Now is the time for cannabis brands to prioritize and engage millennials with long-term, luxury aspirations in mind. The consumer group born between 1981 and 1997 is poised to be the next great luxury cannabis consumers. Millennials grew up in the age of cannabis normalization, which has shaped their acceptance and use of the plant. According to New Frontier Data’s recent report “Millennials as Cannabis Consumers: Attitudes & Behaviors of America’s Largest Generation,” 38 percent consume cannabis—nearly 10 percent higher than the next-closest demographic (Gen X)—with 46 percent of those set to increase their consumption in the past year.

Beyond their consumption rates, several attributes make millennials a prime target for luxury cannabis offerings. The generation has a high employment rate, consistent earning potential, and many non-traditional jobs—social media influencer, for example—that could be considered cannabis-friendly. They’re the first consumer group luxury brands have a chance to establish lifetime relationships with as they build disposable income.

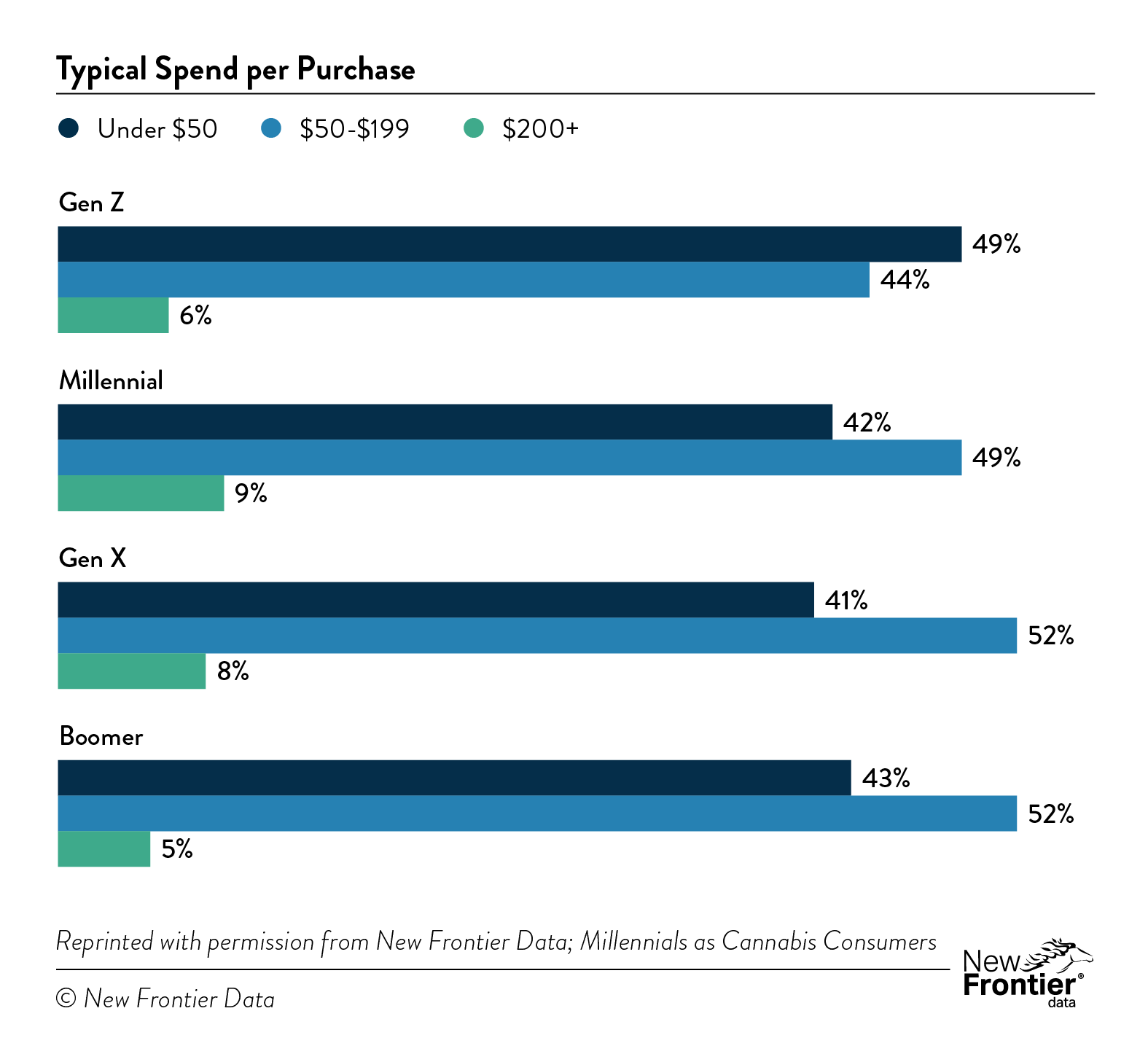

Returning to the report, millennials’ purchase preferences, spending, and frequency are also revealing. Compared to other generations, they are the most likely to obtain their stash from a brick-and-mortar store (35 percent) and the least likely to obtain it from a family member (26 percent), a decision possibly driven by desires for niche products and informative labeling. Millennial consumers are the most likely generation to spend $200 or more per purchase.

