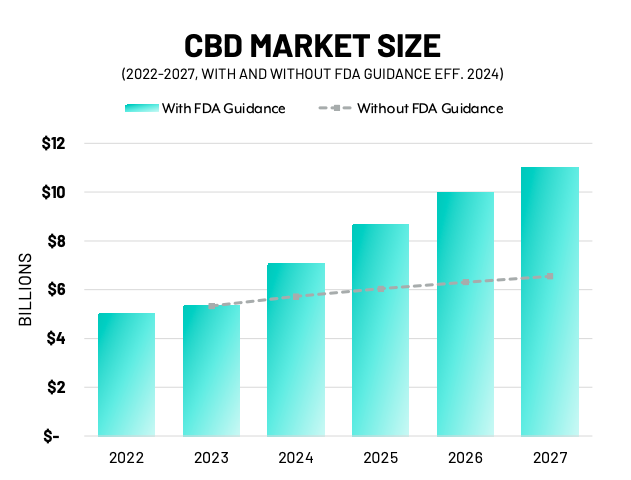

Researchers at the Brightfield Group, a prominent cannabis-focused data and consumer insight firm, have released the 2022 mid-year CBD report. As part of a new forecasting approach, the report is reflective of two potential scenarios: one in which the Food and Drug Administration (FDA) regulates the CBD market in the next few years and one in which the federal agency continues to delay action. If the FDA regulates CBD by 2024, the industry could see as much as $4.5 billion in additional retail sales by 2027.

One key takeaway from both scenarios is a view of the CBD sector growing expeditiously, even if the potential for major growth is largely dependent on the FDA’s actions.

“We normally have a five-year forecast, and we do that with the assumption that the FDA will indeed bring regulation,” said Meg Bluth, senior director of insights at Brightfield Group. “We decided for the first time to create two different scenarios with our forecast. One assumes that there will be regulation that comes about in 2024, and the other assumes it will continue to be delayed.”

According to Bluth, Brightfield expects 2022 will end with approximately $5 billion in retail sales. Assuming FDA regulation is implemented by 2024, Brightfield estimates the category will bring in $11 billion by 2027. However, without FDA regulation, the same projections come down to $6.5 billion.

The significant growth projected under FDA regulation is tied to higher comfort levels among consumers who would see a wide variety of health and wellness CBD products available for sale in grocery and other traditional retail settings across the country.

It seems clear to a number of industry professionals that the FDA wants to regulate the sector for safety and clarity, and many companies are preparing for some form of national regulation. “There are companies we work with right now that are regulating themselves much stronger than is required. They’re preparing to live in a world where they can continue to dominate,” said Bluth.

The report also dives into the product segments currently leading the CBD market. For example, tinctures remain the most prominent product in the sector with the most usage, accounting for 19 percent of annual CBD sales. Gummy sales came in second at 14 percent, and topical sales came in third at 13.6 percent. However, Brightfield portends exponential growth of the edibles category moving forward.

“Gummies, capsules, drinks; we expect those to increase, especially with FDA regulation,” said Bluth. “That is where you will see the largest growth coming in. We know gummies within cannabis have been seeing really strong growth.” Brightfield also tracks the supplements sector and sees gummies as a preferred method of ingestion for wellness products with CBD as a key ingredient.

The right approach is still “hurry up and wait”

According to Bluth, one of the initiatives of the study was to assist businesses with effective strategies to undertake today while they wait for FDA regulations to come to fruition. “What we’ve seen with a lot of CBD companies is they’re creating adjacent ventures for themselves.” Ever since the 2018 Farm Bill, hemp-based cannabinoids have become a viable market across the country in markets where traditional cannabis products are restricted.

“In regard to delta-8, some companies are really leaning into that and some are dabbling. Then there’s another group that’s really digging into functional categories like adaptogens,” said Bluth.

The main impetus for side hustles, or even complete pivots in the cannabis industry, is the potential to establish brand recognition. While businesses wait for the FDA to allow for true national expansion, they want to make sure customers see their brand on the shelf. However, determining the correct level of investment remains a challenge because delta-8 is perceived as a less desirable substitute for traditional delta-9-THC.

“We’ve been talking about that internally,” said Bluth. “If you look at where delta-8 has its popularity, it is in non-legal adult-use states. This leads you to believe when those states become legal for adult use, delta-8 will no longer be absolutely necessary.”

Bluth added Brightfield believes delta-8 is going to play out as a short-term investment strategy because of the complexities and related expenses associated with the production of delta-8 products.

Of course, something that can’t be ignored is what will happen if the FDA delays its regulations further. Bluth believes companies should be aware of this potential outcome to mitigate risk and manage expectations. “I do believe they [the FDA] will regulate, it’s a matter of when. The earliest we think it will be at this point is 2024, but there are all sorts of plans within that. It’s hard to say, but I do think it will come,” said Bluth.

Be the ant, not the grasshopper

There are a number of steps businesses can take now to prepare for FDA regulations if and when it comes.

“Get GMP/NSF certified, run consumer trials with current customers, and ensure language and claims are accurate,” said Derek Chase, president of Flora + Bast, a brand “founded on the belief that wellness is a lifestyle decision.”

In Chase’s eyes, delta-8 products have a questionable foothold at best with limited long-term viability in the marketplace. “I don’t think so, or at least not in its current form, which is basically a loophole to get around federal laws surrounding delta-9,” he said. “I think that if D8 shows promise for a certain need, like sleep, then yes it’s viable. But I don’t think it will survive as a D9 replacement, especially since one can formulate with up to 13mg of THC in a 5g gummy and still be within legal hemp limits.”

Chase also added some wisdom on how he believes CBD-focused companies should view themselves and their products.

“I believe CBD companies should stop thinking of themselves as CBD companies, and instead focus on the end-end benefit to the consumer that their product provides. CBD is a feature, not a benefit, and consumers do not know the benefits of CBD for the most part. Focusing on the benefit will allow CBD brands to more clearly communicate their value equation to the consumer.”

Whether federal regulation and national expansion for CBD-related products come sooner or later, brands that are able to take the time to earn customer loyalty now and position themselves for long-term success over short-term gains appear to have the winning strategy in place.

According to Brightfield’s most recent Q2 company analysis by revenue, the market share of the top 20 CBD companies which includes Charlotte’s Web, Your CBD Store (SUNMED), Medterra, and CBD American Shaman has remained largely unchanged since 2021 with little consolidation occurring during the second quarter of 2022. However, no company has a market share of more than 2.5 percent, showing strong potential for new entrants to earn substantial customer loyalty today and a larger market share in the future.

[…] those who hope to end misinformation should advocate for a clearer regulatory environment for hemp and CBD products. By creating a process by which hemp and CBD products can apply for FDA approval, they will be […]