Whether they have been consuming cannabis since the 1970s or they have never touched the plant before, a significant and growing number of seniors across the country are heading to dispensaries today. While GenZ is getting all of the marketing buzz, Baby Boomers still make up the largest generational portion of the U.S. population, and the elder population is only expected to grow with increased access to modern healthcare. Astute cannabis brands are capitalizing on this group of consumers, designing their products, promotions, and retail strategies to accommodate the needs of older customers.

A recent report published by the Medicare Plans Patient Resource Center found a majority of Medicare recipients support legalized cannabis, demonstrate a consistent interest in their holistic wellness, and believe in the medicinal powers of the plant. With the right information and opportunities, the elder population has the potential to carve out a dominant position in the cannabis market. The businesses that can establish long-lasting, positive relationships with seniors today will gain an invaluable competitive edge in the future.

The wellness market

While medical marijuana is well-known for the physical relief it provides people with chronic and terminal conditions, its therapeutic uses extend far beyond pain mitigation. Both medical card carriers and health-conscious recreational consumers are using cannabis for its wellness benefits. Over the past few years, the global wellness economy has expanded nearly five times as fast as global economic growth. According to a recent study published in the Journal of the American Medical Association, cannabis consumption among seniors increased by 75 percent between 2015 and 2020. Most of these elders seek out cannabis for wellness purposes, like the alleviation of pain, insomnia, and anxiety. For many in this generation, Cannabis offers an appealing alternative to pharmaceuticals, allowing older people to treat multiple conditions and symptoms without the negative and unwanted side effects that come with many traditional pharmaceutical medications.

Trends in elder cannabis consumption

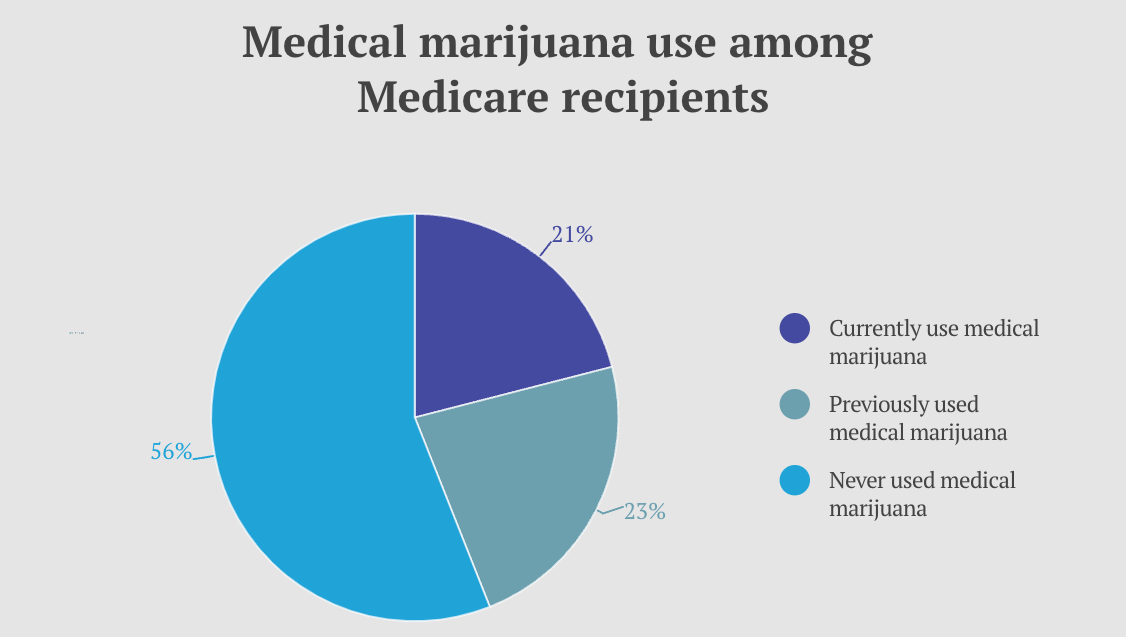

Of the 62.6 million people receiving Medicare in the United States, more than 12.5 million (21 percent) report current cannabis use for therapeutic purposes. This data accounts for only non-institutionalized Medicare recipients, meaning another 1.5 million people in nursing homes have not been surveyed on their cannabis consumption. While it is incredibly encouraging to see the continual growth of seniors accessing cannabis, it poses some big questions for the industry. Because cannabis is still classified as a Schedule I substance, FDA-approved health insurance does not pay for medical marijuana.

