Cannabis consumers are spending less, increasing the need to bring new consumers into the legal market. While there are short-term tactics to offset the effects of shrinking wallets, the most profound impact will come from transitioning more consumers from the gray market to the legal market, increasing the available customer pool. When wallets shrink, retailers must attract more wallets.

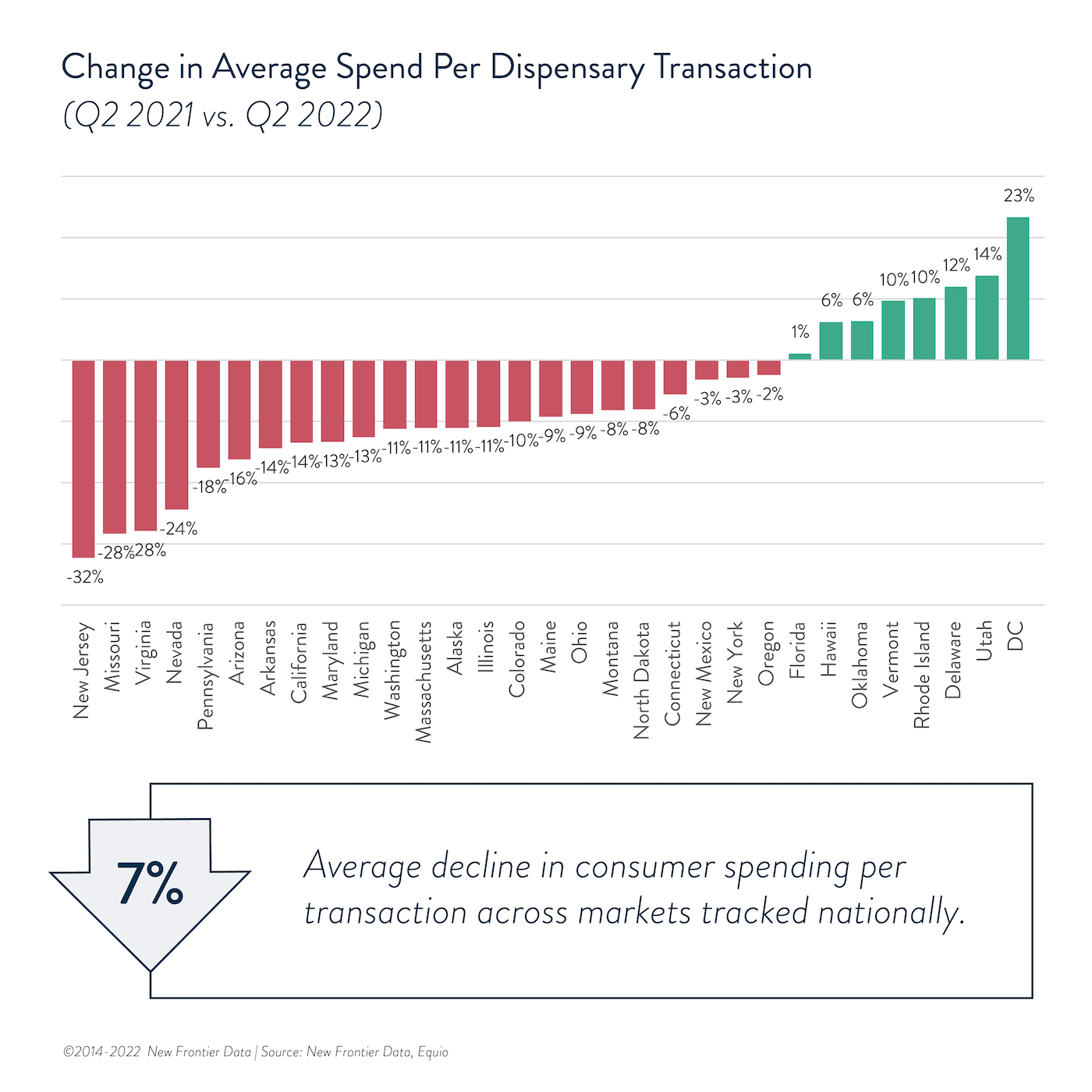

According to recent research from New Frontier Data, the average decline in consumer spending per transaction has decreased 7 percent nationally year over year (YoY). Economic issues like inflation and a looming recession are primary motivating factors; others include the end of the “COVID bump” that drove sales increases during the coronavirus pandemic and changing regulatory statuses as states transition from medical to recreational.