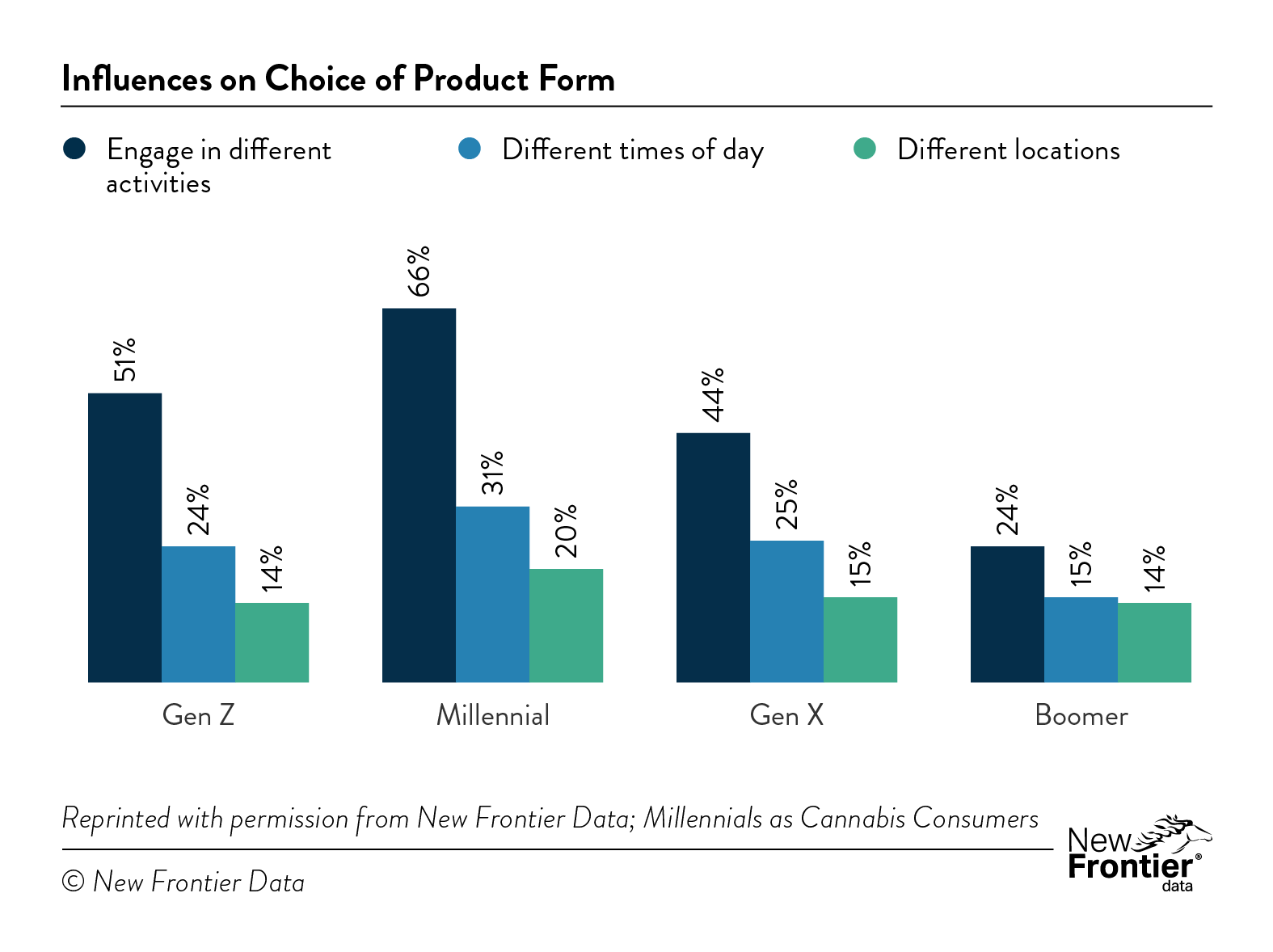

They’re also more diverse in their product selection and the ways they match products to their lifestyle, using various forms of cannabis depending on the activity they engage in (66 percent), the time of day (31 percent), and where they are (15 percent).

