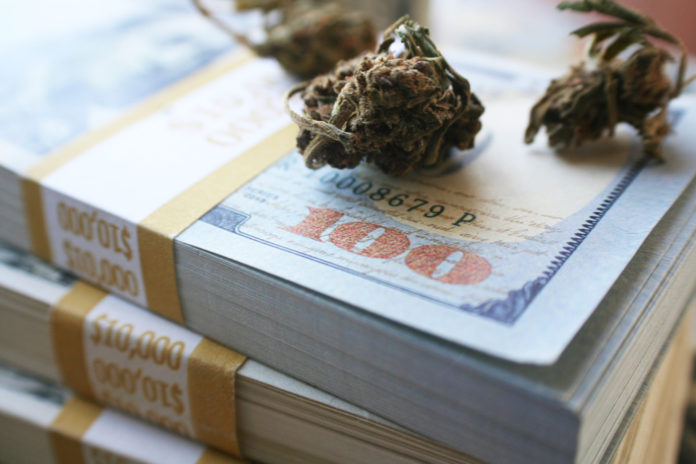

COLUMBUS, Ohio – Medicinal cannabis in Ohio could be bring in big dollars for tax collectors, even before sales start in September.

According to an analysis by the Cincinnati Enquirer, Ohio officials should expect to rake in $11 million in application and license fees. Of that total, $5.2 million will come from the more than 650 businesses that applied for cannabis licenses.

Approved growers, processors, and retailers also will have to pay millions in additional fees. Approximately $2.6 million will come from growers operating with provisional licenses. Growers will have to pay the fees after state inspectors finish reviewing their sites. Paying the fee is a requirement for any grower seeking a permanent license. Growers collectively will pay an additional $2.6 million in renewal fees.

Stephanie Gostomski, a spokesperson for the Ohio Department of Commerce, claims the fees will be used to cover costs incurred by the state in administering the medicinal cannabis program. However, exact details as to how the money will be applied are unavailable.

“The fees are necessary to ensure that the medical marijuana program is run in a manner that makes it safe for Ohio patients,” Gostomski said according to the Cincinnati Enquirer.

Large-scale growers, with operations over 3,000 square feet, are required to pay $20,000 for the application fee, $180,000 for the initial license, and an annual renewal of $200,000 for their permanent license.

Smaller, or Level 2 growers, will be required to pay $2,000 for their application fee along with $18,000 for their initial license and $20,000 per year to renew their permanent license.

High fees often make it difficult for many trying to enter the legal cannabis industry. Besides the obvious obstacles created by high application and license renewal fees, growers often have to focus on bulk production as opposed to quality focused production in order to cover the costs of operating.

Ohio is considered to have some of the highest fees for cannabis licenses and applications in the United States.

Once the medicinal cannabis program becomes operational in Ohio, many analysts are expecting officials to collect a significant amount in tax fees. While some projections predict $200m in medicinal cannabis taxes, the number could end up being lower. California, for instance, is taking in far less than what economists originally predicted.

Officials have now released the locations of 56 approved dispensaries. It is unclear if all of the shops will be operating in September. In total, the state received 376 applications for cannabis dispensary licenses.