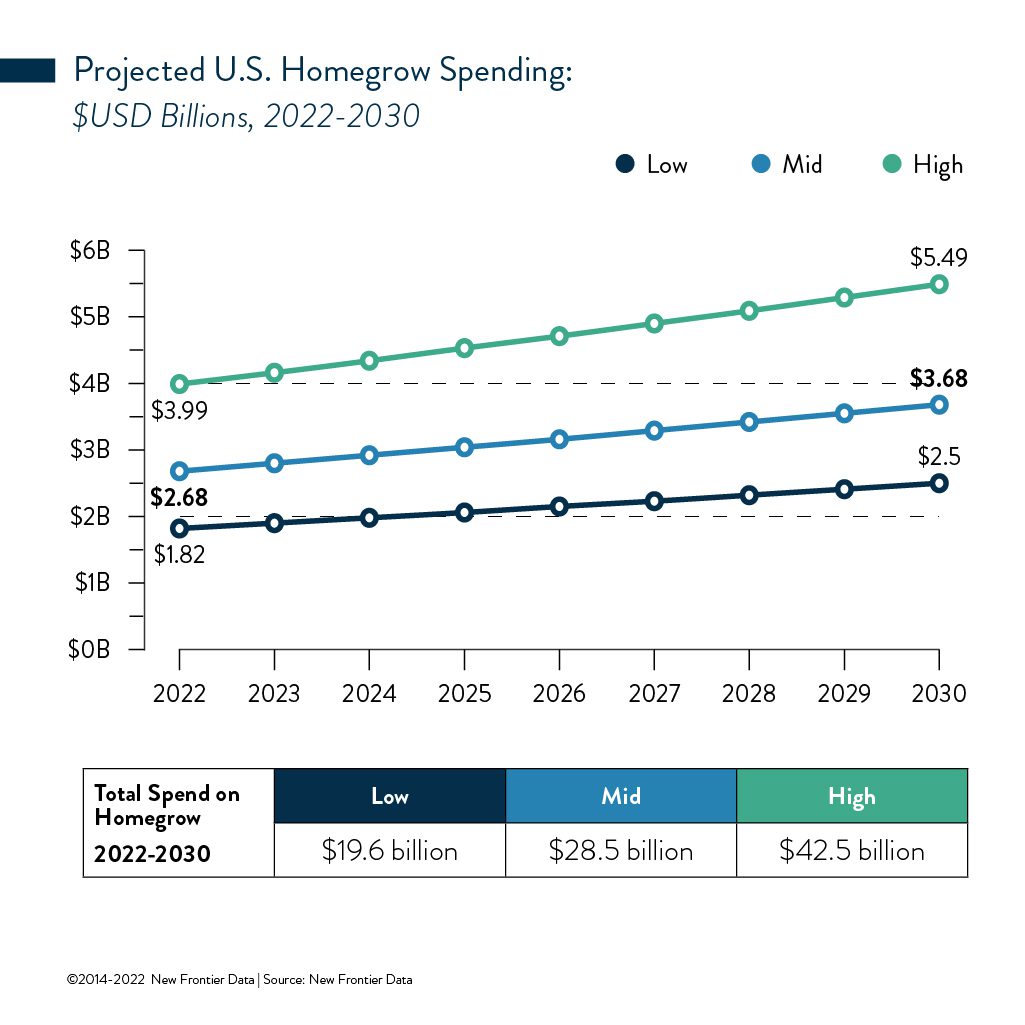

Today’s legal industry focuses heavily on the retail and cultivation space, and as a result, conversations and awareness around homegrowers are few and far between. Despite the lack of noise in this arena, more than 3 million Americans are exercising their newfound right to grow cannabis at home — a group that’s estimated to spend nearly $29 billion on homegrow supplies from 2022 to 2030 according to a detailed 46-page homegrow market report from New Frontier Data.

Retailers and cultivators alike are wise to pay attention to this growing trend. Who are these Americans, why are they growing their plants at home, and how can operators provide a service that either brings them back into the dispensary or capitalizes on their homegrowing efforts?