Elders are clearly embracing medical cannabis, but its affordability could affect their consumption rates. The Medicare Plans Patient Resource Center’s report revealed conflicting public opinions about the future of medical cannabis. When asked if cannabis should be included under Medicare coverage, respondents expressed diametric viewpoints. Almost 40 percent of Medicare recipients who use medical cannabis said no because they fear it will increase the price. Conversely, around 70 percent of seniors who had never used medical cannabis want it covered because it can be effective when other treatments fail.

In Minnesota, a state with only medicinal legalization on the books, the average 30-day supply of cannabis costs over $300. For some this is affordable, and for others, it’s detrimentally expensive. No one can definitively say whether cannabis prices would increase if insurance companies got involved, but historical cases of prescription drug price gouging give Medicare recipients reasonable cause for concern.

Elders also have different preferences when it comes to cannabis consumption. Flower products still make up over half of Baby Boomer’s purchases, but that percentage is declining. Topicals have seen the fastest market share growth among seniors, which may be attributed to the appeal of a smokeless consumption option and the need for targeted relief. Vapor pens, edibles, and infused beverages have also seen substantial growth in popularity among the elder population. While all consumer groups have diversified their product preferences as new options hit the shelves, it is important to consider the specific demands induced by the growing senior population.

Despite the evolving regulation and refinement of medical cannabis, retirement communities and dispensaries are already working together to make cannabis more accessible for residents. In Orange County, California, Bud and Bloom sends a weekly free shuttle to and from Laguna Woods Village retirement community that’s home to 18,500 residents. Retirees board the bus for a variety of reasons: some seek a new form of relief, some are repeat customers, and some visit the dispensary for education on cannabis products. This is a vital service for the elder community, as well as a profitable practice. According to the brand’s vice president of retail, roughly 30 percent of Bud and Bloom’s customers are 55 and older.

Serving seniors

Bud and Bloom is not the only cannabis brand strategically interacting with the senior population. Brands of all sizes are prioritizing the older consumer in their operations. Individuals over 50 are the fastest-growing group of cannabis consumers in the United States. Older customers often enter a dispensary with less knowledge of products and an array of questions. Businesses can fine-tune their product selection to provide senior-friendly options and make their dispensaries an inviting space for people of all generations.

In Florida, a state with legalized medical cannabis and a large senior population, Trulieve offers free consultations for folks who are interested in learning about the ways cannabis can improve their quality of life. The consultations are designed to help the customer get comfortable with cannabis, learn about the options in their neighborhood, and choose the product that aligns best with their doctor’s recommendations.

Similarly, the Oregon-based company Periodic Edibles provides a plethora of educational resources centering on seniors. The brand also diligently designed its product for consistency to assure hesitant consumers they are purchasing safe and scientifically developed edibles. Creating space for comprehensive education and providing products designed for seniors helps brands build valuable customer loyalty.

Overall, men consume cannabis more frequently than women, but the population of senior women consuming cannabis is growing at unprecedented rates. Synchronicity Holistic, a dispensary in Carmel, California, was specifically designed for senior women exploring cannabis consumption. The dispensary is a bright, spacious, and accessible facility operated by staff who are trained to help seniors approach cannabis cautiously and medicinally. In fact, all employees are registered nurses or experts in medical cannabis. The dispensary also hosts educational sessions, offers private consultations, and provides individually curated experiences for each customer who comes through their doors.