Cannabis regulations constantly evolve, especially as more states launch legal adult-use markets. As a result, businesses continue to face mounting challenges and confusion when it comes to accessing financial services with the required compliance financial institutions need.

Green Check’s mission is to simplify processes and help both operators and financial institutions remain up to date and in step with current and future rules in their states.

Bridging demand and supply

At the time Green Check was founded, the cannabis industry faced a significant challenge that hasn’t changed dramatically over the years: high demand for financial services coupled with fewer than 10 percent of all banks and credit unions willing to serve the industry. Initially, banks and other institutions were wary of entering the space. While many more banks engage with cannabis businesses now, the financial sector remains reluctant to offer the same suite of services traditional businesses enjoy.

Green Check tackles the reticence head-on. To date, the company works with nearly 13,000 cannabis-related businesses, more than 170 FDIC-insured financial institutions, and a variety of vetted partners offering a wide range of cannabis-friendly business services, all connected on the Green Check platform.

“Our approach is laser-focused on data, because that’s the core of every business decision,” said founder and Chief Executive Officer Kevin Hart. “Whether it’s a cannabis company looking for a loan or payroll services, or a bank ensuring compliance, Green Check simplifies the process.”

Hart compares Green Check’s integrated processes to Zelle, which allows users to send or receive money with just a few, hassle-free clicks.

“When you send money in a payment app, that dollar gets touched by about seven different organizations, but you only care about sending money to me,” Hart said. “Click, click. In your mind, it’s done. But in reality, it goes to five other places before it goes out of your account and shows up in mine. That’s what we do for cannabis operators. We’ve created an app-like experience for the highly-complicated puzzle of regulatory oversight, connecting business operations seamlessly.”

Portfolio management

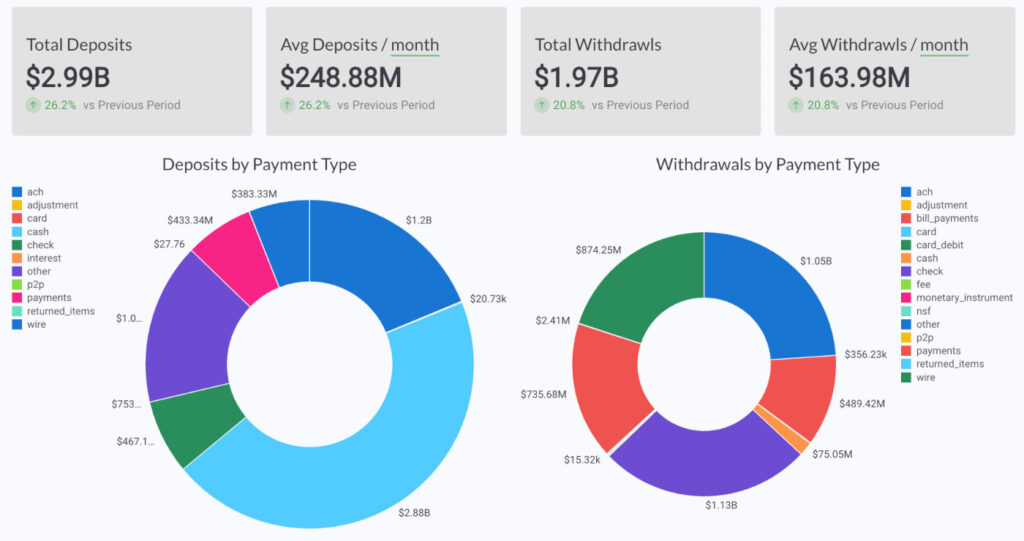

Green Check’s platform goes far beyond connecting businesses to financial services by providing banks, credit unions, and business service providers with the tools they need to provide better products and services to the cannabis industry in a scalable way. The company offers an innovative portfolio-management feature, offering financial institutions a bird’s-eye view of their cannabis business accounts so they can verify details like product type, sales, and local regulations, allowing banks to manage hundreds of cannabis accounts with ease.

The system transforms what was once a daunting task into a streamlined process. Financial institutions now can rank businesses for risk, conduct peer analysis, and even predict industry trends on a state-by-state basis based on independent market forecast data.

“Whether you’re working with retailers, wholesalers, or cultivators, you’ll know exactly how each business is performing, where to focus your efforts, and how to support growth,” Hart said.

Continued expansion with new regulations

With potential cannabis rescheduling and renewed consideration of the SAFE Banking Act on the horizon, Green Check is preparing for an era of interstate and international cannabis commerce.

“With more regions online, there will be more rules and regulations and more products entering the market,” Hart said. “In response, financial institutions will need to either service cannabis businesses or justify why they won’t. Our platform makes it easy for them to do either.”

As regulations evolve, Green Check’s compliance engine will stay ahead of the curve, automatically updating its platform with the latest rules. “We’ve built a system that doesn’t just solve today’s problems,” Hart said. “It’s ready for tomorrow’s.”