3 Million Americans Grow Their Cannabis: But Why?

Most American homgrowers are in it for pleasure, with 73 percent reporting they enjoy it as a hobby. Price and convenience were the next two largest motivators reported at 53 percent and 48 percent respectively. However, more than one-third of homegrowers believe they can grow better quality cannabis than they’re able to find elsewhere. While homegrowers also consume cannabis for many of the same reasons as their non-growing counterparts, homegrowers were more likely to report improving their overall wellness as a reason for consumption.

Cannabis conversations have become more public in recent years, as the majority of Americans believe the plant should be legalized and an increasing share of the population consumes it on a regular basis.

As a result, the “Reefer Madness” stigma is slowly but surely diminishing, and people are more comfortable than ever before sharing details about their purchase and consumption habits. However, there’s one piece of the cannabis market puzzle that still remains largely in the dark when it comes to industry discourse: homegrowing.

Research on cannabis largely still begs to be explored, but when you look into the homegrowing sector, data has been even more sparse.

Although most states with some legal form of cannabis allow adults to grow a limited number of plants at home, the story essentially begins and ends there. The general legal industry doesn’t heavily market toward homegrowers or put a substantial amount of energy into providing them with resources and education, because it just isn’t an aspect of the market that has been widely considered valuable throughout the past few decades of state-level legalization.

Homegrowing is Here to Stay, and the Legal Industry Needs to Act

Three million Americans grow their cannabis at home — that’s six percent of the nationwide consumer market, and just short of the entire population of Colorado. In fact, 18 U.S. states have a total population of fewer than 3 million people. This is no small number, and it’s projected to continue growing significantly over the next eight years.

Of course, homegrowing isn’t free, which implies that among those 3 million people, quite a few dollars are being spent on at-home operations throughout each year.

“Based on how much our homegrowers told us they’re spending on setting up grow systems, the inputs they use for each cycle, and the rate at which new consumers continue to enter the legal space, homegrowers will spend nearly $3 billion on supplies in 2020 alone,” said New Frontier Data Chief Knowledge Officer John Kagia.

“Between 2022 and 2030, we’re estimating that the homegrow community will spend nearly $29 billion on home grow supplies. That’s a really significant scale of investment to manage the homegrow market. It’s also reflective of a market that is really massive — a lot larger than many people realize.”

New Frontier Data used their findings to pin down a consistent demographic for who’s growing at home, but the data revealed that, just like the average cannabis consumer, the homegrower community is incredibly diverse. Home cultivators are spread proportionally across the socioeconomic spectrum and other varying conditions. More than half of homegrowers are married and more than two-thirds have children. Roughly 25 percent earn $100,000 a year while 45 percent earn under $50,000; however, nearly 25 percent of homegrowers earn $25,000 to $50,000.

“I think the size of the homegrow market will surprise most people. Frankly, up until today, getting this data was a little difficult. People weren’t necessarily so eager to let people know, even anonymously, that they’re growing cannabis at home,” said LEAF co-founder and CEO of Jonathan Yoni Ofir.

“Now people are beginning to be more open about this. It’s not weird, it’s not just the college student growing weed in their closet, which is what a lot of people tell me. It’s far from that. But maybe back in the day, the college student was the only one willing to run their mouth about it.”

The data speaks for itself and agrees wholeheartedly with Yoni Ofir. New Frontier Data found that 11 million pounds of dried flower were produced from homegrowers in 2022 alone, and that figure is projected to hit over 15 million by 2030. On average, 60 percent of homegrowers produce “all or most of what they consume.”

“To put that in perspective, Colorado’s legal market in 2022 only put out about a million pounds of dried flower. You’re looking at more than ten times the number from home growers. That’s a really strong demonstration of the scale of output being put out by these, in some cases, basement tinkerers,” Kagia said. With all of that flower, there’s a real need for consumer-driven genetics, nutrients, lighting, temperature control, trimming equipment, curing technology, storage solutions, and education.

However, there’s one glaring issue with this growing statistic: most homegrowers today have less than three years of experience, and 84 percent reported only having two years or less of experience.

The homegrow market isn’t going anywhere, but the need for proper education and resources will remain and even expand with the community. So how can legal operators turn this large sector of cannabis into an opportunity for profit, education, and the continued destigmatization of weed?

