comes to advertising and technology within the industry. Ironically, we have seen a wide range of approaches taken by states with regard to regulating advertising and digital commerce, and those that overregulate in these areas tend to have the most outsized illicit markets. That’s simply because all they’re doing is preventing legal, licensed businesses from reaching consumers for which the illicit market is vying.