Cannabis dispensaries make a significant marketing investment in engaging and optimizing current customers. Afterall, repeat customers are the lifeblood of a dispensary … right? Well, yes and no. Yes, in the sense that repeat customers provide higher lifetime value to the dispensary as they rack up purchases. No, in the sense that their reason for returning might not be brand loyalty but the discounts the dispensary offers, diminishing that lifetime value.

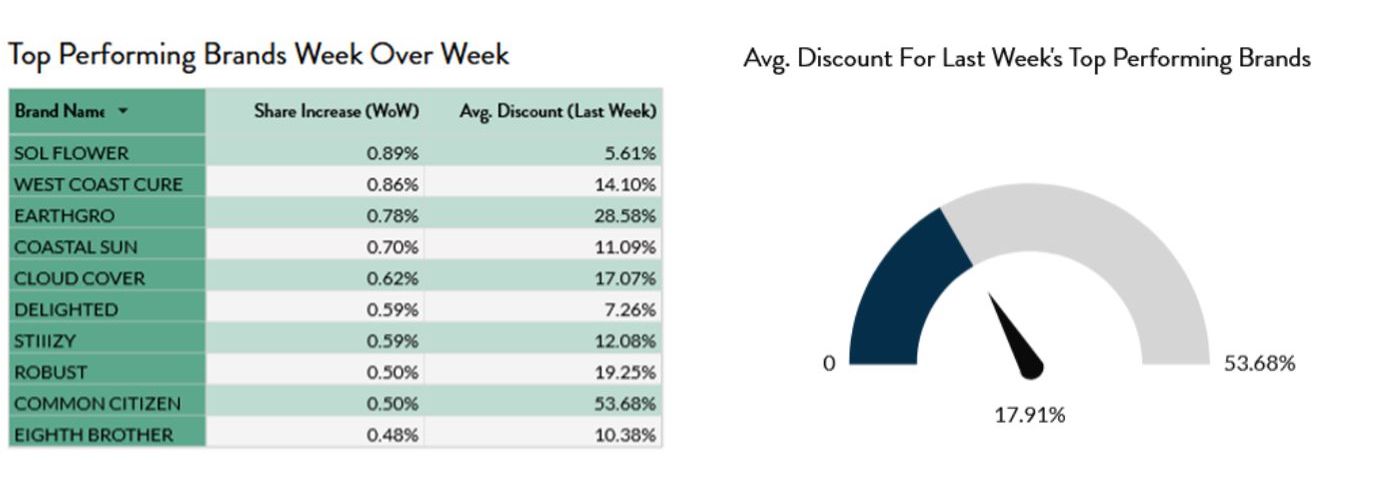

Looking at the top-performing flower brands week over week in New Frontier Data’s Equio Retail Suite, the average discount offered for each bestseller leaps off the page.

Common Citizen, for example, was discounted more than half of its typical retail cost. While that level of discount is certainly an outlier, the average discount for the week’s top performing brands was about 18 percent. For dispensaries, giving up nearly 20 percent of their revenue to keep customers engaged is a double-edged sword:

- In a market like California, for example, where the largest consumer archetype is “sale and savvy”—also known as cost-conscious—there’s a higher risk loyalty can be swayed by discounts from other dispensaries. To keep them coming back, dispensaries discount aggressively.

- As cash-based businesses, dispensaries put themselves in serious financial risk by deeply discounting prices and reducing their access to the cash required to stock inventory.

“Discounted pricing as the primary sales driver results in a compounding revenue decline,” said Gary Allen, chief executive officer at New Frontier Data. “The less cash coming in the door, the less stock a dispensary can purchase from distributors. Discounting that product to attract customers continues the cycle, lessening available funds each time. Eventually, dispensaries won’t have the product on hand to discount.”

To end that vicious cycle, dispensaries must engage the top of the marketing funnel and bring in new customers while retaining their current ones, and they must stop doing so by focusing on discounts.

Engaging consumers at the top of the marketing funnel starts with understanding the consumers in a given area. By using New Frontier Data’s NXTeck, dispensaries can determine the number of cannabis consumers in their footprint and filter them by attributes such as product preferences and consumer archetype.

A dispensary in Detroit, for example, seeking to connect with THC consumers who purchase flower, has access to 193,000 marketable consumers. If that dispensary attracts roughly 500 unique customers per month, they’re only attracting a small percentage of the total addressable market. Even if a competing dispensary down the road attracts twice that, it still barely makes a dent.