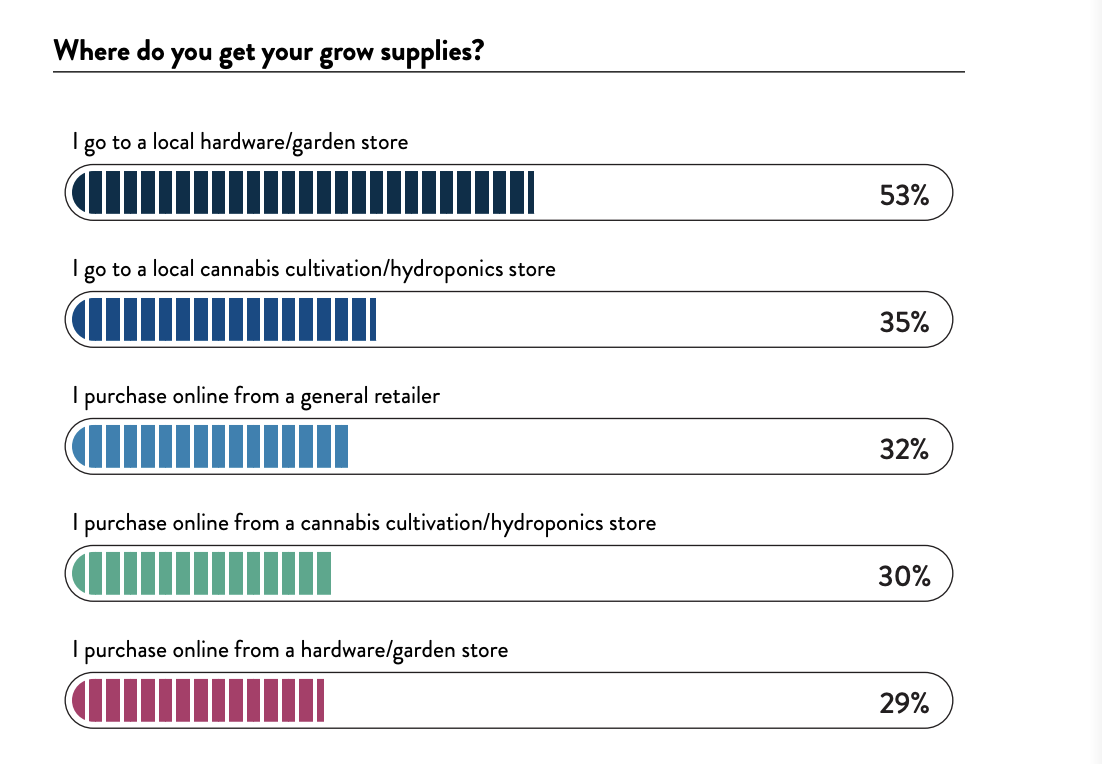

Growing supplies is one area to address with more than half of homegrowers making purchases at local hardware/garden stores, and more than half reporting they acquire their seeds from flower they’ve purchased. Both of these areas show significant gaps in the cannabis industry’s ability to provide marketable products and services to hobby growers who are spending anywhere from a few dollars to more than $1,000 per harvest. In fact, just under 58 percent of homegrowers say they spend less than $200 per harvest.

[…] operating procedure for anyone who is growing at a commercial scale, or even for anyone who is growing at home and not necessarily looking to have the greatest yield,” said Christian Pantoja, head cultivation […]

[…] I really think [home growing] is about to blossom, and what we saw happen in Germany is one of the best examples. With the open borders, people could […]

[…] tCheck 2 cannabis potency tester is suited for homegrowers and licensed cannabis brands that want to test cannabinoid levels in buds and other manufactured […]

[…] and 800 milligrams worth of edibles from state-licensed retailers. Minnesotans also may home-cultivate up to eight plants, no more than four of which can be mature, and possess up to two pounds of plant […]

[…] “These are not multi-pound plants,” Lind said, who also noted the size means more are necessary to fill a garden space. However, this is often attractive for craft or home growers. […]