New Jersey provides the perfect example of this transitional effect with the greatest decline in spending per transaction. Typically, medical consumers spend more per transaction than recreational consumers, but the volume of transactions is significantly higher in recreational markets because consumers don’t have to jump through as many hoops, more than making up the difference.

Not all markets declined in average spending per transaction; a handful moved in the other direction. The most likely explanations for this fall into three categories.

A few are uniquely small markets. With smaller markets in Hawaii, Vermont, Rhode Island, Delaware, and Washington D.C., even minor changes to consumer behavior are especially pronounced.

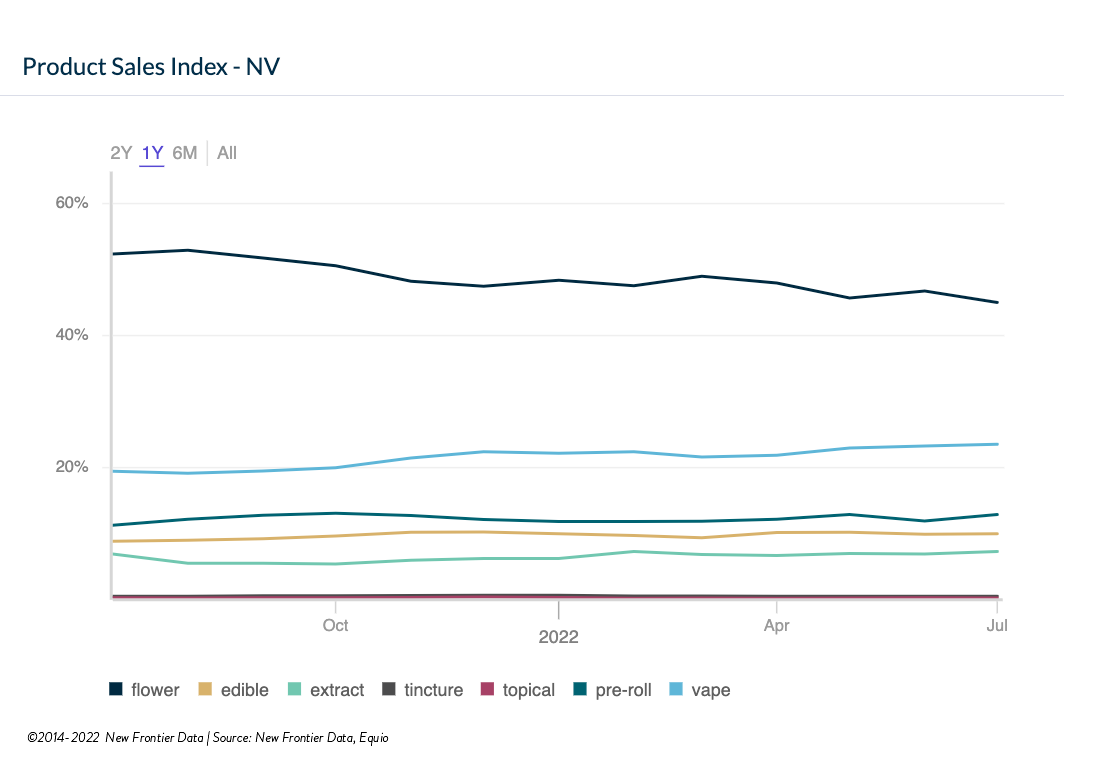

Demand for value-added products increased. In the past eighteen months, flower’s share has declined significantly as demand for value-added products increased. In Hawaii, for example, flower’s share of sales fell from 55 percent in the first quarter of 2021 to 45 percent in the first quarter of 2022. Vapes gained the most over that same period, jumping from 27 percent to 41 percent. Since value-added products tend to command a premium over flower, the significantly higher demand for vapes is likely the largest contributor to higher spending.