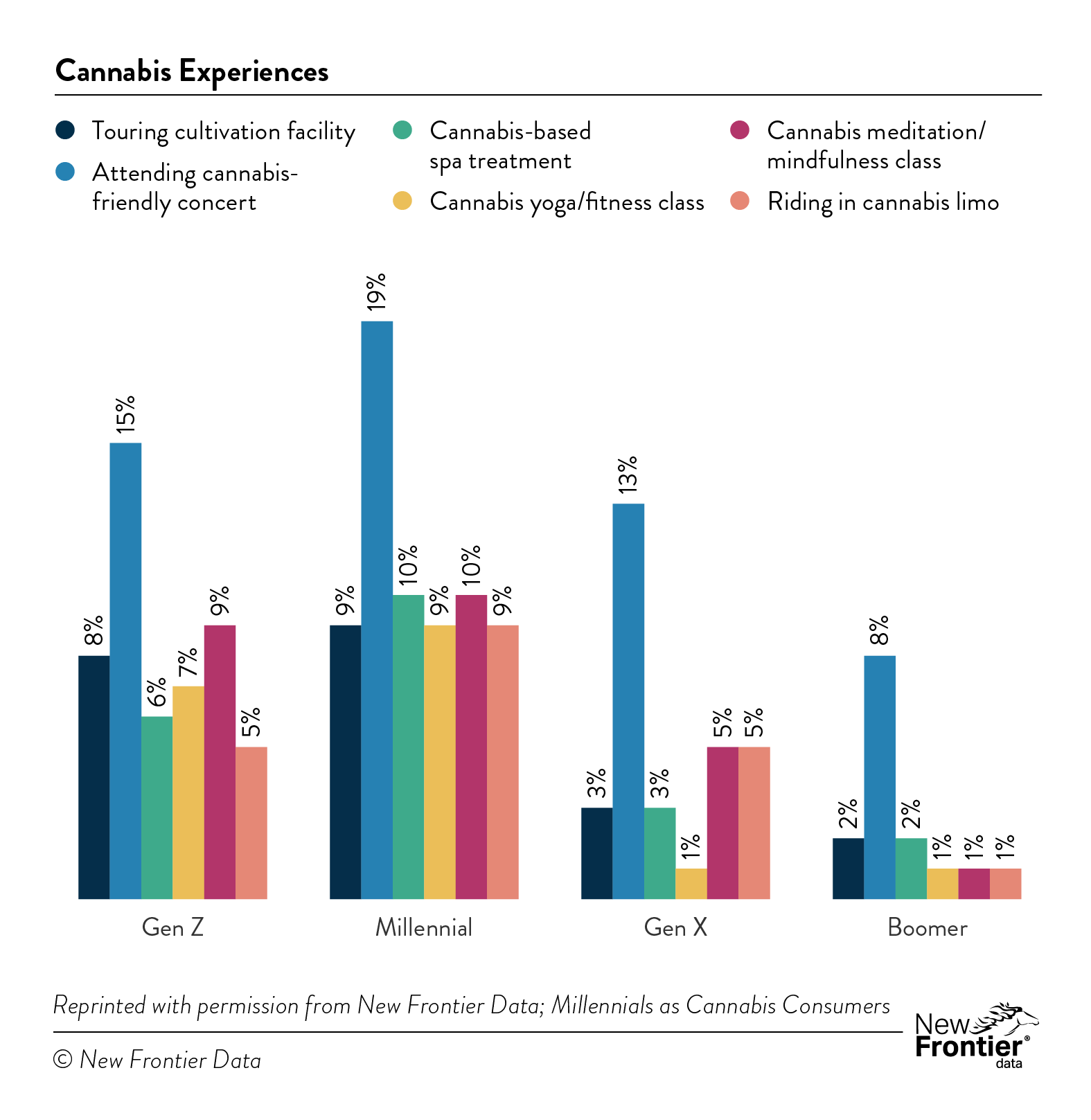

Even though normalization is still being defined, millennials were more likely to report participating in curated cannabis experiences. Their choices could be connected to desires to consume away from home and to seek out experiences where cannabis is welcome and consumed freely as a way to enhance the experience.

These factors combine to make millennials the most promising market for luxury cannabis products.

