DENVER and SAN DIEGO – Salaries are on the rise by an average of five to ten percent and 2023 will see the addition of more than 100,000 new jobs, according to a pair of reports from two industry staffing firms that collect information about hiring trends.

CannabizTeam and Vangst both released annual salary guides this week. The competing projections paint a similar picture of significant growth across newer Midwest and East Coast markets, which is expected to offset the stagnation or downturn seen in some mature West Coast markets.

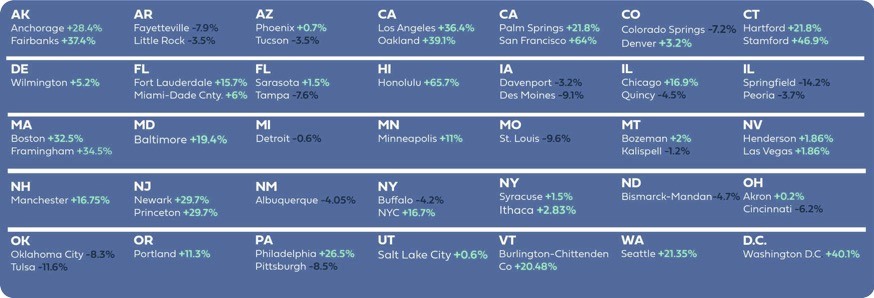

CannabizTeam’s fifth annual salary guide utilizes proprietary salary data, salary surveys, and “independent research from trusted sources through the end of Q4 2022” to provide detailed and location-based salary benchmarking in 35 states. Based on this data, cost of living averages positively influenced the potential for industry salary increases in Honolulu and San Francisco, with the lowest influence of salary increases in Springfield, Illinois, and Tulsa, Oklahoma.

Over the past year, industry salaries increased by an average of five percent with compensation for senior executives increasing by as much as ten percent.

In terms of projected salary growth, the roles of financial analyst, corporate controller, vice president of technology, director of finance, and vice president of cultivation top the list with a median increase of 8–10 percent in 2023. On the other hand, the roles of budtender, brand ambassador, territory sales manager, accounts payable clerk, warehouse technician, and director of merchandising are expected to see minimal growth of 1–2 percent.

The CannabizTeam report notes the “continued challenges in some mature West Coast markets in 2023, resulting from pricing, oversupply, and insufficient access to capital.” This insight is supported by multistate operator Curaleaf’s recent departure from California, Colorado, and Oregon. However, with five emerging high-population adult-use markets in Connecticut, New Jersey, New York, Maryland, and Montana, and expected growth in a handful of medical-only states including Florida, Oklahoma, Ohio, and Pennsylvania, CannabizTeam predicts the industry will add 108,000 new jobs, bringing the total to 600,000 nationwide by 2024.

Vangst’s fifth annual salary guide utilizes more than 2,500 survey responses and thousands of data points to develop an in-depth look at industry salaries, employee satisfaction, benefits, and workforce trends. The Vangst report also cites third-party data from industry trade associations and publications. According to Vangst, 62 percent of employees are more satisfied with their position in cannabis than their previous industry, despite the fact only 43.4 percent earn more money.

Employee benefits appear to be on the decline. All the companies surveyed by Vangst for last year’s 2021 report offered healthcare benefits to their employees, but only 82 percent of companies surveyed this year reported offering employee benefits—putting cannabis slightly above the national average. According to the Bureau of Labor Statistics, 78 percent of U.S. workers have access to health benefits. Of the 82 percent of cannabis companies that reported benefits, here’s the breakdown of what’s being offered:

- Medical: 95%

- Paid time off: 89.2%

- Dental: 84.2%

- Vision: 76.7%

- Cannabis-friendly work culture: 71.78%

- 401K: 47.5%

- Long/short-term disability: 41.7%

- Equity stock options: 30%

According to Vangst data, brand managers and edibles specialists saw the best salary growth last year (up 56.9 percent and 42.1 percent respectively). On the other hand, directors of cultivation and vice presidents of operations took the biggest hits, seeing their salaries drop by 122.7 percent and 52.8 percent, respectively.

The Vangst report also compares similar roles in cannabis with other industries. The data shows strong relative industry wages for human-resources generalists and customer support agents who earn more when working in cannabis—29.8 percent and 28.3 percent more, respectively.

While frontline retail wages remain stagnant, budtenders earn 45.1 percent more than bartenders. On the other hand, vice presidents of manufacturing, vice presidents of marketing, and controllers all earn significantly less than their non-cannabis-industry counterparts by 103.4 percent, 100.5 percent, and 100.1 percent, respectively.