Travel destinations play a role. Despite their small sizes, some of these markets are leading travel destinations within the United States. Washington, D.C., attracted nearly 25 million visitors in 2019. Hawaii was visited by nearly 10.5 million tourists in 2019, while Vermont welcomes more than 13 million tourists each year. The gradual return of tourists to these locations following the pandemic may be attracting higher spending from returning visitors.

There are valuable lessons to learn from the markets where spending per transaction increased. In Nevada, spending per transaction saw the fourth-largest YoY decline (down 24 percent). Like Hawaii, its share of flower sales, while still substantial, steadily declined over the past year from a peak of 57 percent in June 2021 to 45 percent in July 2022. During the same period, vape sales increased from 17 percent to 24 percent.

How can dispensaries take advantage of the trends?

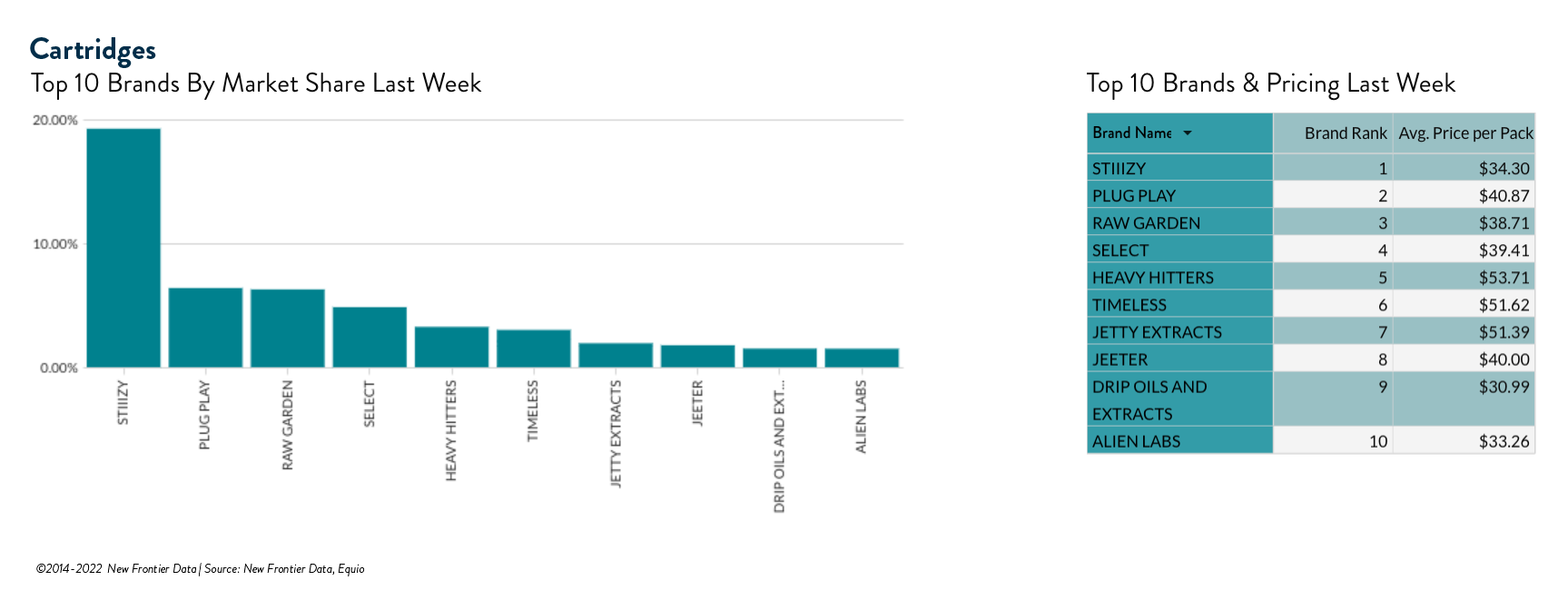

Promote popular products that command a premium. Knowing vapes are increasing in popularity is a good first step, but with more than 2,000 cartridges currently manufactured, dispensaries must go further and identify which of those are the best-selling and what price they command. Be sure to stock the popular products that command a premium and promote them to customers and potential customers via advertising to draw them in.