While millennials are primed for luxury cannabis, most won’t consistently adopt the products without encouragement. Luxury brands must engage the cohort with compelling products and messaging to capitalize on this opportunity.

First, build products around lifetime relationships with millennials who are loyal to products with which they identify. Tailor products to the specific experiences that match the effects they desire for their typical activities. Ensure those products offer something unique that differentiates them from other brands or products.

Second, take special care when devising targeting and messaging strategies for consumer outreach. Millennials get bombarded with lots of info, and brands must cut through the noise. As Fleur Marché cofounder and Chief Executive Officer Ashley Lewis pointed out at the Luxury Meets Cannabis Conference (LMCC), “There needs to be a fundamental shift in strategic thinking about communications. [Brands] need to start talking to customers as if [they’re] a beauty brand or lifestyle brand, not a cannabis-first brand. The first point of entry needs to be talking about the benefits… What will this do for you?”

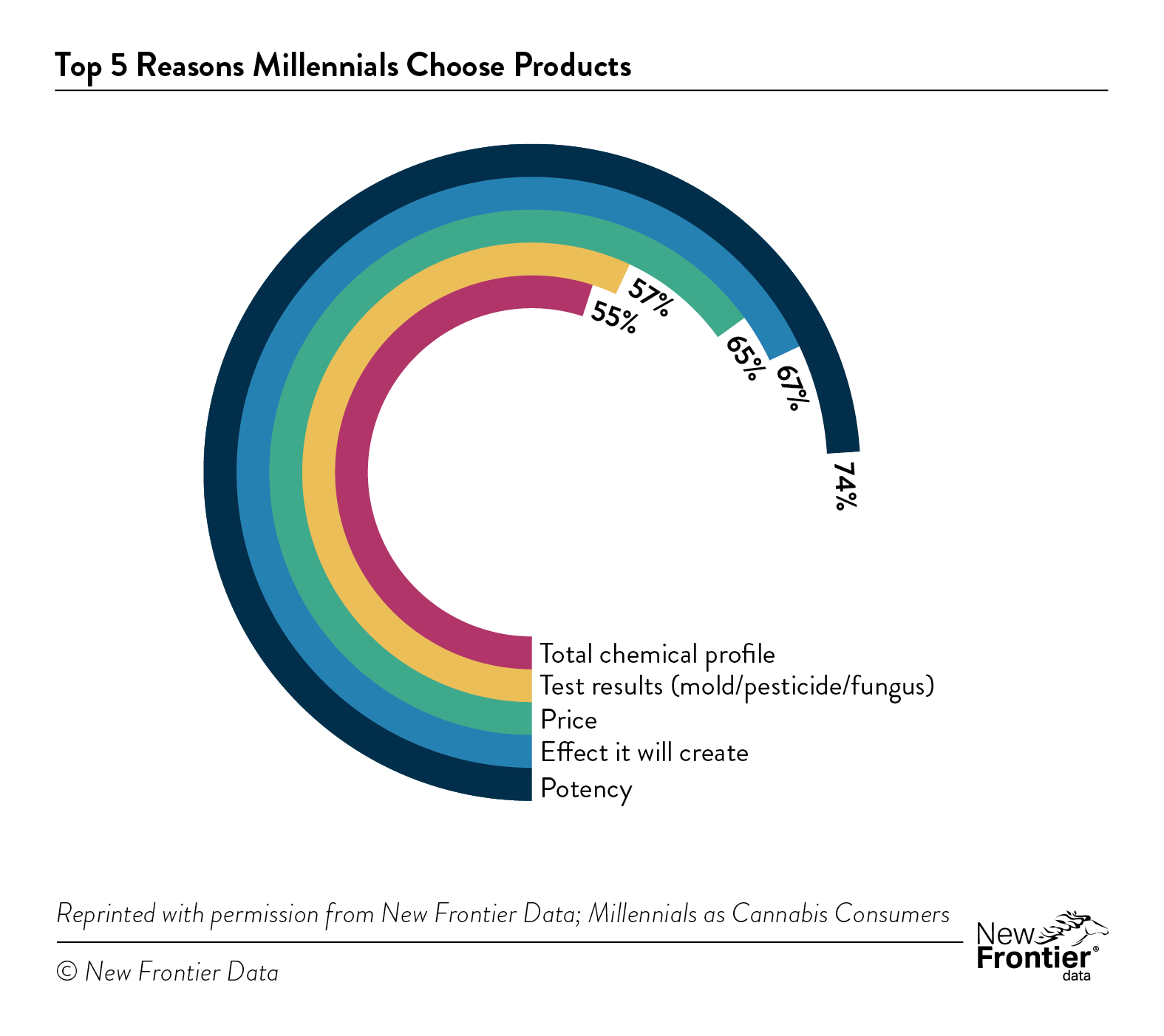

This closely aligns with New Frontier Data’s research, which shows 67 percent of millennials choose products based on the effect brands claim the products will create.