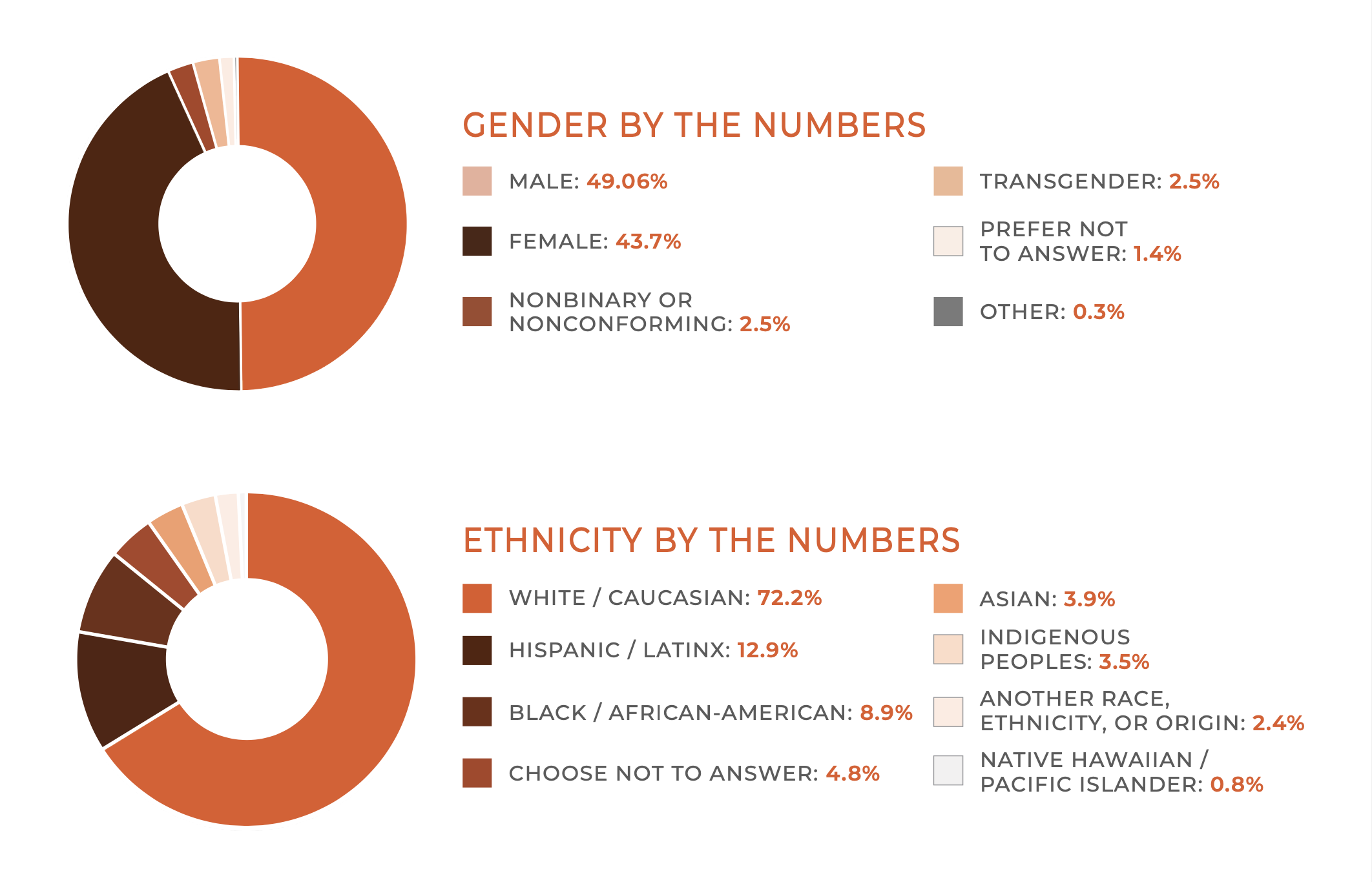

In addition to salary data, the Vangst report also covers diversity.

More than 75 percent of respondents characterized their company as either somewhat or strongly diverse, with 55.5 percent identifying as a protected veteran or active-duty military member. The study revealed LBGTQIA+ representation at 20.4 percent with 41.8 percent of respondents identifying as community allies. Nearly half the companies surveyed employ individuals with a cannabis-related criminal record, while 45.6 percent participate in social equity programs by “promoting employment opportunities for individuals disproportionately impacted by the war on drugs.”

Despite the largely positive outlook, the Vangst report acknowledges the role played by Venture Capital funding, “which has virtually bankrolled the industry for the past five years. This influx of investment, coupled with cannabis’ ‘essential goods’ classification in 2020, caused a false sense of security which we, unfortunately, saw come to an end in 2022.” The report predicts investors will continue to pull back funding, “resulting in difficult decisions.”

Some of those difficult decisions already have led to staffing reductions. More may be on the way, although some sectors and regions may be more heavily impacted than others.

In November, Weedmaps parent company WM Technology Inc. announced plans to cut 175 employees, or 25 percent of its staff, as part of “cost-reduction initiatives intended to reduce operating expenses and sharpen the company’s focus on key growth priorities,” according to an SEC filing. In December, Trulieve. Inc let dozens of Pennsylvania employees go, and Columbia Care Inc. announced layoffs for numerous employees at its Saxton facility. In January, Akera Corp. began shedding business units and eventually announced plans to exit the market altogether. Curaleaf Holdings Inc., the largest American cannabis company by market capitalization, announced plans to begin closing cultivation and production operations in California, Colorado, and Oregon.