Capitalize on cannatourism. Nevada is a popular tourist destination with gambling, luxury resorts, golf, fine dining, and other draws in Las Vegas, Reno, and sites throughout the state. As cannatourism grows in popularity, legal markets that are also popular tourist destinations should make attracting cannatourists a priority. A report from MMGY Travel Intelligence showed nearly a third of leisure travelers are interested in cannabis-related tourism, including both cannabis-infused experiences (millennials in particular) and simply purchasing and consuming cannabis as part of their broader travel experience. Engaging cannatourists can help bring in more consumers to assist in overcoming declining spend-per-transaction trends.

Cannatourists are just one segment of the market. While attracting and engaging them should be a priority, dispensaries shouldn’t stop there. With the normalization of the plant and more legal markets coming online, the potential to bring new consumers into the market as well as move existing consumers over from the gray market is substantial. In 2021, New Frontier Data reported the illicit market accounted for $70.64 billion in sales, while the legal market (medical and recreational combined) accounted for $26.53 billion. By 2030, New Frontier Data projects that gap to be much narrower at $64.19 billion vs. $57.43 billion.

Part of closing the gap will be natural movement as legal markets emerge. But dispensaries and retailers can accelerate the transition by using the technology at their disposal for sophisticated decisioning. They also can use audience-builders to zero in on the right slice of the addressable market, defining and identifying ideal consumers who may be primed to transition from the gray market pending the right product or offer. By using lookalike audiences for gray-market customers that closely resemble their most loyal current customers, dispensaries can bring those new shoppers into the legal-market fold. Closing the loop with advertising attribution solutions that tie online engagement to dispensary visits and in-store purchases will detail the effectiveness of that outreach, including how many new customers were acquired, what offer inspired their visit, and what they purchased. Use this data to expand outreach to other potential audiences and refine the messaging and offers to make them more effective.

Consumers’ shopping carts and wallets are shrinking. A variety of economic factors are contributing to the challenge, including inflation, a looming recession, the end of the “COVID bump,” and more states transitioning from medical to recreational markets. But there are opportunities to combat the trend, both short-term and long-term. In the short term, taking lessons from markets like Washington, D.C., can be effective. In the long term, the greatest opportunity for combatting declining spending per transaction is to increase the number of transactions, which will happen by bringing new consumers into the legal market.

When wallets shrink, attract more wallets.

Marketing technology expert Gary Allen serves as chief executive officer at New Frontier Data. Over the course of his career, he has led the development of technologies that were later acquired by Google, DoubleClick, Kantar Media, and other market leaders. Prior to joining New Frontier, Allen founded ModernMinds, a strategy consulting firm focused on startups in the technology space.

[…] in highly competitive markets. Prohibitive rents could cripple operations, underscoring the precarious balance between opportunity and limitation. Nevertheless, these market transformations spotlight the profound impact of the industry on […]

[…] encouraging news, one of the most prevalent trends in nearly every state over the past few years is price compression. This is particularly pronounced on the West Coast, where a variety of factors—supply glut, […]

[…] anticipated. And last year, legal sales in the key states of California, Washington, and Colorado declined for the first time ever. While there is no denying the industry’s progress overall, there always seem to be headwinds […]

[…] should be asking ourselves whether can we operate sustainable, profitable companies during challenging market dynamics. Are we able to switch our mindset from growth at all costs to survival at any […]

[…] pack, having operated in the recreational market for about five years. As operators begin to see pricing compression and flattening of the supply-and-demand curve, they may realize their systems and procedures are no longer “good enough” and they no longer […]

[…] Arizona, customers are price-conscious,” said Briseno. “They’re looking for promotions because we’re a deal-driven […]