As the first generation to come of age with the internet, millennials are savvy enough to leverage online research to determine whether brands align with their personal values—so make sure your messages and products resonate on a personal level. It’s also critical to ensure consumers understand what makes the product “luxury” and why they should be willing to pay a premium.

As Elle and Town & Country contributor Emily Dougherty, who has covered the luxury health and beauty space for twenty-five years, said at LMCC, “Right now, you have a very prime consumer who isn’t necessarily as obsessed with price point. She’ll spend $500 on a Dyson blow dryer; she’ll spend $200 on an Augustinus Bader serum and maybe save elsewhere, but she is okay spending more on things she knows work. She wants you to meet her where she is.”

Understanding who the consumer is, making a product that meets their needs, and then engaging them with messages that both inform and entice are critical tactics for success at any price point, but even more so for luxury products where consumers must be willing to pay a premium.

Millennials represent the intersection of the first generation to come of age with some form of legal cannabis in the United States and may be the last generation to interact with commerce in a traditional way, enabling them to embrace cannabis in closer accord to traditional commerce than as an underground vice. Their characteristic position as full-time employees (half among them at a managerial level or above) provides them with disposable income, allowing them to be less cost-conscious and opt for products that more uniquely align with their experiences. Millennials’ cannabis use is purposeful and efficient, intended to enhance daily activities like health, wellness, and beauty as well as less-common experiences such as attending concerts or spa treatments.

Millennials are poised to be the next luxury cannabis consumers, and brands would be well-served to engage them as such right now to create long-term loyalty.

Marketing technology expert Gary Allen serves as chief executive officer at New Frontier Data. Over the course of his career, he has led the development of technologies that were later acquired by Google, DoubleClick, Kantar Media, and other market leaders. Prior to joining New Frontier, Allen founded ModernMinds, a strategy consulting firm focused on startups in the technology space.

[…] operators to redefine floor plans and take better advantage of traffic flow or redirect the flow to higher-value merchandise. Semi-permanent installations allow operators to add seasonal or special-event […]

[…] stigma off cannabis,” he said. “To accomplish that successfully, I wanted to approach it like a luxury brand—that really clean look, like walking into a modern […]

[…] to divide up its flower offerings into three tiers—exclusive, essential, and everyday—to test different price points and consumer preferences in the medical market. After reviewing the data, the company determined […]

[…] The initial conversations resulted in a striking design featuring floating metal and glass display cases; a creamy-rose-and-emerald palette applied in geometrical splashes to calm the boldness of brass and wood; and Art Deco-inspired fonts that punctuate the space and marry its battling energies. Although the dispensary was created with Alameda locals in mind, the interior design is captivating enough to draw in a wider crowd, including Berkeley and Oakland residents who hop on the ferry and visit Park Social for its reasonable prices, relaxed ambiance, and a customer journey designed for both convenience and an aura of exclusivity. […]

[…] One aspect of the generation that makes it economically significant: The entirety of Gen Z has grown up during a time when cannabis was legal in at least some places. Cannabis is not among the taboos recognized by anyone in the cohort. They’re not afraid of the plant, and they’re not afraid to spend money on products and services related to it. Neither, by the way, are millennials, the next most impactful group for this industry. Their buying power is $2.5 trillion today, much of which they spend online, where they’re particularly fond of luxury goods. […]

[…] more general lesson about deals also surfaces: Your deals should hit the people who are most likely to make a purchase and convince them to buy more than they normally would. Anything that drives up the order value to […]

[…] Blondie packaging, with its mouth-watering cascade of gooey caramel goodness. Highlighting the product’s ingredients in a luxurious way is a classic, reliable technique to emphasize quality and get people standing in line at the […]

[…] values sustainability may opt for packaging made from recycled or biodegradable materials, while a luxury brand may choose more expensive earth-friendly materials such as glass or tin to convey a sense of […]

[…] worth of your content is. To properly advocate for fair compensation, Black content creators must understand who their audience is, what their skill set is, and how it differs from their […]

[…] personally love premium brands, because they are heavy and experienced cannabis users,” said Gomez. “Less than 25 percent of […]