“A recent study showed 91 percent of dispensaries have less than 1-percent market share in their local market,” said Allen. “There is an enormous retail opportunity for dispensaries that can act strategically to engage the total addressable market. Even capturing five percent of their local market would be a windfall for the dispensary.”

Of course, the messages used to engage potential consumers play a crucial role in converting them from potential to actual. Marketing is not a one-size-fits-all tactic; the dispensaries must reach their targets where they are, when they’re receptive, and with messages that speak to them.

First, the dispensary must determine its target audiences from the greater pool.

“The cannabis industry needs to take lessons from more mature industries that deployed effective targeting strategies and messaging personas long ago,” said Allen. “If you want to attract a different type of consumer, you must use a different type of bait. High-spending, high-lifetime-value customer relationships start with establishing the luxury value of any good. That applies to cannabis just like it does any other luxury product. If retailers only target cost-conscious consumers with sales and discounts, they’re never going to stop the financial bleeding.”

With New Frontier Data’s NXTeck, dispensaries can not only identify their target consumers but also get competitive intelligence on other dispensaries’ customers, learn more about each consumer archetype (including the best methods for communicating with them), and track which campaigns are most successful.

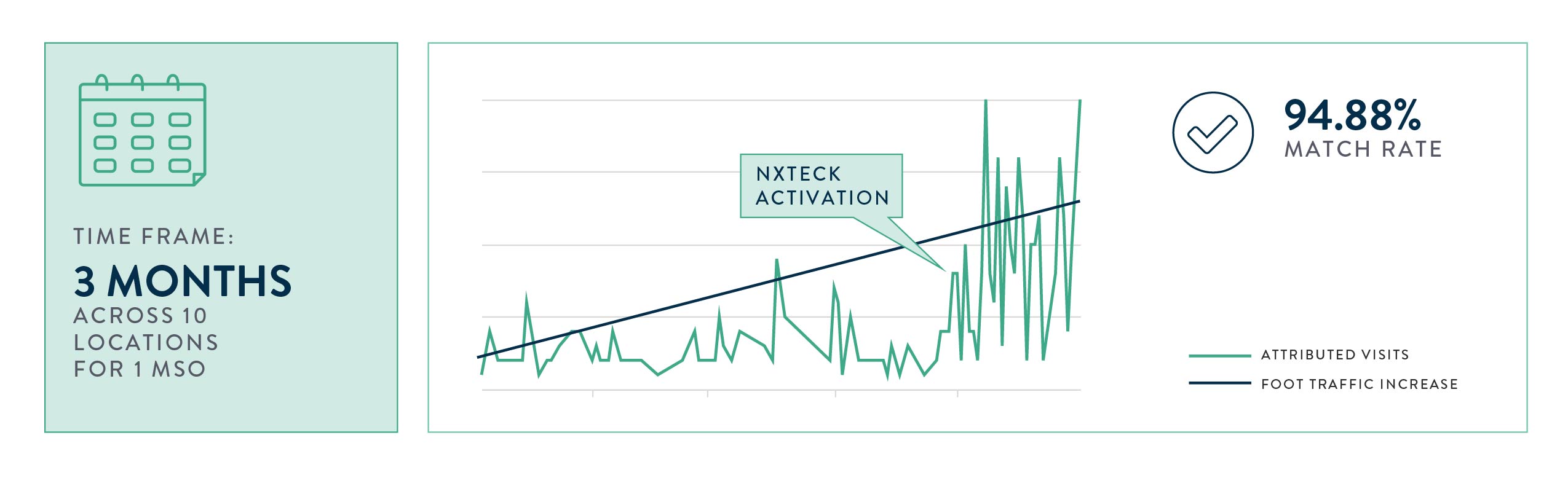

New Frontier Data worked with a multistate operator facing a plateau in dispensary customer visits and sales to help them attract new customers by leveraging this information. The company’s stores had experienced a decrease in revenue growth despite communicating effectively with current customers and spending a considerable amount on marketing. Management wanted to take action and explore new ways to increase sales and bring in new customers.

The stores successfully leveraged location services with NXTeck to reach potential customers in their vicinity. After implementing NXTeck’s consumer insights and attribution reporting, they matched 94.88 percent of digital impressions to attributed store visitors, providing a true understanding of their customers and how to engage with them, and delivering a 3x increase in in-store visits from marketing efforts. Ultimately, by utilizing NXTeck, the dispensary increased new customers, boosting sales and revenue.